Top 5 Most and Least Affordable Housing Markets Amid Higher Rates

By

Mark Fleming on March 13, 2017

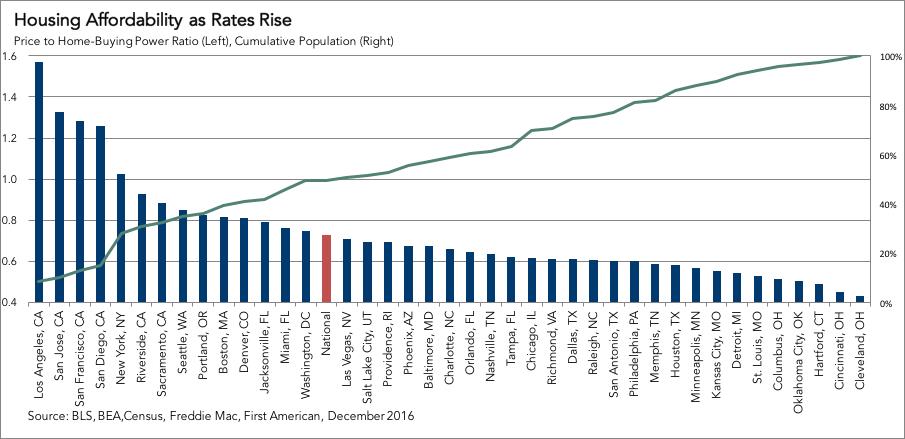

Recent economic data and comments by members of the Federal Open Market Committee (FOMC) all suggest that the chance of a rate increase this week after the FOMC meets is substantially higher than it was just a few weeks ago. Now that we are most likely in a rising rate environment, what does it mean for housing affordability?

Read More ›

What’s Behind the December Dip in Housing Affordability?

By

FirstAm Editor on February 27, 2017

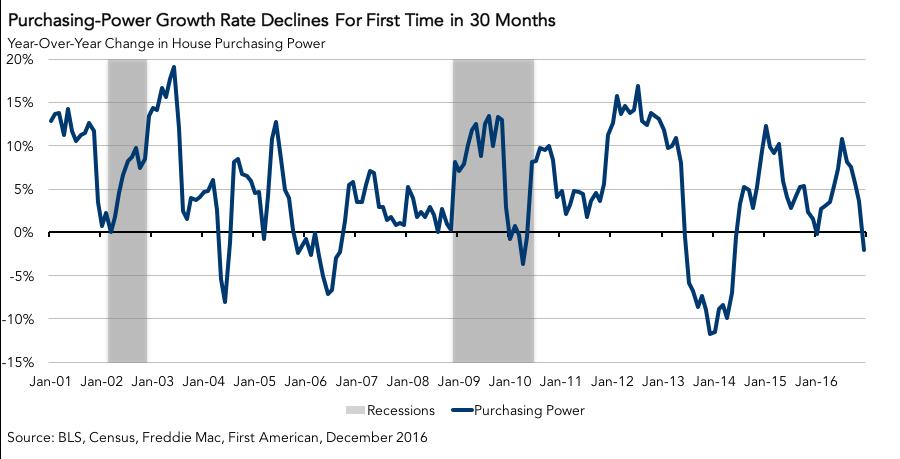

First American’s proprietary Real House Price Index (RHPI) looks at December 2016 data and includes analysis from First American Chief Economist Mark Fleming on the decline in affordability as consumer house-buying power dipped due to rising rates.

Read More ›

Rising Rates and Strong Nominal Price Growth Halt Six-Month Run of Increasing Affordability

