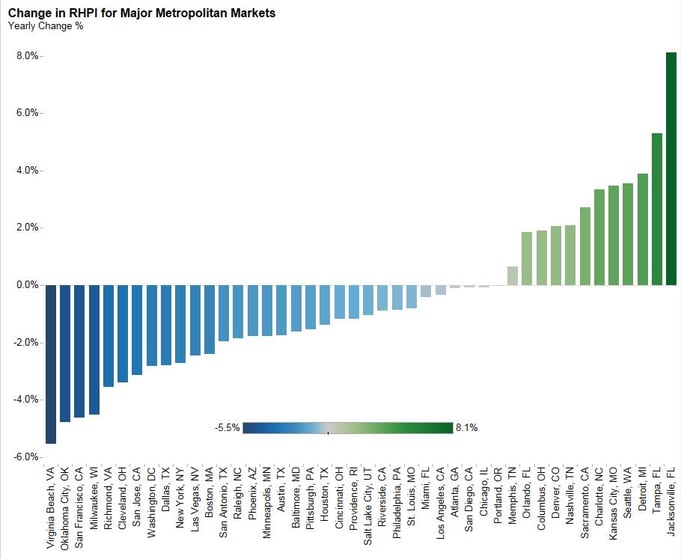

First American’s proprietary Real House Price Index (RHPI) looks at August 2016 data and includes analysis from First American Chief Economist Mark Fleming that explains that counter to conventional wisdom, affordability for home buyers in many markets is increasing due to low interest rates and increasing wages.

“Interest rate declines, combined with meaningful gains in incomes, have provided the consumer with greater buying power, which increases housing affordability.”

“Interest rate declines, combined with meaningful gains in incomes, have provided the consumer with greater buying power, which increases housing affordability,” said Fleming. “The growth in consumer house-buying power is actually outpacing the increases in nominal prices driven by remarkably tight inventories.”

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what really matters to potential buyers - their purchasing power, or how much they can afford to buy. The RHPI adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

For Mark’s full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of November 28, 2016.