Why Housing Affordability May Rebound in 2023

By

Mark Fleming on December 26, 2022

Affordability continued to suffer in October 2022, as the Real House Price Index (RHPI) jumped up by 68 percent on an annual basis. This rapid annual decline in affordability was driven by a 12 percent annual increase in nominal house prices and a 3.8 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. ...

Read More ›

House Prices Decline, But Equity Buffers Remain Robust

By

Mark Fleming on November 28, 2022

In September 2022, the Real House Price Index (RHPI) jumped up by 60.6 percent on an annual basis. This rapid annual decline in affordability was driven by two factors – a 13.5 percent annual increase in nominal house prices and a 3.2 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though ...

Read More ›

Pandemic Boom Markets Cooling the Fastest

By

Mark Fleming on October 21, 2022

Affordability continued its rapid decline in August 2022, as the Real House Price Index (RHPI) soared 49 percent on an annual basis. The ongoing and swift decline in affordability was driven by a 15 percent increase in nominal house prices and a 2.4 percentage point increase in the 30-year, fixed mortgage rate compared with one year ago. As ...

Read More ›

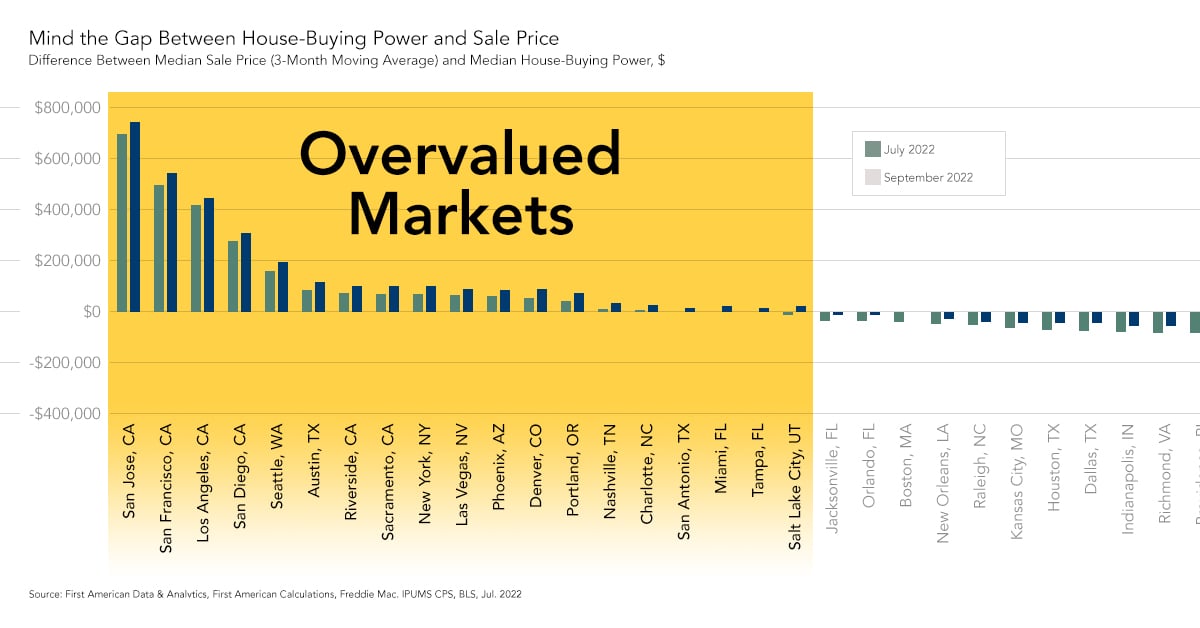

Where is Housing Overvalued?

By

Mark Fleming on September 27, 2022

Housing affordability continued its rapid annual decline in July 2022, as nominal house prices increased 16.7 percent year over year and the 30-year, fixed mortgage rate increased 2.5 percentage points compared with a year ago. The decline in affordability is reflected in the Real House Price Index (RHPI) jumping up by nearly 54 percent on an ...

Read More ›

Where are House Prices Moderating the Most?

By

Mark Fleming on August 29, 2022

In June 2022, the Real House Price Index (RHPI) jumped up by 53.3 percent on an annual basis, setting a new record for the fifth month in a row for the fastest year-over-year growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by an 18.5 percent annual increase in nominal house prices and a ...

Read More ›

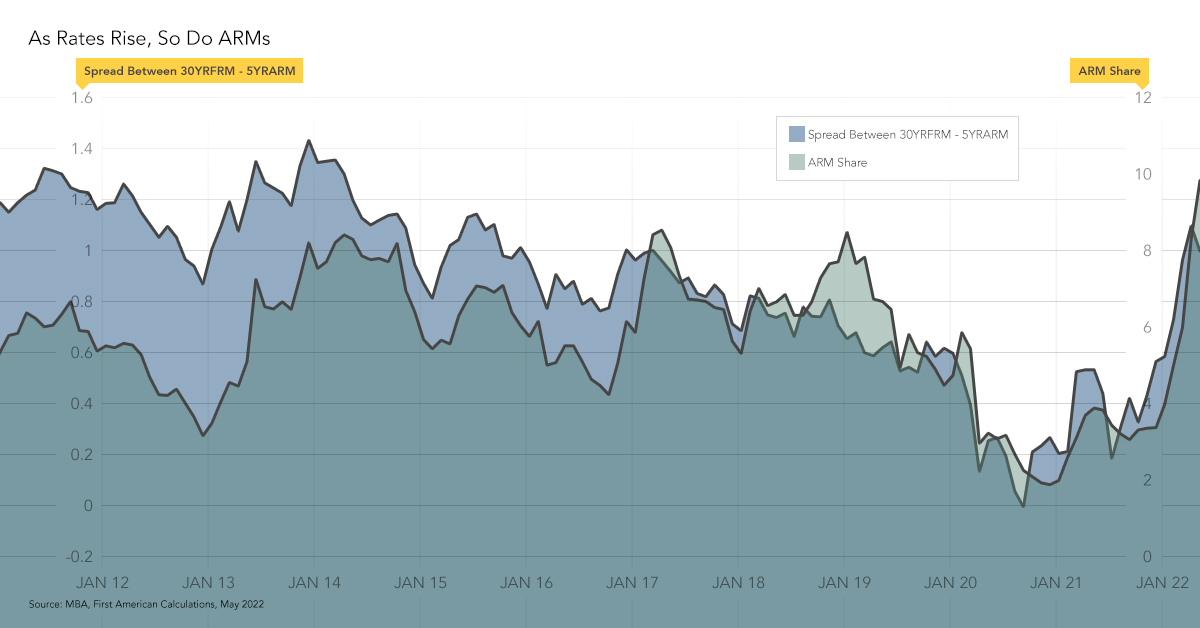

Will Rising Mortgage Rates Trigger an 'ARMs' Race for Home Buyers?

By

Mark Fleming on July 22, 2022

In May 2022, the Real House Price Index (RHPI) jumped up by 50.8 percent year over year, which is the fastest growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by a 20.1 percent annual increase in nominal house prices and a 2.3 percentage point increase in the 30-year, fixed-mortgage rate ...

Read More ›

.jpg)

.jpg)