Defect Risk Rises Modestly on Shift toward Purchase-Dominated Market

By

FirstAm Editor on January 26, 2017

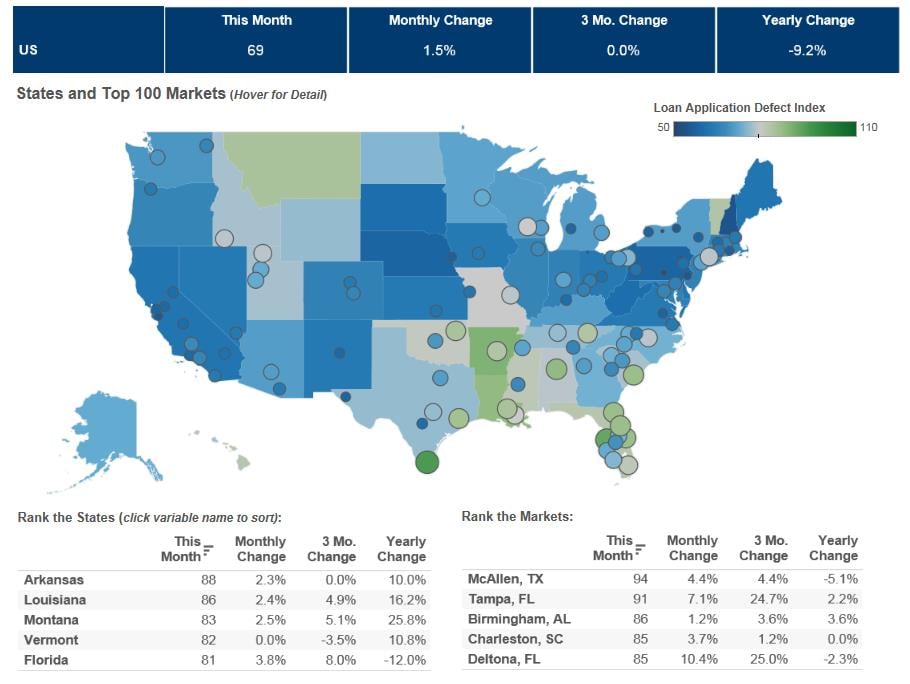

We’ve posted the December First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 1.5 percent in December 2016 as compared with November 2016 and decreased by 9.2 percent as compared to December ...

Read More ›

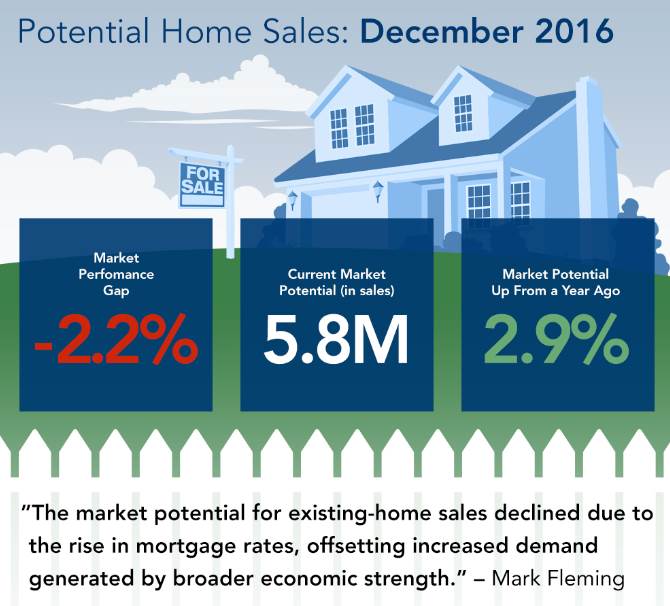

Infographic - Why Did Market Potential Pull Back in December?

By

FirstAm Editor on January 24, 2017

The infographic below provides some additional perspective on the market forces influencing First American Chief Economist Mark Fleming's proprietary Potential Home Sales model in December 2016.

