Streak of Consecutive Months with Rising Loan Application Defect Risk Reaches Seven

By

FirstAm Editor on July 31, 2017

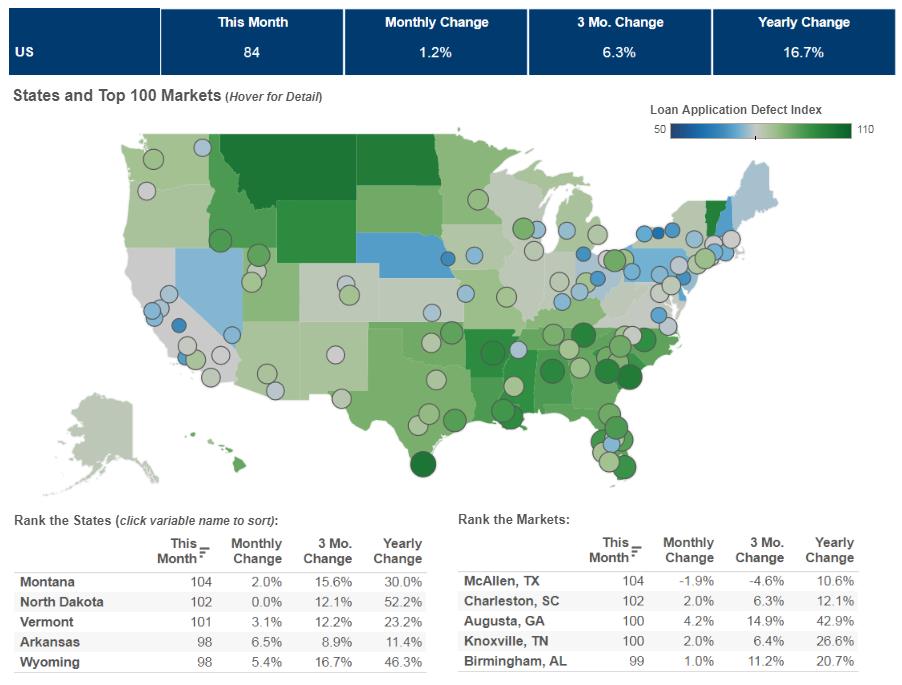

We’ve posted the June First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 1.2 percent in June 2017 as compared with the previous month, and increased 16.7 percent as compared to June 2016. The ...

