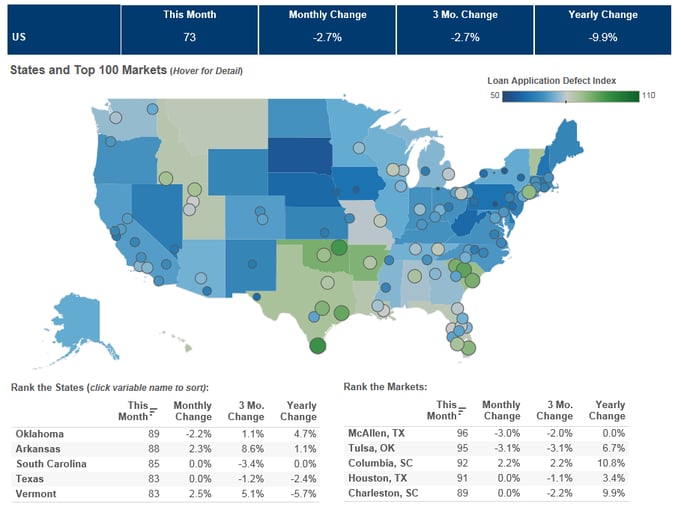

We’ve posted the May First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 2.7 percent in May as compared with April and decreased by 9.9 percent as compared with May 2015. The Defect Index is down 28.4 percent from the high point of risk in October 2013.

“Fewer defects and less misrepresentation will reduce repurchase risk and expenses for underwriters in the future.”

The Defect Index continues to decline, reaching a historically measured low point. Apart from the increases in risk in 2013 and early 2015, the Defect Index has been consistently trending lower since inception.

“Better technology and standards in the loan application process combined with more time spent underwriting each loan application may be increasing the cost of loan production, but we continue to see clear benefits too,” said Mark Fleming, chief economist at First American. “While the costs of compliance are higher and reducing the profitability of mortgage lending, there is long-term financial benefit to increased loan quality. Fewer defects and less misrepresentation will reduce repurchase risk and expenses for underwriters in the future.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.