Millennials Continued to Drive Homeownership Demand in 2021

By

Odeta Kushi on July 6, 2022

In 2022, National Homeownership Month arrived in June as the housing market adjusts to higher mortgage rates amid still strong nominal house price appreciation, which have resulted in a significant decline in house-buying power. The housing boom of 2020 and 2021 was the exception, not the rule. Record-low mortgage rates, the ability to work from ...

Read More ›

Housing Millennials Homeownership Progress Index Homeownership

Does Greater Educational Achievement Increase the Likelihood of Homeownership?

By

Odeta Kushi on October 14, 2021

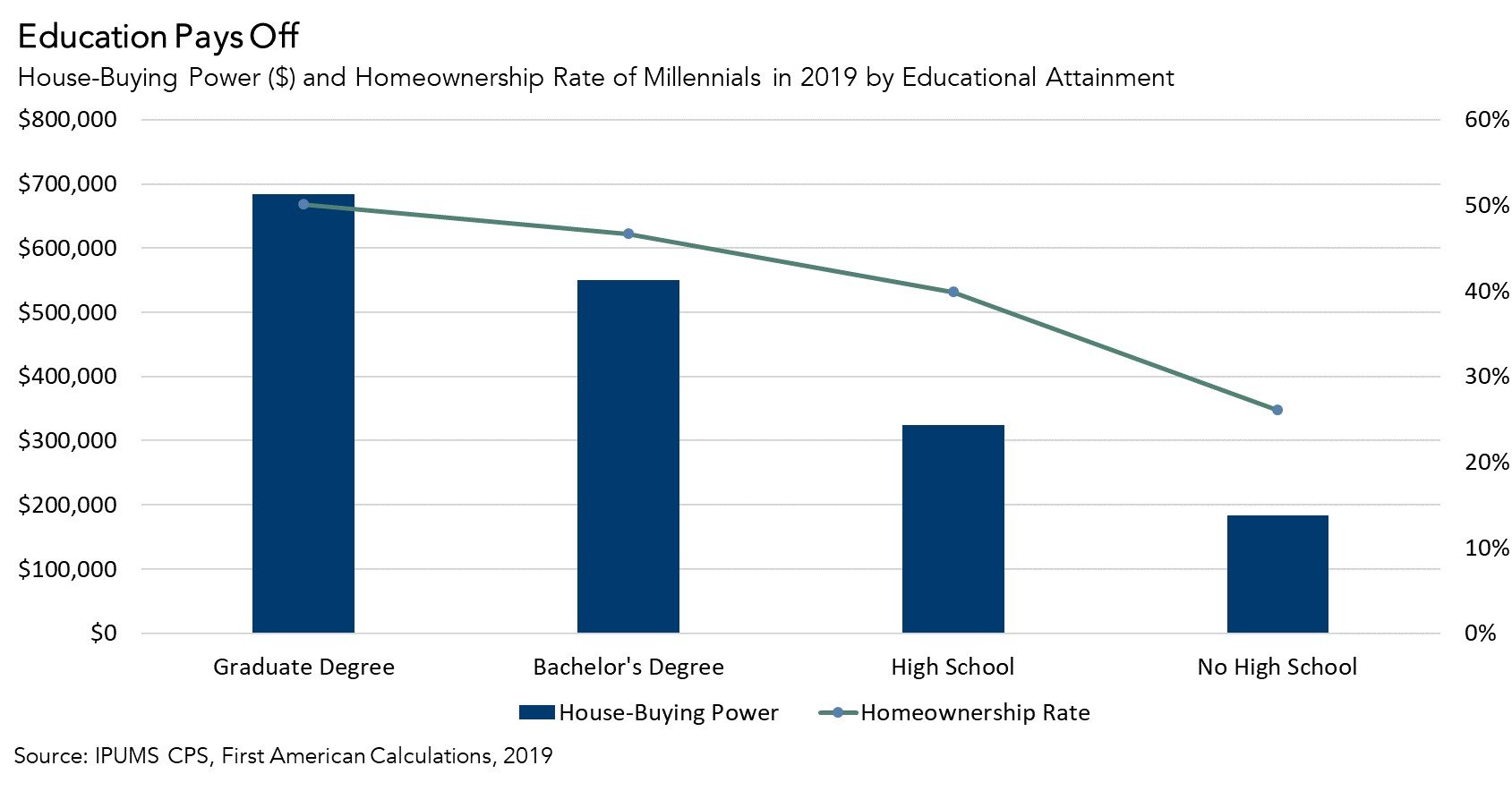

We’re often told that education is the key to a more secure financial future. Most people spend at least 12 years of their lives as students and even more if they pursue higher education. But does more education equate to increased earning potential? And, if so, does the increased earning potential translate to a greater likelihood of becoming a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership

Pandemic Accelerated 'Roaring 20s' of Millennial Homeownership Demand

By

Odeta Kushi on June 29, 2021

National Homeownership Month takes on a new meaning this year, as the pandemic has redefined the role of a home. A home is not just a dwelling or even just a vehicle for wealth creation, but also an office, a classroom, a daycare and even a gym. A home, now more than ever, has become a top priority for American households. The broadening role of ...

Read More ›

Housing Millennials Homeownership Progress Index Homeownership

Pandemic Unlikely to Slow Looming Wave of Millennial Marriages and Corresponding Increase in Potential Homeownership Demand in the Long Run

By

Odeta Kushi on July 15, 2020

Millennials are already the most educated generational cohort in U.S. history, which bodes well for future homeownership demand. But they are also aging into key lifestyle decisions, like marriage and having children, associated with a greater likelihood of purchasing a home. According to our analysis of anonymized household data, millennials ...

Read More ›

Affordable housing Millennials Homeownership Progress Index Homeownership

Rising Millennial Educational Attainment Signals Homeownership Demand Primed for Growth

By

Odeta Kushi on July 9, 2020

Examining critical lifestyle, societal and economic trends can provide a strong indication of the likelihood of owning a home and, in turn, potential homeownership demand. This is the fundamental concept behind our annual Homeownership Progress Index (HPRI). Understanding these forces and tracking how they change over time allows us to measure ...

Read More ›

Housing Millennials Education Homeownership Progress Index Homeownership

Millennial Homeownership Delayed, But Not Denied

By

Mark Fleming on July 1, 2020

As we navigate the unprecedented impact of COVID-19, home has taken on added significance and there are signs that homeownership remains one of the main tenets of the American Dream. After hitting a bottom in the second week of April, mortgage applications to purchase a home increased for nine consecutive weeks, even exceeding levels from a year ...

Read More ›

Housing Millennials Homeownership Progress Index Homeownership