Read More ›

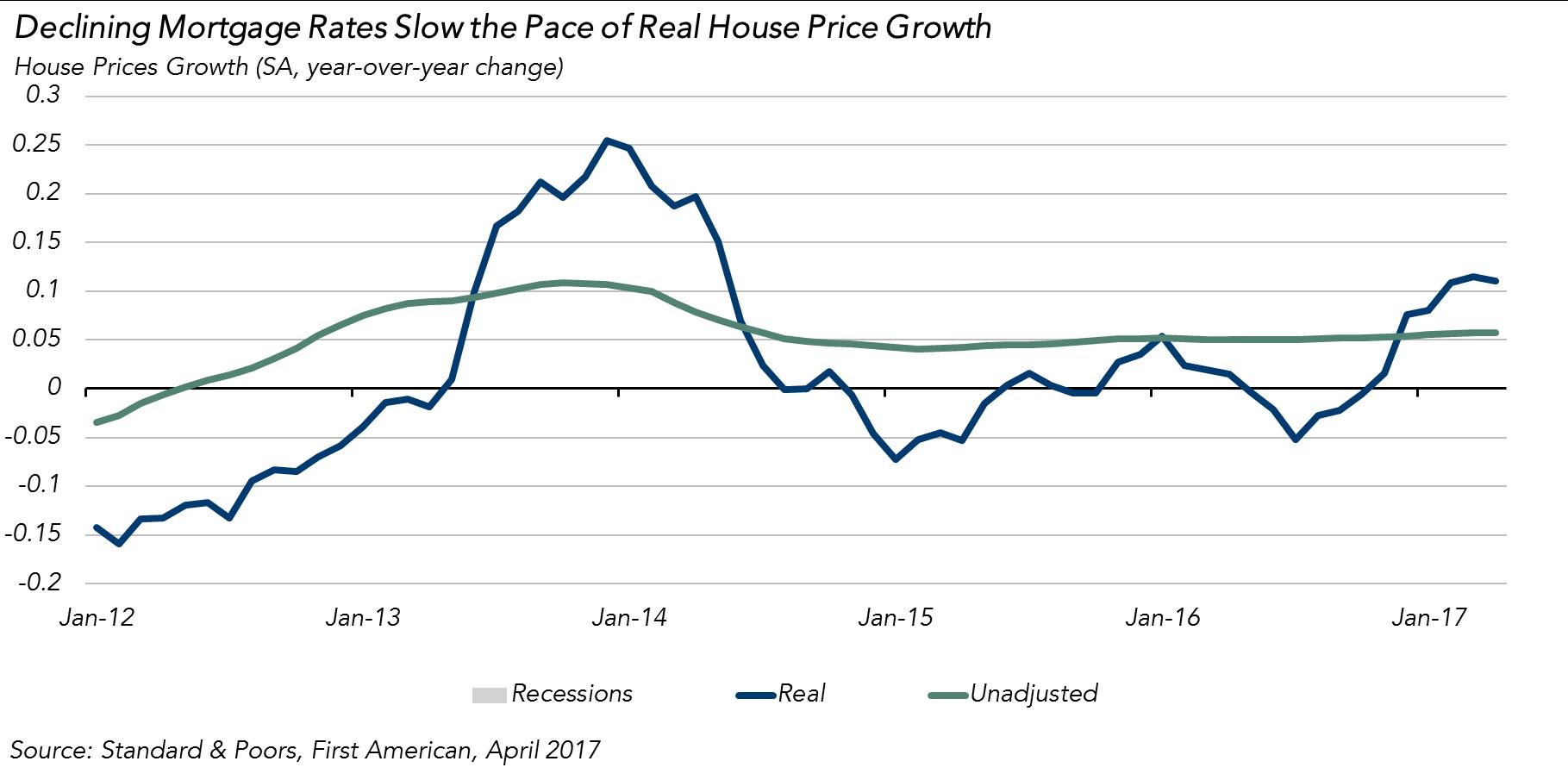

What Caused Real House Price Growth to Cool in May?

