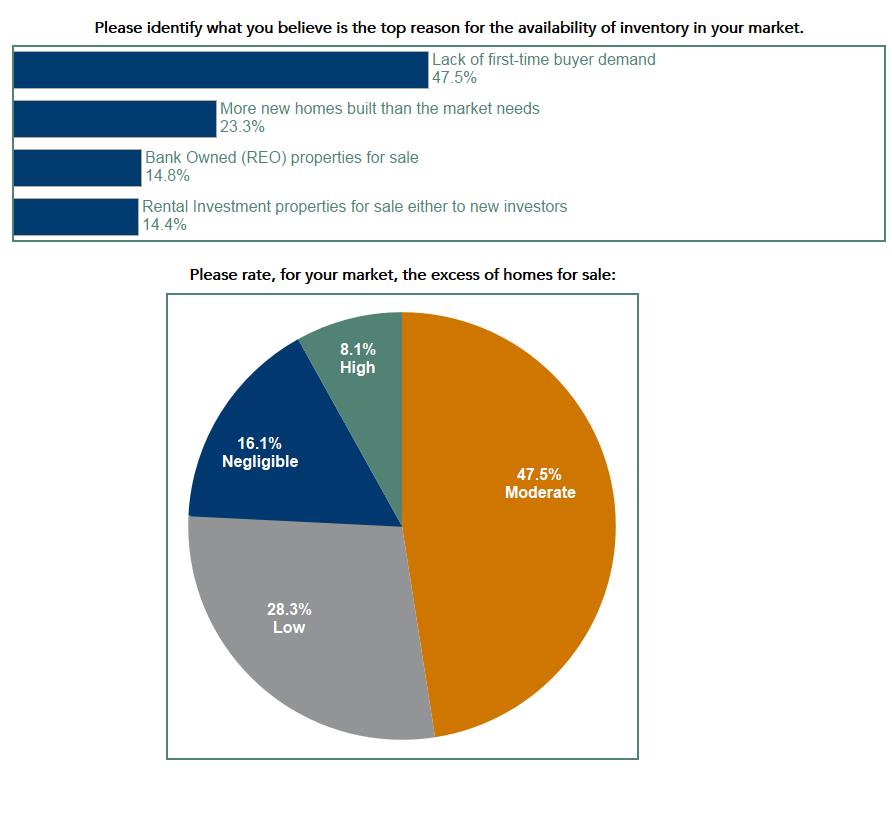

We Crowd-Sourced the Reason for Housing Supply Shortages

By

Mark Fleming on September 15, 2017

We’ve said it before and we’ll say it again – the shortage of houses on the market is making it difficult for Americans to find homes to buy, which is especially concerning for the Millennial first-time home buyer. There are many possible reasons for the housing supply shortage, ranging from fear of paying a higher mortgage rate to insufficient ...

Read More ›

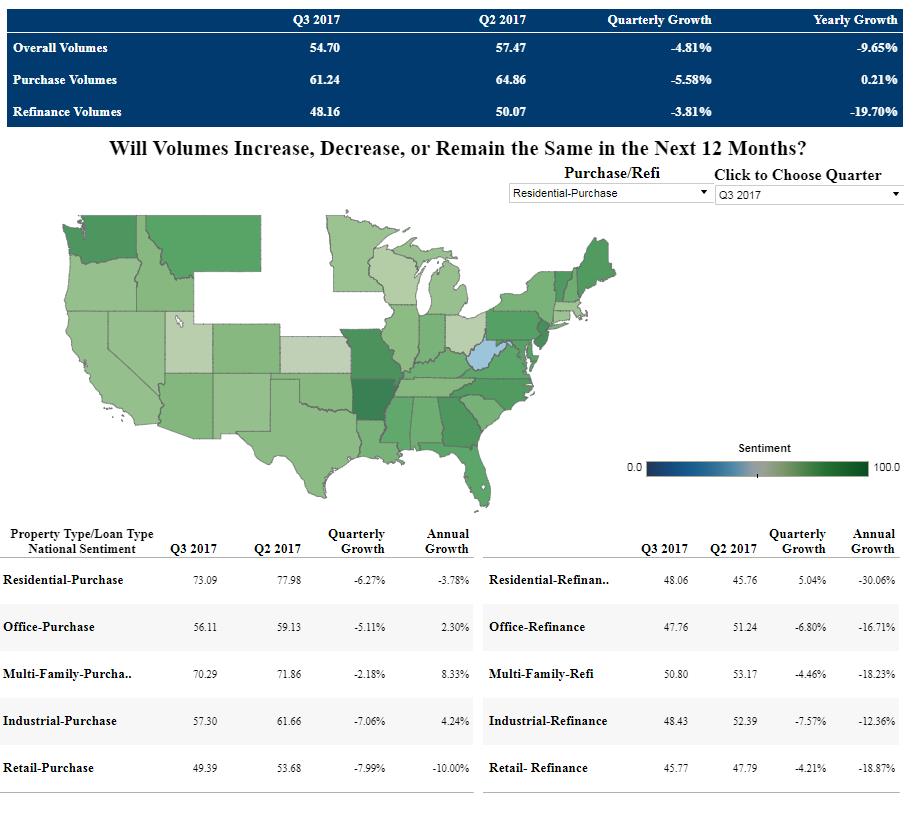

Outlook for Real Estate Falls in Third Quarter Amid Rate Uncertainty

By

FirstAm Editor on September 12, 2017

We invite you to browse the third quarter 2017 First American Real Estate Sentiment Index, which is based on a quarterly survey of independent title agents and other real estate professionals, providing a unique gauge on the real estate market using the crowd-sourced wisdom and expertise of real estate experts.