By

FirstAm Editor on January 30, 2017

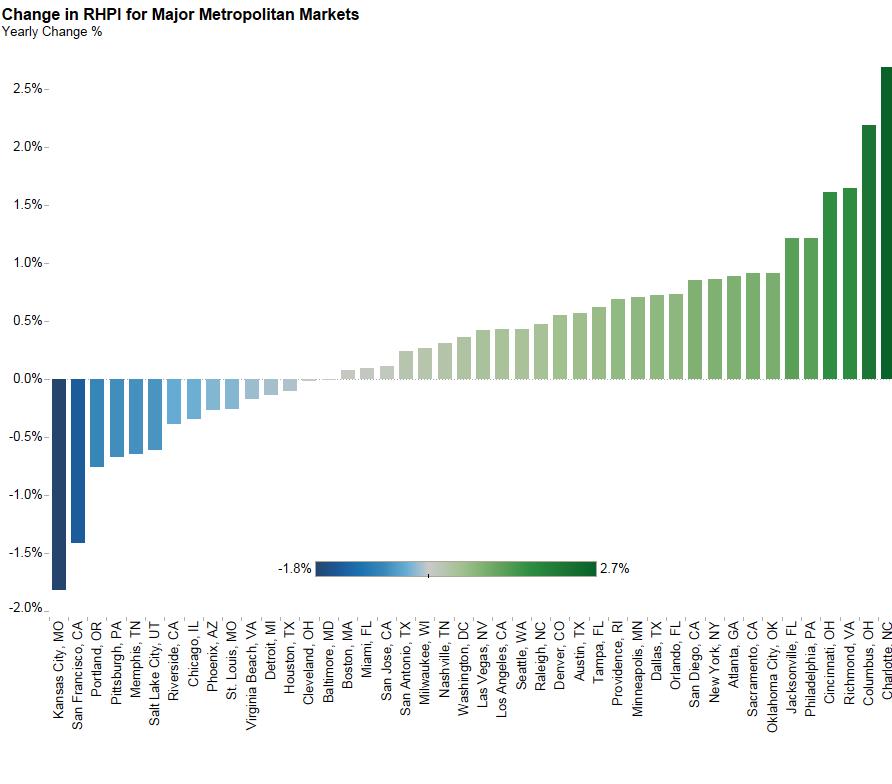

First American’s proprietary Real House Price Index (RHPI) looks at November 2016 data and includes analysis from First American Chief Economist Mark Fleming on a shift in affordability as real house prices increased for the first time in six months.