By

FirstAm Editor on July 24, 2017

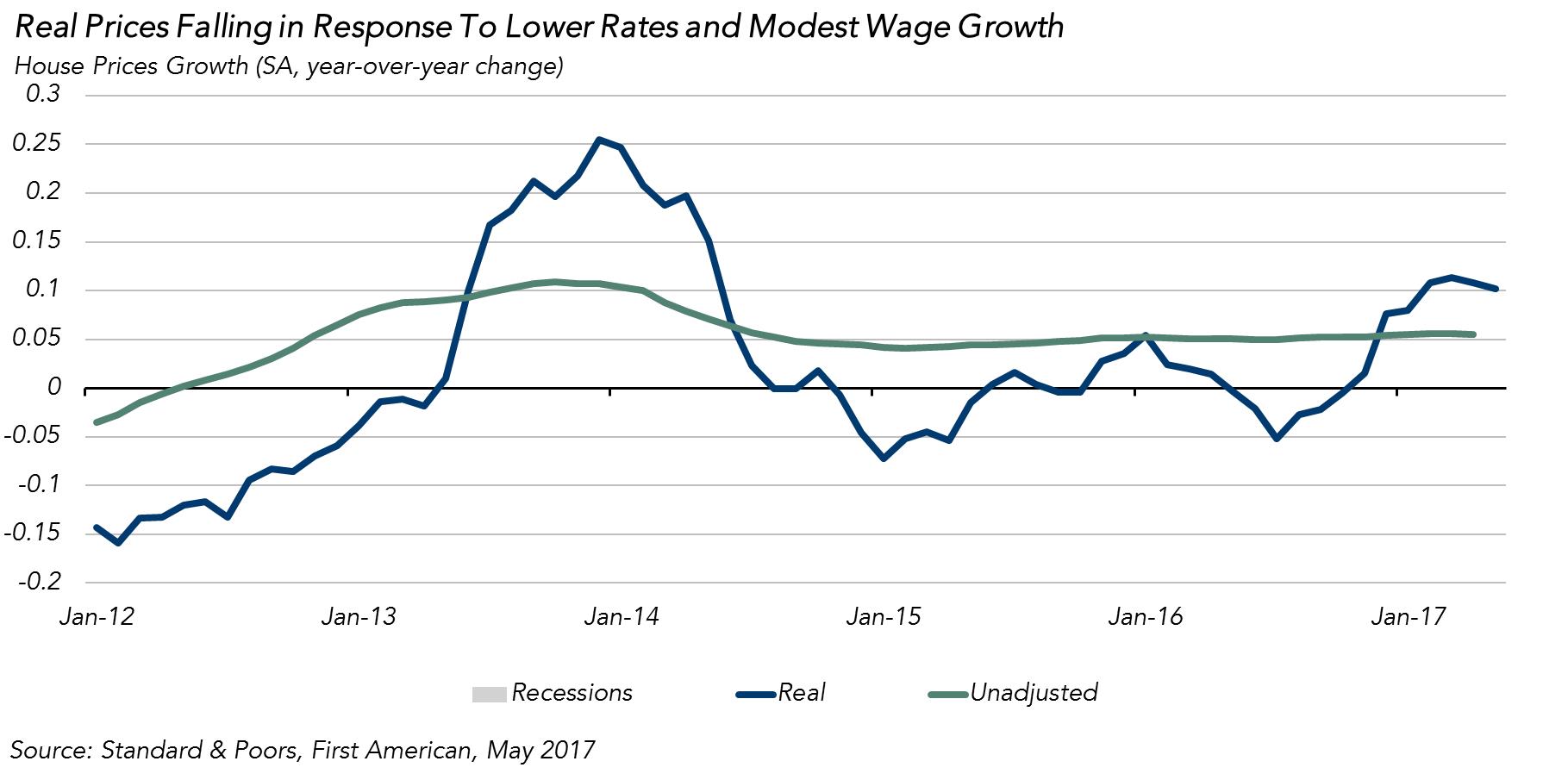

First American’s proprietary Real House Price Index (RHPI) looks at May 2017 data and includes analysis from First American Chief Economist Mark Fleming on the impact of wages and lower interest rates on consumer house-buying power – a brief reprieve from rising real house prices.

Read More ›

The Persistent Force Behind Lower Affordability

By

Mark Fleming on July 20, 2017

First American’s proprietary Potential Home Sales model examines June 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›

When Does a Home Become a Prison?

