Life, Liberty, and the Pursuit of Homeownership

By

Mark Fleming on November 18, 2016

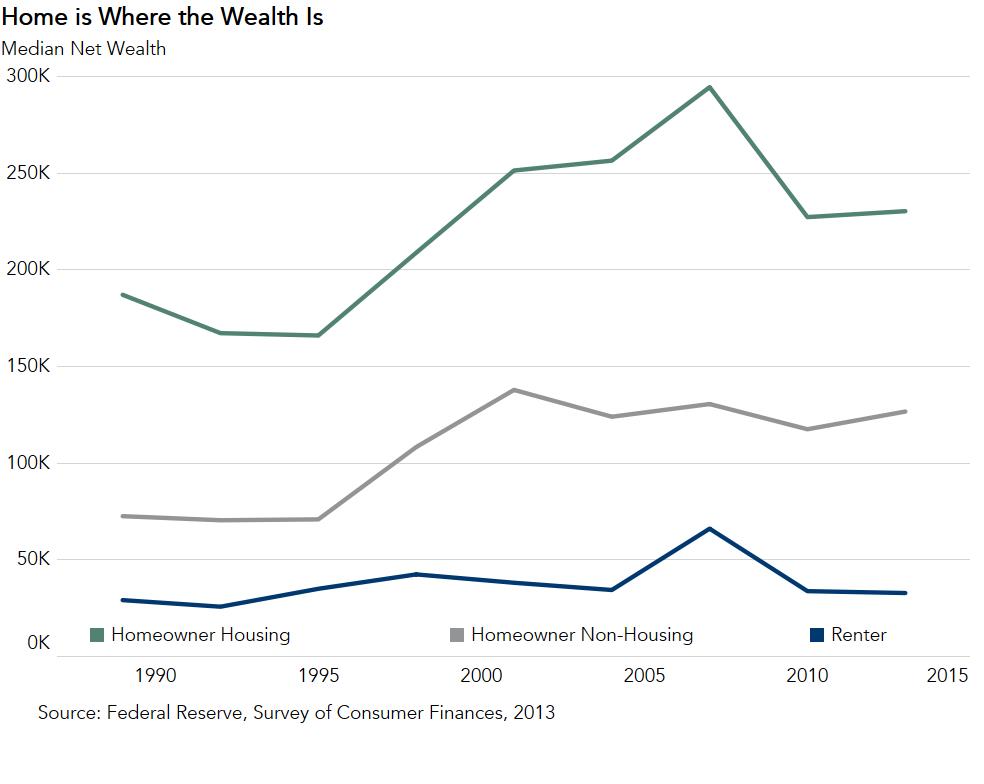

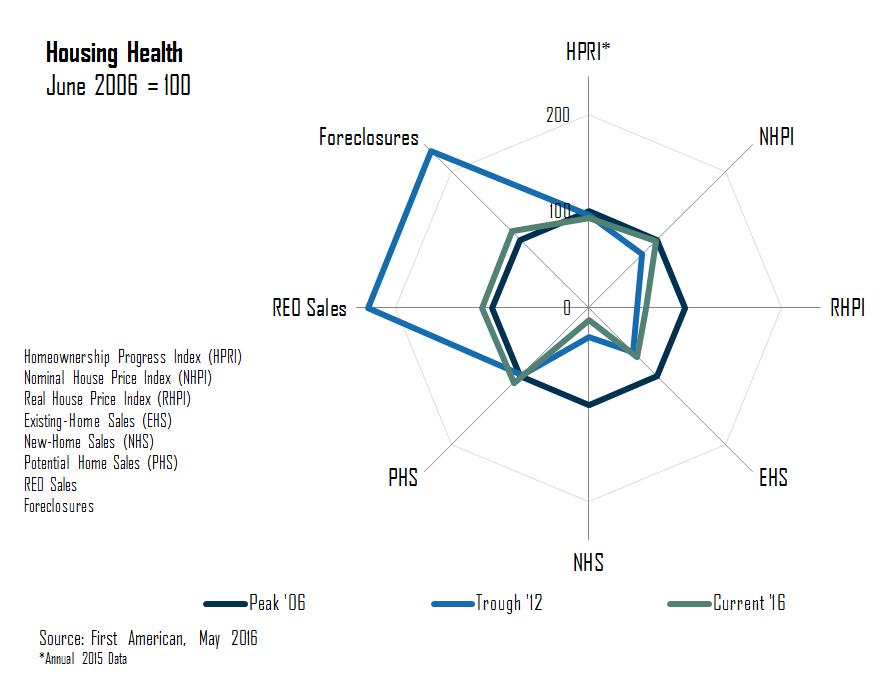

It’s that time of year again. The time when we come together and celebrate the American tradition of giving thanks for the many blessings in our lives. Often we give thanks for having the basic necessities of life: food, health, water and shelter. While all of these things are vital to human existence, as a housing economist, I naturally tend to ...

Read More ›

Seeking Certainty Again

By

Mark Fleming on November 9, 2016

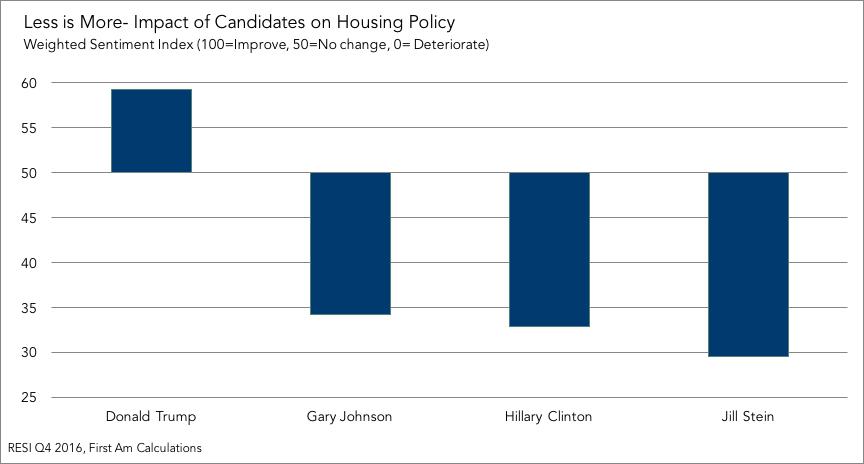

Our analysis in recent months has touched on the influence of uncertainty on our housing market. In particular, two significant events have influenced housing markets this past year. First, the Brexit benefit to the housing market triggered by the vote in the United Kingdom to leave the European Union this past summer. Second, and more recently, ...

Read More ›

Buy, Buy Millennials!

By

Mark Fleming on November 7, 2016

A common narrative over the last several years is that Millennials are breaking with the habits of their parents when it comes to home buying. Millennials rent longer, live with their parents, and are burdened with student loan debt. In short, it would seem that for a variety of reasons they aren’t as interested in homeownership as their ...

Read More ›

Millennial First-Time Homebuyer Demand Does Not Increase Defect, Fraud and Misrepresentation Risk

