The pandemic brought about both policies to protect homeowners from losing their homes – foreclosure moratoriums and forbearance programs – and concerns that a wave of foreclosures would crash upon the housing market once the protections ended. The wave did not materialize, and foreclosures remain near historic lows. Now, the Federal Reserve is raising interest rates to tame inflation and, as a result, the housing market is rapidly cooling and the labor market is likely to follow suit. As house price appreciation decelerates and the labor market loses steam, will we now see foreclosures accelerate?

“Foreclosures in the third quarter of 2022 increased, but remained below pre-pandemic levels. While we can expect the number to drift higher as the labor market slows and house prices fall from their peak, the result will likely be more of a foreclosure ‘trickle’ than a ‘tsunami.’”

The Dual Triggers Behind Foreclosure

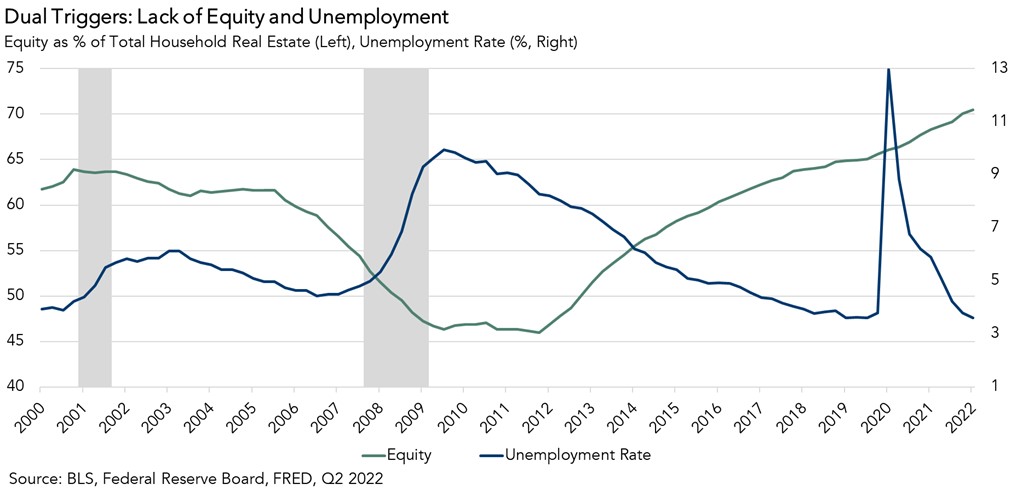

Foreclosure is the result of two simultaneous triggers: the lack of ability to pay (delinquency) and the lack of equity in a home. A homeowner may suffer an adverse economic shock, typically a loss of income, serious illness, or the death of a spouse, leading to the homeowner becoming delinquent on their mortgage. But not every delinquency will become a foreclosure. With enough equity, a homeowner has the option of selling the home or tapping into that equity to weather a temporary financial setback. The inverse—a lack of equity in the home without a financial setback that leads to delinquency—will again not end in a foreclosure. Alone, economic hardship or a lack of equity are each necessary, but not sufficient to trigger a foreclosure. Both triggers need to be present to create the conditions for a foreclosure. What does that imply for today’s housing market?

Historically Low Unemployment, Historically High Equity

Mentions of foreclosures invariably bring up memories of the Great Financial Crisis, but the housing market today is very different from a decade ago. Nationally, household equity reached 70 percent in the second quarter of 2022, the highest level in over 35 years. At the same time, the labor market continues to show strength. The unemployment rate is near pre-pandemic lows, and the supply and demand imbalance persists, pushing up wage growth. However, the housing market has cooled considerably amid the affordability shock driven by rapidly rising mortgage rates, and signs of a labor market slowdown are emerging. Both trends threaten to increase the risk of foreclosures over the near term.

House price appreciation is slowing from its peak in all major markets, and many markets have even experienced nominal price declines from their respective peaks. Prices are poised to fall further as the hot sellers’ market of 2021 and early 2022 turns in favor of buyers, which could chip away at some of the equity that homeowners have built up. Annual house price growth in August, according to the S&P Case Shiller house price index, was 13 percent, down from a peak of 20.8 percent in March 2022. Price growth will inevitably continue to decelerate to reflect the reality of higher mortgage rates. The double-digit house price appreciation of the past two years was not sustainable in the long run and was far outside the historical norm – average annual house price appreciation nationally since 1990, not including the pandemic, is 3.6 percent. But, even if house prices turn negative, the decline would have to be substantial to eat away at all the equity that many homeowners have accumulated over the last few years. For example, for the average national homeowner who bought a home in July 2020, house prices would need to decline 27 percent to wipe out all of their equity gains from appreciation.

As for the labor market, the Federal Reserve is tightening monetary policy to cool demand and tame inflation, which is likely to lead to an increase in unemployment. That increase, however, could be modest. Federal Reserve projections as of September 2022 expect the unemployment rate to peak at 4.4 percent in the fourth quarter of 2024, a rate like that of 2017. It would take a significant decline in equity and a strong spike in unemployment to trigger a wave of foreclosures, and that doesn’t look likely in the near term.

Strong Fundamentals Support the Housing Market

Homeowners have very high levels of tappable home equity today, providing a cushion to withstand potential price declines, but also preventing housing distress from turning into a foreclosure. In fact, if distressed homeowners are required to resolve delinquency, given their equity buffers, involuntary sales are much more likely than foreclosures. Foreclosures in the third quarter of 2022 increased, but remained below pre-pandemic levels. While we can expect the number to drift higher as the labor market slows and house prices fall from their peak, the result will likely be more of a foreclosure ‘trickle’ than a ‘tsunami.’

.jpg)