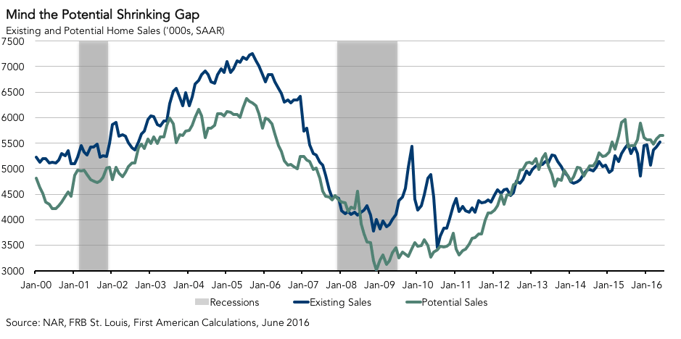

For the month of June, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by only 0.3 percent or an estimated 17,000 seasonally adjusted, annualized rate (SAAR) of sales, an improvement over last month’s revised performance gap of -3.1 percent or 180,000 (SAAR) sales. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals. In June, the market potential for existing-home sales grew by 0.19 percent compared to May, an increase of 11,000 (SAAR) sales, and decreased by 5.2 percent compared with a year ago.

This month, potential existing-home sales increased to 5.66 million (SAAR). This represents an 87.5 percent increase from the market potential low point reached in December 2008*, but is down 542,000 (SAAR) or 9.6 percent from the pre-recession peak of market potential, which occurred in July 2005.

Analysis: Market at Potential in Era of Low Interest Rates and Job Growth

According to the National Association of Realtors (NAR), existing-home sales rose for the second consecutive month in May, with a reported level of 5.53 million (SAAR), up from a downwardly revised 5.43 million (SAAR) sales in April. The 1.8 percent month-over-month increase and the slightly slower revised year-over-year increase of 4.5 percent brought existing-home sales to a pace not seen since February 2007. The gains were once again driven by broad growth across the country, including in the West where sales jumped 5.4 percent on a month-over-month basis. This increase follows a recent period in which buying activity in the West was hampered by large price gains and tight supply.

"Low mortgage rates, greater employment and rising wages all indicate that the housing market is settling on solid ground."

Inventories held steady at an unchanged level between April and May, remaining at a 4.7-month supply, which is down from a 5.1-month supply a year ago. The constrained supply continues to both frustrate potential home buyers and add further upward pressure on home prices, which rose 5.9 percent year-over-year on a seasonally adjusted basis, according to the Case-Shiller House Price Index.

The silver lining for home buyers is that the low interest rate environment continues to absorb some of the impact of rising prices through the benefits of increased leverage and buoyed home-buying power. The average rate for a 30-year, fixed rate mortgage fell further in June, dropping to 3.57 percent from 3.6 percent in May. This marks the lowest mortgage rates have been since May 2013. There is little indication mortgage rates will change course and start to rise, even in the face of potential rate hikes from the Federal Reserve later this year. This is due in part to pressure on the 10-year Treasury note, as record levels of both foreign and domestic demand continue to drive down yields. Investors are seeking income as a response to negative yields on bonds in Europe and Asia, as well as safety from global economic uncertainty. This demand for treasuries is not expected to abate soon, which means mortgage rates will likely remain low – good news for the housing market.

Also good news for the housing market, the Bureau of Labor Statistics (BLS) reported that employers added 287,000 new jobs to the economy in June, significantly exceeding expectations of 187,000. Adding to that, the BLS also reported that average hourly earnings have risen by 2.6 percent year-over-year, alongside an increase in the labor force participation rate to 62.7 percent. While one month of data does not make a trend, when you consider today’s low mortgage rates, greater employment and rising wages, the housing market is settling on solid ground.

Next Potential Home Sales release: August 19, 2016 for July data

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.