By

FirstAm Editor on October 31, 2016

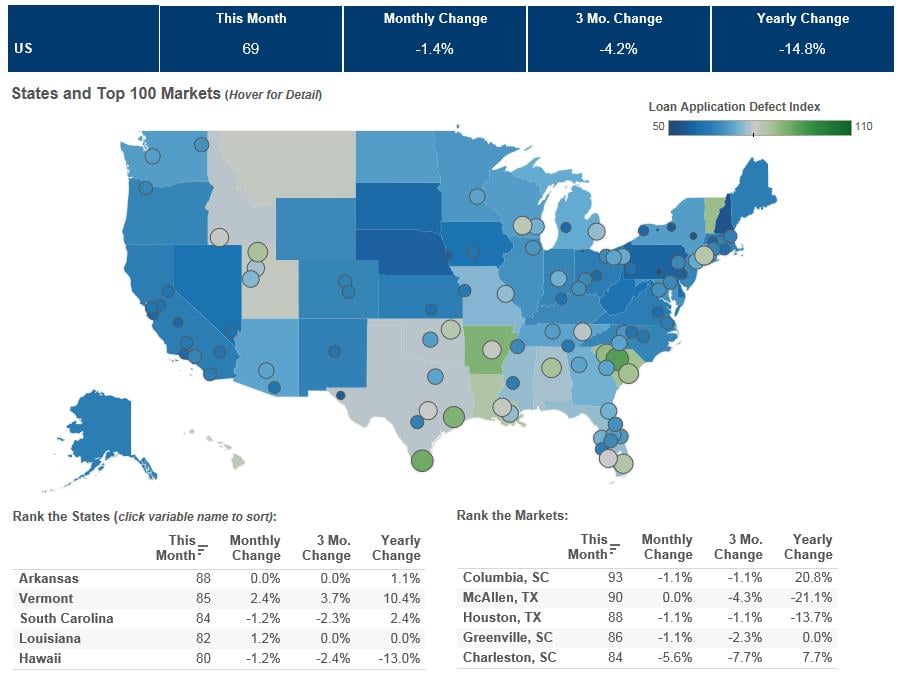

We’ve posted the September First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in September as compared with August and decreased by 14.8 percent as compared to September 2015. The ...

Read More ›

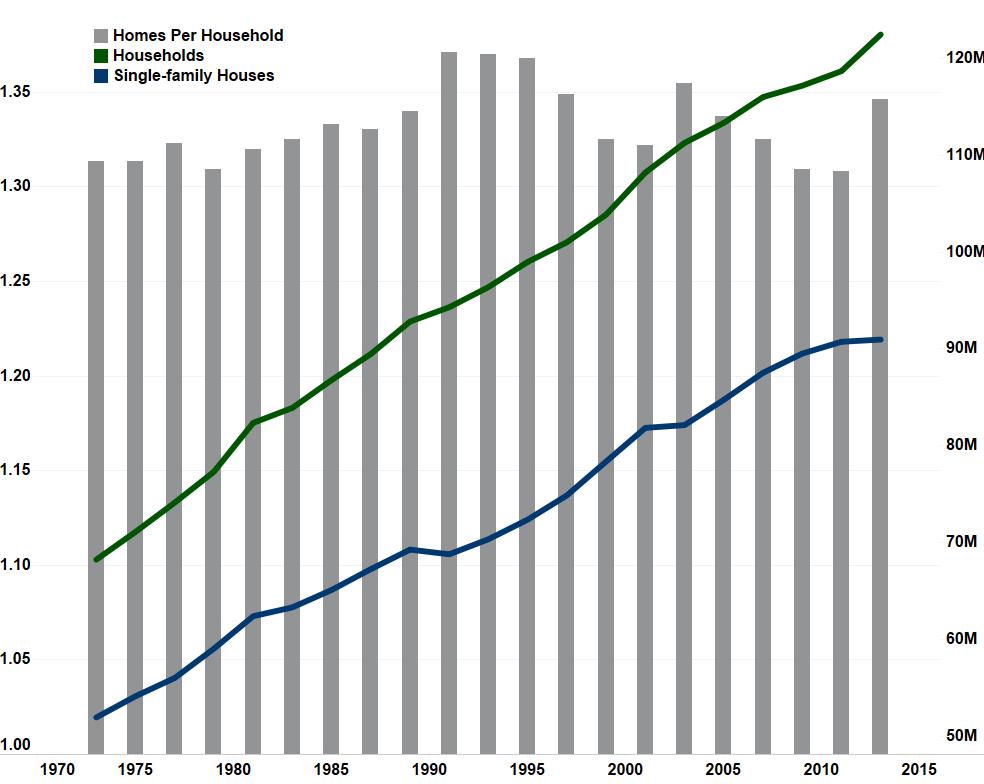

Housing Starts – Just Keeping Up with the Millennials

By

Mark Fleming on October 28, 2016

Given the most recent release on housing starts showing a decline, many are asking if the housing market is stagnating. Builders fear that the decades of broad-based demand for single-family suburban homes is now a bygone era. Young millennials are pouring into the big city and eschewing homeownership permanently. Who, if anyone, will want to buy ...

Read More ›

Bloomberg Radio Interview – Fleming says Housing is More Affordable

By

FirstAm Editor on October 26, 2016

First American Chief Economist Mark Fleming is interviewed on Bloomberg Radio to explain why housing is more affordable today than many people believe.

Read More ›