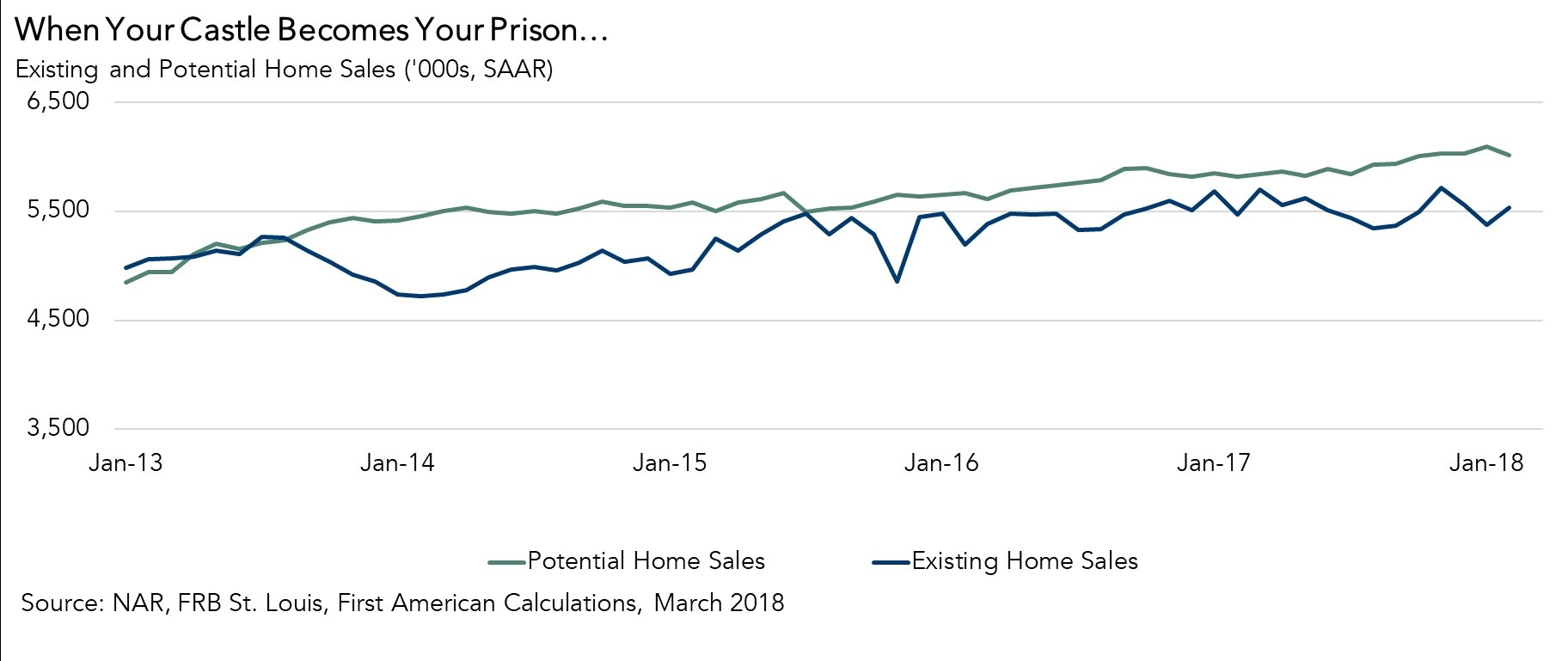

In March, the housing market continued to underperform its potential. Actual existing home sales are 4.5 percent below the market potential for home sales, according to our Potential Home Sales model. The lack of supply is the primary culprit. The inventory of homes for sale in most markets remains historically tight, yet demand continues to rise as millennials further age into homeownership. Limited supply and rising demand means house prices are surging, so why aren’t more existing homeowners selling their homes? Two market dynamics are at play.

Market Dynamic 1: Locked to Your Mortgage Rate

Many existing homeowners are ‘rate-locked.’ The majority of existing homeowners have mortgages with historically low rates and, now that rates are rising, they are hesitant to sell their homes. They recognize that once they sell and purchase a new home, they will have a higher mortgage rate. There is limited incentive to sell when, due to higher mortgage rates, it will cost you more each month just to borrow the same amount from the bank. As mortgage rates rise further, more existing homeowners may become rate locked into their existing homes.

Market Dynamic 2: Prisoner to the Market

The root of the second dynamic at play is that the housing market is not like most markets. Typically, the seller, or supplier, makes their decision about adding supply to the market independent of the buyer, or source of demand, and their decision to buy. Yet, in the housing market, the seller and the buyer are, in many cases, actually the same person – the existing homeowner. In order to buy a new home, you have to sell the home you already own, and then find a home you like better. Every home is different, an almost perfectly heterogeneous product so, when supply is constrained like it is in today’s market, it becomes difficult to find a home better than what you already own.

Potential sellers face a prisoner’s dilemma, a situation in which individuals don’t cooperate with each other, even though it seems in their best interest to do so. If sellers all choose to sell, they would all benefit as buyers because they would increase the inventory of homes available and alleviate the supply shortage. However, the risk of selling if others don’t in a market with a shortage of inventory prevents many existing homeowners from selling. The result is prices are further bid up by competition for the increasingly short supply.

“There are two reasons why existing homeowners have become prisoners in their own castles – the rate lock-in effect and the seller’s prisoner’s dilemma.”

Our Potential Home Sales Model estimates the expected level of existing-home sales based on market fundamentals. The market potential for home sales based on current fundamentals is currently estimated to be 6 million at a seasonally adjusted annualized rate (SAAR). The market for existing-home sales is underperforming its potential by 4.5 percent and this market performance gap is growing.

The housing market is facing a deluge of demographically-driven demand, and the greatest supply shortage in 60 years of record keeping, according to the Federal Reserve Bank of Kansas City. The increasing pace of new construction, particularly completions, will alleviate some of the supply shortage in the longer run, but in the meantime there are two reasons why existing homeowners have become prisoners in their own castles -- the rate lock-in effect and the seller’s prisoner’s dilemma.

March 2018 Potential Home Sales

For the month of March, First American updated its proprietary Potential Home Sales model to show that:

- Potential existing-home sales increased to a 6.04 million seasonally adjusted annualized rate (SAAR), a 0.3 percent month-over-month increase.

- This represents a 61.8 percent increase from the market potential low point reached in February 2011.

- The market potential for existing-home sales increased by 3.4 percent compared with a year ago, a gain of 201,190 (SAAR) sales.

- Currently, potential existing-home sales is 1.25 million (SAAR), or 17.1 percent below the pre-recession peak of market potential, which occurred in July 2005.

Market Performance Gap

- The market for existing-home sales is underperforming its potential by 4.5 percent or an estimated 273,000 (SAAR) sales.

- The market performance gap increased by an estimated 22,700 (SAAR) sales between February 2018 and March 2018.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.