By

Mark Fleming on July 19, 2017

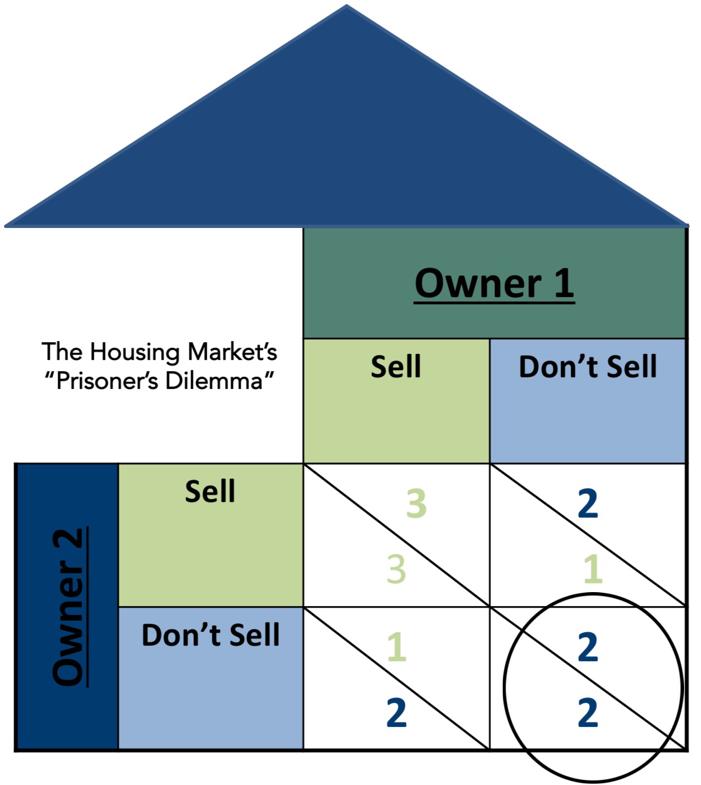

The housing market is suffering from a supply shortage, not a demand dilemma. As Millennial first-time homebuyer demand continues to increase, the inventory of homes for sale tightens. At the same time, prices are increasing, so why aren’t there more homeowners selling their homes?

Read More ›

Which Markets are Wilting Under a Loan Defect Risk ‘Heat Wave’?

By

FirstAm Editor on June 28, 2017

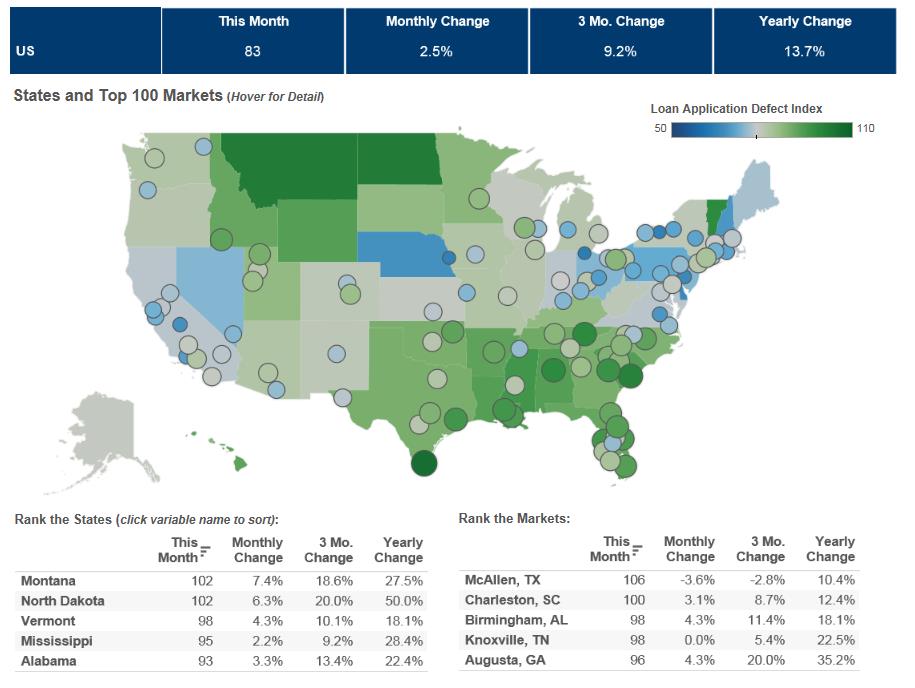

We’ve posted the April First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 2.5 percent in May 2017 as compared with the previous month, and increased 13.7 percent as compared to May 2016. The ...

Read More ›

What Caused Real House Prices to Decline for the First Time in 8 months?

By

FirstAm Editor on June 26, 2017

First American’s proprietary Real House Price Index (RHPI) looks at April 2017 data and includes analysis from First American Chief Economist Mark Fleming on the impact of wages and lower interest rates on real house prices.

Read More ›