As we celebrate International Women’s Day and Women’s History Month, it’s important to reflect on the progress that women, and single women in particular, have made in achieving one of the main tenets of the American Dream – homeownership. Since 2019, the number of single, female-headed households (including widowed, separated, or divorced) has increased by 1.4 million, one million of whom are homeowners.

The overall homeownership rate declined in the aftermath of the Great Recession, but has since rebounded, in part due to the growth in single female homeownership. According to an analysis of anonymized household-level survey data, the homeownership rate among single, female-headed households surpassed 52 percent in 2022, recovering from a post-Great Recession low point of 50 percent in 2016. Single women’s homeownership rate outpaced that of single men by approximately two percentage points. There is good reason to celebrate this rebound, as housing wealth is a primary driver of wealth creation in the United States.

Homeownership Drives Wealth Creation

Analysis of the 2019 Survey of Consumer Finances data (latest available), a triennial survey that collects detailed accounts of U.S. household finances, reveals that homeowners had 40 times the household wealth of a renter—the majority of which came from their home. Between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups, a period during which annual house price appreciation averaged 5.5 percent.

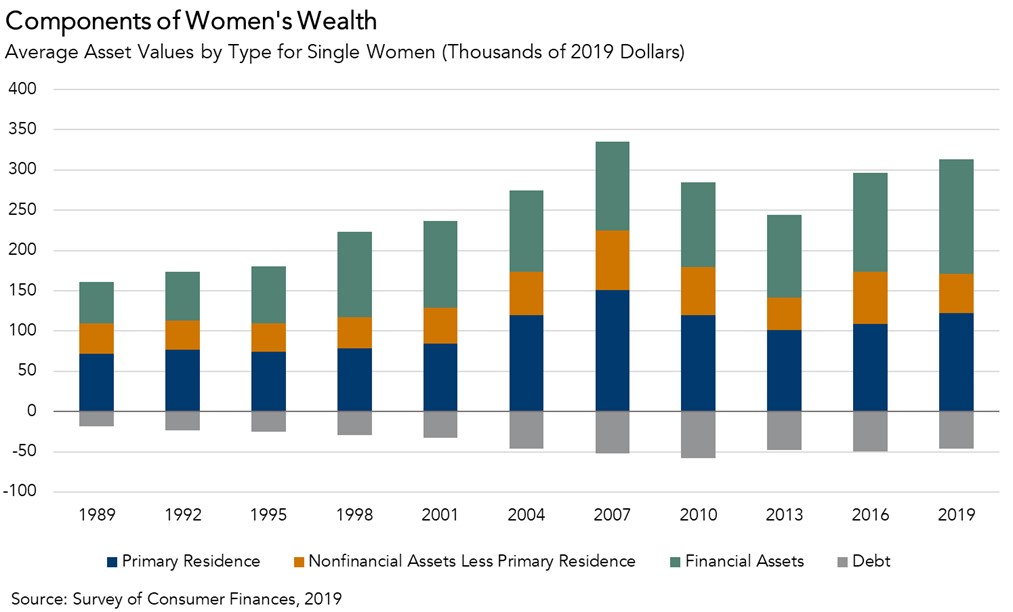

For single women, housing has always made up a large share of total assets. Over the last 30 years, the average single woman’s wealth has increased 88 percent on an inflation-adjusted basis, from just over $142,000 in 1989 to $267,000 in 2019, and housing has remained the single largest component of their wealth. In the latest available 2019 data, housing made up 49 percent of total assets for the average single, female-headed household, up from 44 percent three years prior. Housing has likely generated further wealth gains for single women since 2019, given that house prices increased over 40 percent between 2020 and 2022.

Typically, the lower the income of a home-owning household, the greater the share of its wealth that stems from homeownership. This pattern is no different for single, female-headed households. Housing wealth made up 68 percent of total assets in 2019 among single women in the lowest income quintile, while it made up only 22 percent among single women in the top income quintile.

The difference in the composition of wealth means that fluctuations in home prices will have a much bigger impact on the wealth of lower-income, single, female-headed households. However, there are several benefits of homeownership that, despite the potential downside risk from volatility in house prices, result in greater wealth accumulation when compared with renting. Homeowners benefit from wealth accumulation from house price appreciation over time and the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners. While house price growth may stall, or even decline, in the near term, historically housing has been a key driver of wealth creation and single women are taking note.