With the Federal Reserve Open Market Committee (FOMC) meeting to decide whether to increase the Federal Funds rate in just a few days, the potential for an increase in mortgage rates dominates the housing news and industry chatter. Yet, changes to the short-term rate matter little to the housing market.

“If the FOMC raises rates again, will the yield curve flatten further, or will longer-term rates feel the pressure and rise as well? History suggests further flattening.”

The truth is changes to short-term interest rates, like the Federal Funds rate, tend to have very little influence on mortgage rates. That’s because mortgage rates, particularly the very popular 30-year, fixed-rate mortgage, are benchmarked to the 10-year Treasury bond. A wide range of global political and economic factors can influence the yield on long-term bonds, such as the ten-year Treasury bond. For example, last summer the Brexit vote caused a “flight to safety” and increased demand for U.S. Treasury bonds. In the week following the Brexit vote, the yield on the 10-year Treasury declined by .3 percentage points and the mortgage rate fell from 3.56 percent to 3.41 percent.

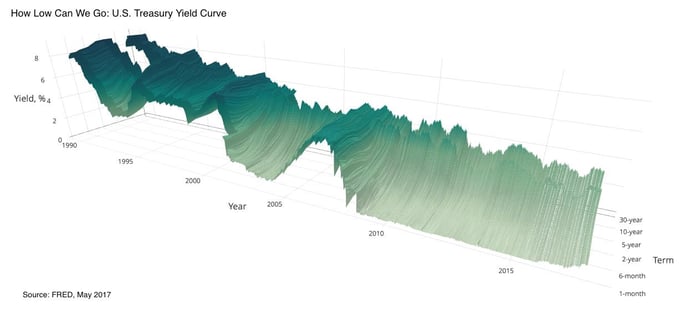

When the FOMC raises short-term rates and longer term rates do not rise by the same amount or more, the gap between short- and long-term rates narrows. This is referred to as a flattening yield curve. The yield curve below plots short- and long-term rates for a variety of different durations over time. There have been periods of steep and flat yield curves since 1990. Particularly in 2006 when short-term rates were higher than long-term rates, a condition known as yield curve inversion. One can also see the reduction of the Federal Funds rate to zero in response to the recession and slow recovery (the lower right front corner of the chart). It should be noted that rates can be high and the yield curve flat, as was the case in the early 2000’s.

Today, by historic standards, the yield curve is flat, but not inverted, and rates are low. The housing market has benefited as mortgage rates have stayed at or near historic lows, even as the Fed has started to increase the Federal Funds rate and push up the short end of the yield curve. So, where will rates go from here? If the FOMC raises rates again, will the yield curve flatten further, or will longer-term rates feel the pressure and rise as well? History suggests further flattening.

Odeta Kushi contributed to this blog post.