The second edition of First American’s proprietary Real House Price Index (RHPI) looks at April 2016 data and includes analysis from First American Chief Economist Mark Fleming explaining the connection between “Brexit” and recent trends in rates for fixed-rate mortgages.

“FOMC decisions matter less than global uncertainty caused by events like ‘Brexit.’”

“This month, the housing market continues to benefit from low, and even falling, mortgage rates driven by the ‘flight-to-safety’ and relative yield that is maintaining demand for U.S. 10-year Treasury bonds, which underpin fixed-rate mortgages,” said Fleming. “The 30-year fixed rate mortgage has been below 5 percent since May 2010 – six years – for a variety of reasons, but ‘Brexit’ has played an influential role in the recent trend in rates.”

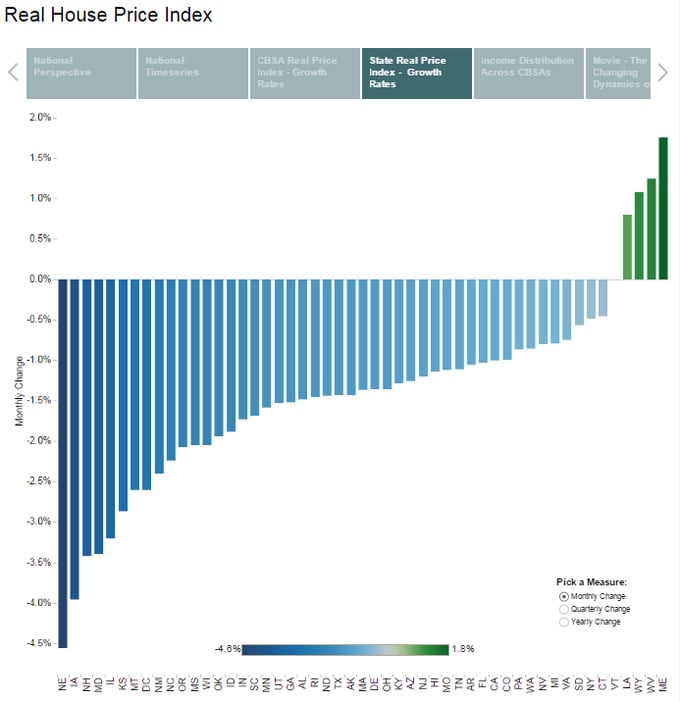

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. It measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes on consumer house-buying power. Because the RHPI adjusts for house-buying power, it is also a measure of housing affordability.

“Counter to the conventional wisdom that housing is becoming less affordable, many consumers who were house hunting benefitted from an improvement in affordability,” said Fleming.

For Mark’s full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI will be updated monthly with new data, so look for the next edition of the RHPI on July 25.