Read More ›

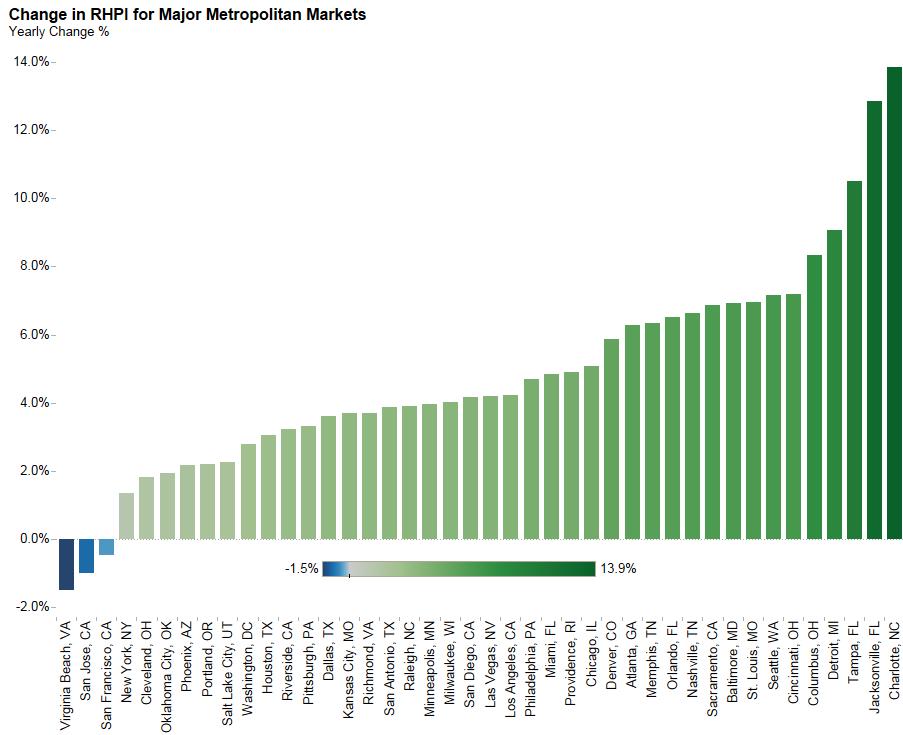

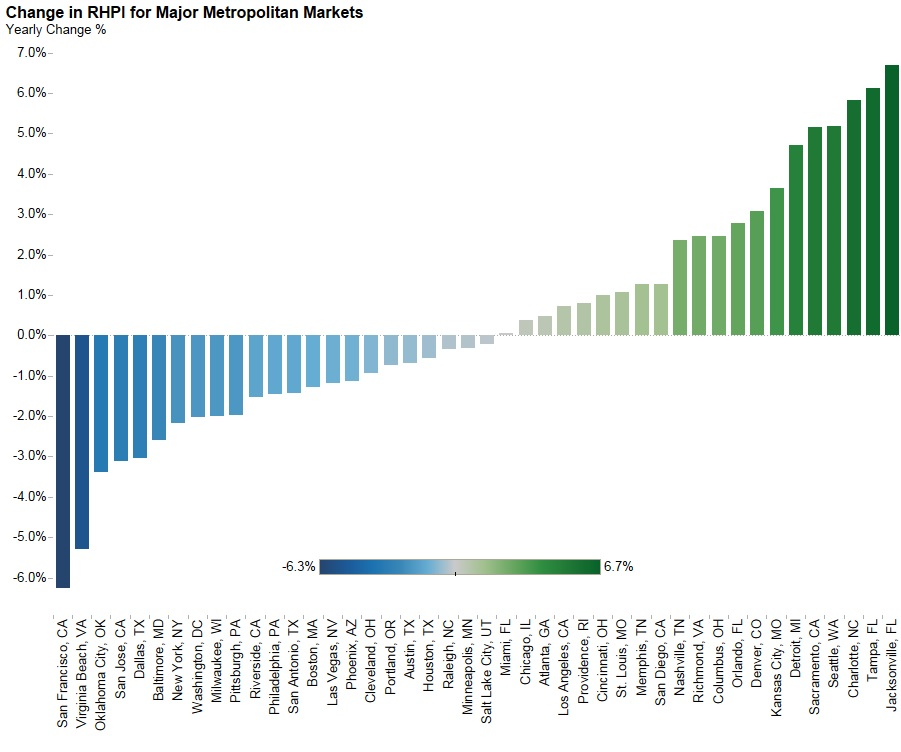

Affordability Improves Nationally Based on Wage Growth, Although Not for Many Major Markets

By

FirstAm Editor on December 26, 2016

First American’s proprietary Real House Price Index (RHPI) looks at October 2016 data and includes analysis from First American Chief Economist Mark Fleming on the impact of rising mortgage rates on consumer house buying power and affordability heading in to 2017.

Read More ›

What a Difference an Election Makes

By

Mark Fleming on December 13, 2016

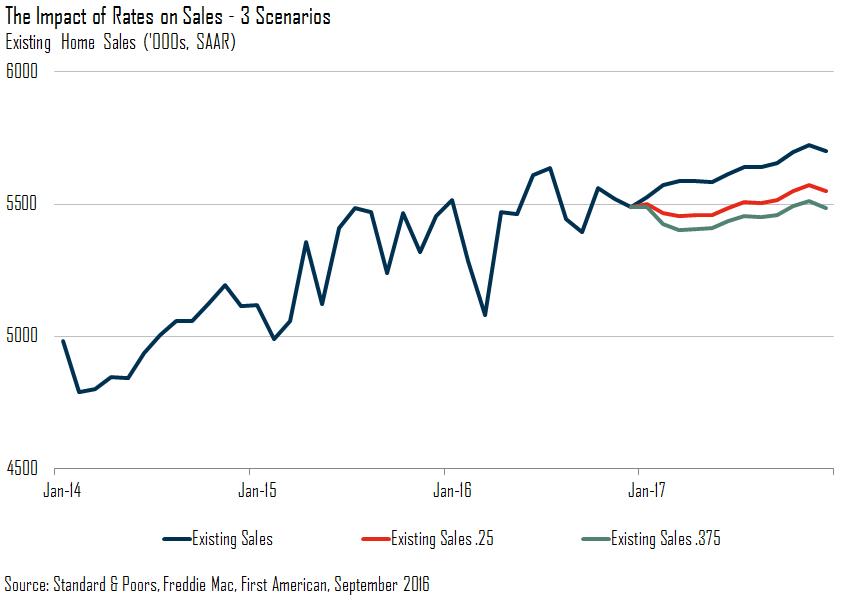

What a difference an election makes. Since the election, we have seen a pronounced increase in the popular 30 year-fixed mortgage rate. In the words of Federal Reserve Chairman Janet Yellen, financial markets expect that expansionary fiscal policy will accelerate U.S. economic growth and increase inflation. As a result, the 30-year fixed mortgage ...

Read More ›

Housing Interest Rates Real House Price Index Federal Reserve

Wage Growth Contributes to Increased Affordability in Most Major Markets

By

FirstAm Editor on November 28, 2016

First American’s proprietary Real House Price Index (RHPI) looks at September 2016 data and includes analysis from First American Chief Economist Mark Fleming that includes comments on last week’s conforming loan limit increase.

Read More ›