Read More ›

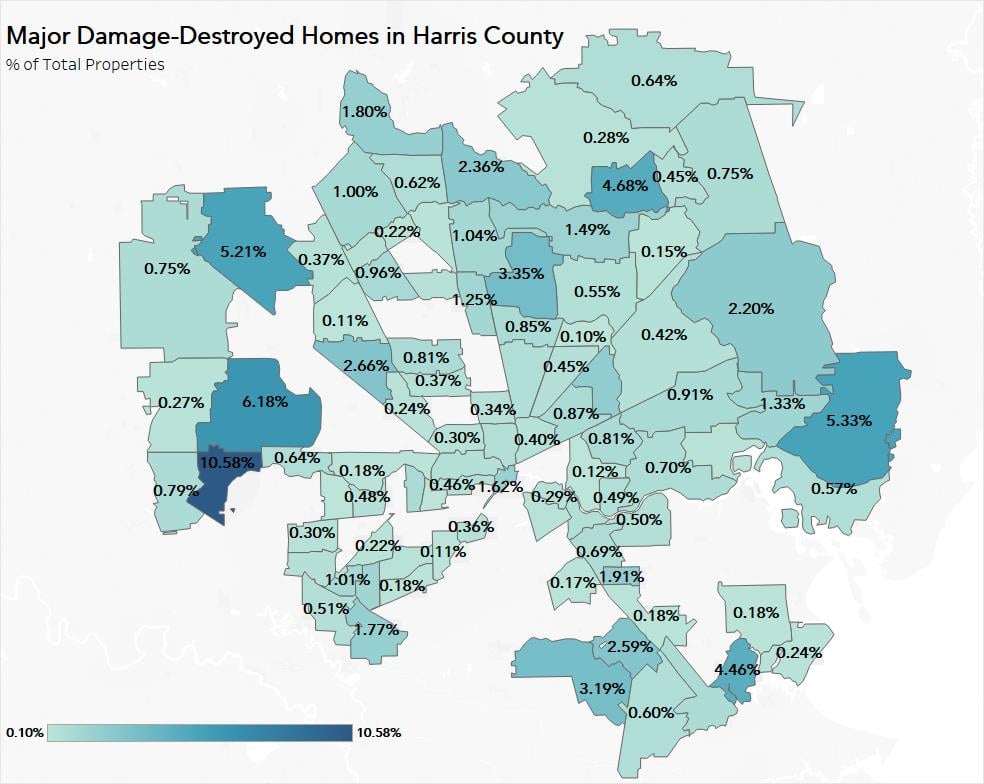

What the Post-Katrina Real Estate Market Can Tell us About Hurricane Harvey’s Impact on Houston

By

Mark Fleming on September 8, 2017

As Hurricane Harvey’s flood waters finally recede, the degree of damage is becoming more apparent. The most recent estimates indicate that flood damage could be assessed as high as $37 billion and that 70 percent of that damage is to property that is uninsured. According to the Federal Emergency Management Agency (FEMA), more than 30 counties and ...

Read More ›

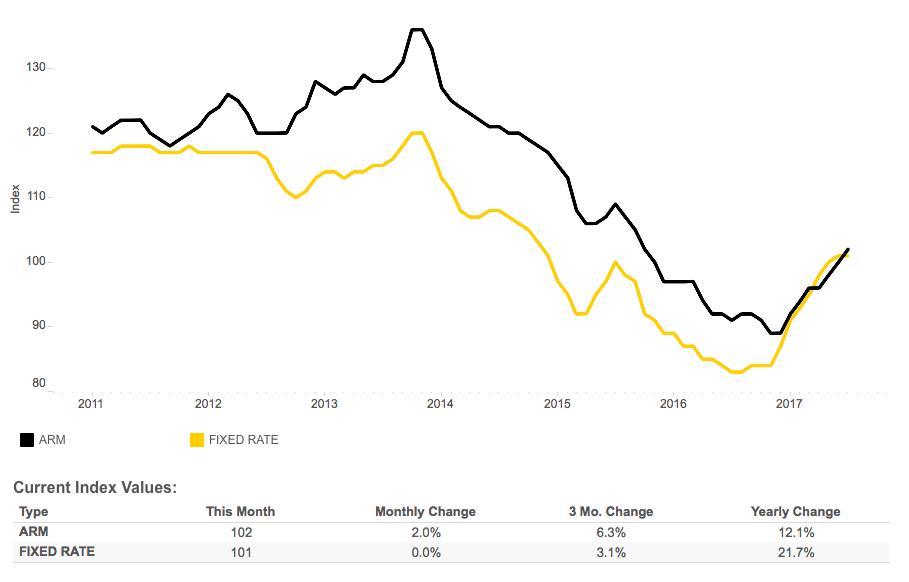

Will the Fed’s Actions in September Increase Loan Defect Risk?

By

FirstAm Editor on August 31, 2017

We’ve posted the July First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained the same in July 2017 as compared with the previous month, and increased 20.0 percent as compared to July 2016. The ...

Read More ›

The Fundamental Underlying Issue in the Housing Market

By

FirstAm Editor on August 28, 2017

First American’s proprietary Real House Price Index (RHPI) looks at June 2017 data and includes analysis from First American Chief Economist Mark Fleming on the prevailing issue facing today’s housing market.

Read More ›

The Struggle is Real for First-Time Homebuyers

By

Mark Fleming on August 23, 2017

First American’s proprietary Potential Home Sales model examines July 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›