The spring home-buying season is right around the corner. As we reflect back on the spring of last year, it becomes clear that we were spoiled in 2016 with mortgage rates well below 4 percent at the beginning spring, and flirting with record lows at 3.4 percent in the summer. This year began with mortgage rates at 4.25 percent, and concern mounting that mortgage rates would rise further this spring. Despite the higher mortgage rates, the most recent January existing-home sales numbers increased dramatically, surpassing a recent cyclical high and increasing to the fastest pace in almost a decade. This represents a potential trigger moment in housing. While inventories remain very low, and median home prices are on a 59-month streak of increases on a year-over-year basis (7.1 percent), home sales remain robust. Could the strong home sales signal a pending broad upsurge in the desire for homeownership?

“It will be interesting to see if the market can keep up with this resurgent demand as these two trends converge. This may be the trigger moment that pushes the housing market to a whole new level.”

Last month, I analyzed the effects of demographics, specifically marriage and having children, on homeownership. The main finding was that, in time, as Millennials reach their mid-30s, I expect to see the share of married households with children increase, which should spur a corresponding increase in homeownership. Yet, it’s not just the decisions to marry or have children that increase the likelihood of being a homeowner. Economic conditions also play an important role. If the economy is in recession and it’s hard to find a job, or one’s income is flat or declining, it would make sense that there would be less demand for homeownership. But, could the converse also be true too?

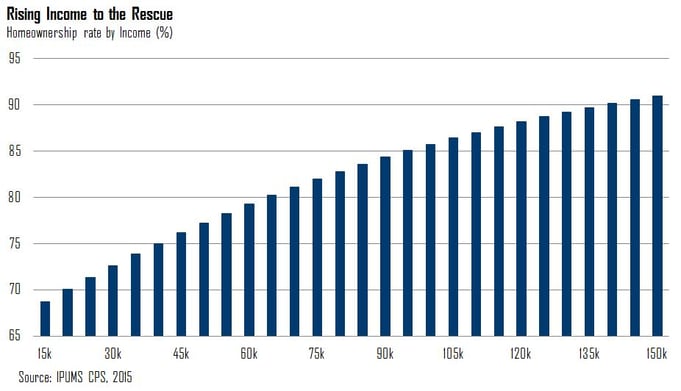

Rising Income to the Rescue

Let’s first look at how income levels impact the likelihood of homeownership. According to our Homeownership Progress Index (HPRI), homeownership rates in 2014 (most recent data available) for those households with an average income of $110,000 or greater, had a homeownership rate of approximately 86 percent. At the lowest annual income bracket of $28,000, the homeownership rate is 45 percent. Using the same model used to analyze the impact of marriage and having children on homeownership, Figure 1 below shows the correlation between the homeownership rate and median, inflation-adjusted income, when all other lifestyle and demographic factors are held equal. As one might expect, homeownership increases as household real incomes increase. For a household earning $50,000, an extra $10,000 a year would increase the likelihood of homeownership by 2.1 percent. Going from an income of $50,000 to $100,000 increases the likelihood of homeownership by approximately 10 percent.

The good news for the real estate industry is that there are some positive trends in income growth. After a period of stagnant wage growth, median household income in the United States increased from $53,718 in 2014 to $56,516 in 2015. Based on my analysis, this upward trend in income translates, all other factors held equal, to an almost 1 percent rise in the likelihood of homeownership. According to a CBS MoneyWatch article, more jobs are being created for the 25-to-34-year-olds (potential Millennial home buyers) than any other age cohort, and these jobs are in higher paying fields. While we may not see it in today’s homeownership rates, this analysis shows that higher income households are more likely to be homeowners.

So, there is compelling evidence to expect rising incomes will spur an increase in homeownership demand. Based on my research last month, we can also expect a positive impact on homeownership as older Millennials enter their 30’s and pursue marriage and start families in greater numbers. Now, we have two significant trends, income growth and the pending increase in marriage and family formation, which may come together this spring as the trigger moment for the housing market.

Figure 1

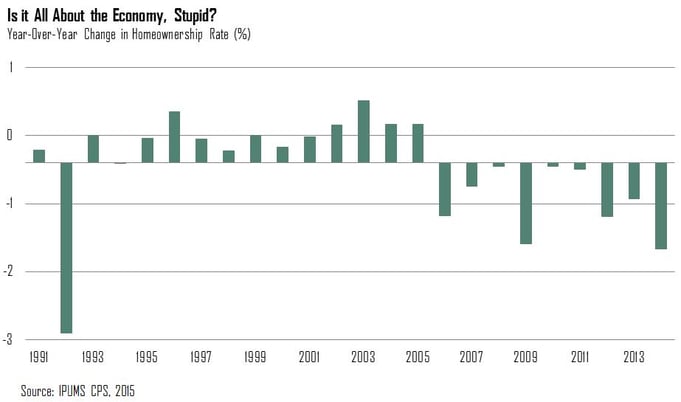

Is it All About the Economy, Stupid?

Household income is only one measure of overall economic conditions. Equally important is whether one can get a job, change a job or keep a job. Changes in economic conditions and consumer access to mortgage financing are also important influences on homeownership. Our decision and ability to buy a home is closely tied to all of these economic factors.

Figure 2 shows the change in the homeownership rate, all other factors held constant, due to changing economic conditions over time. Between 1992 and 2005, the strong economy of the 1990s and the housing boom of the early aughts increased homeownership, all else held equal, by 5.6 percent. The recession that followed the housing boom peak forced the homeownership rate to decline 5.1 percentage points. More recently, improving economic conditions have helped fuel a resurgence in the homeownership rate. While the most recent economic data for the analysis is 2015, we know that economic conditions further improved in 2016, which suggests further increased homeownership demand.

Figure 2

Good News for Spring?

It’s hard to predict future economic conditions. However, this analysis shows that a growing economy and rising income levels each play a role in increasing the likelihood of homeownership. The decision by many Millennials to delay marriage and start a family are currently reducing homeownership demand, but there are signs Millennials are increasingly looking to enter the housing market. In fact, a Realtor.com survey shows that the 2017 spring home buying season will largely be made up of first-time home buyers – 61 percent of these being Millennials. Higher household incomes and continued good news on the economy are also increasing demand to buy a home as we enter the spring home buying season. It will be interesting to see if the market can keep up with this resurgent demand as these two trends converge. This may be the trigger moment that pushes the housing market to a whole new level.