Read More ›

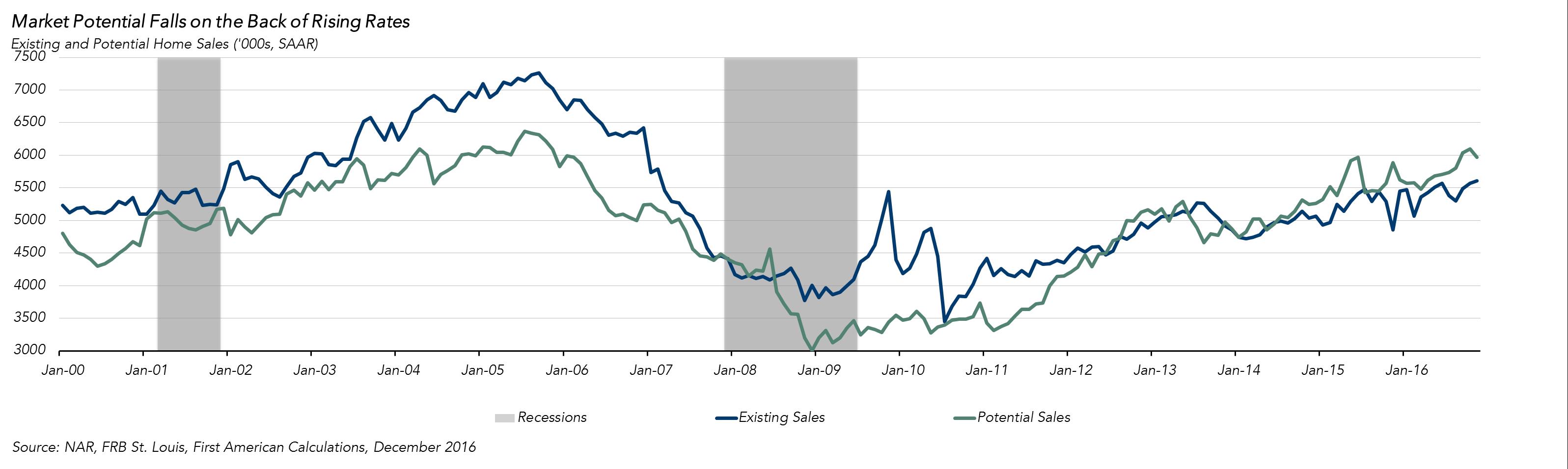

Rising Mortgage Rates Dampen Market Potential in December

By

Mark Fleming on January 23, 2017

First American's proprietary Potential Home Sales model examines December 2016 data and includes analysis from Chief Economist Mark Fleming on the impact of rising rates amid growing demand and limited inventory.

Read More ›

Three Reasons to Remain Bullish on Housing

By

Mark Fleming on January 17, 2017

Last week, I participated in the 2017 Housing Market Forecast and Homebuyer Trends webinar hosted by the American Land Title Association (ALTA). Jessica Lautz, a consumer research expert from the National Association of Realtors, and I discussed how the real estate market is changing and what we can expect. We tried to answer the question posed in ...

Read More ›

Automation of Verification Tools to Drive Risk Improvements in 2017

By

FirstAm Editor on December 28, 2016

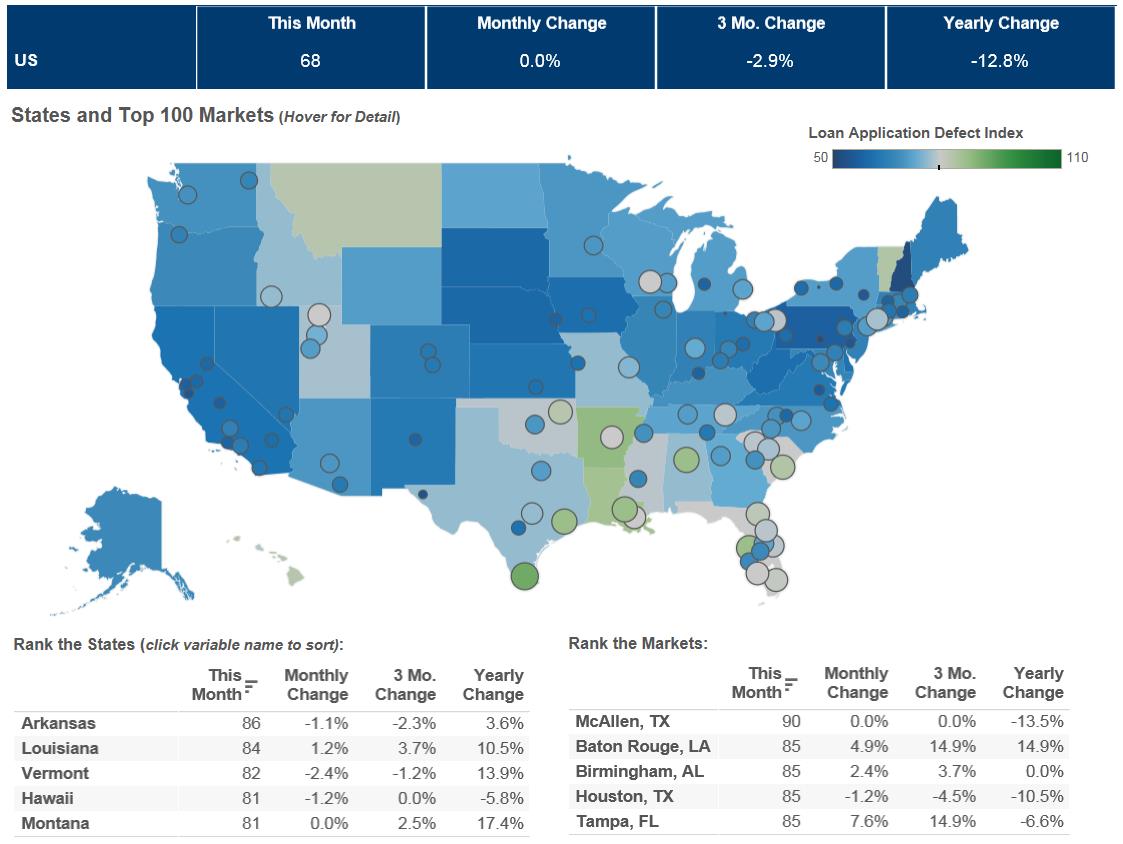

We’ve posted the November First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained unchanged in November as compared with October and decreased by 12.8 percent as compared to November 2015. The ...

Read More ›

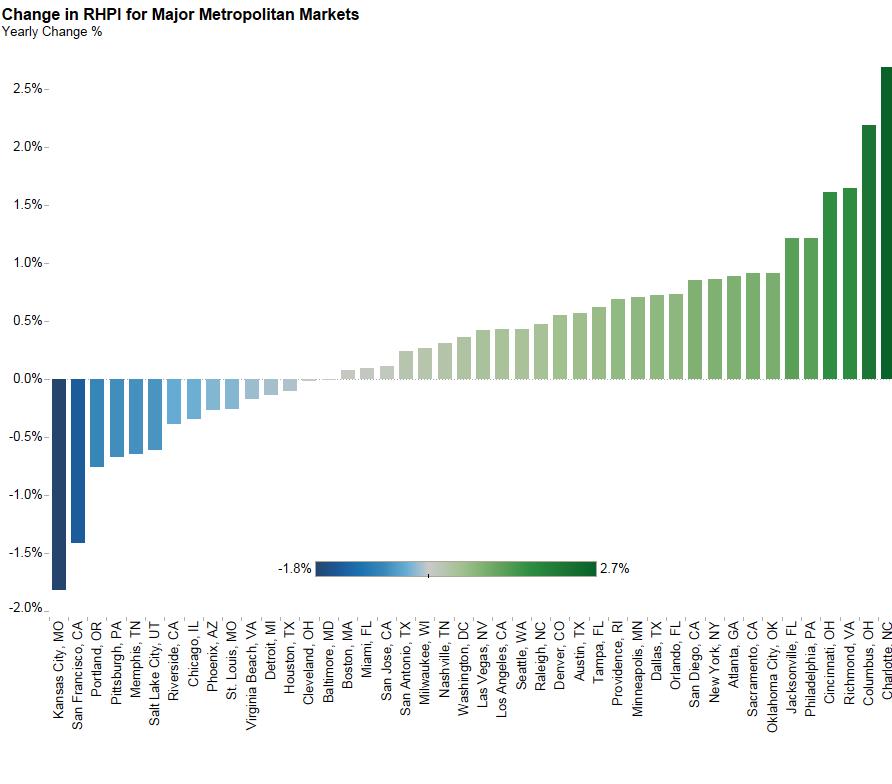

Affordability Improves Nationally Based on Wage Growth, Although Not for Many Major Markets

By

FirstAm Editor on December 26, 2016

First American’s proprietary Real House Price Index (RHPI) looks at October 2016 data and includes analysis from First American Chief Economist Mark Fleming on the impact of rising mortgage rates on consumer house buying power and affordability heading in to 2017.

Read More ›