Whether you plan to buy a modest studio or a four-bedroom penthouse, how much you can afford to borrow primarily rests on two main factors: income and interest rates. Income growth seems to be increasing, thus increasing affordability. However, the near certainty of future rate hikes will likely be a drag on affordability.

Mortgage rates tend to follow the same path as long-term bond yields, which have been steadily climbing. The yield on the 10-year Treasury note has climbed about 40 basis points since the start of the year on the expectation of escalating inflation and concerns about Federal Reserve rate hikes. According to data released by Freddie Mac last week, the 30-year, fixed-rate mortgage increased to 4.32 percent, up 40 basis points from the beginning of the year. This marks the fifth consecutive week of rising rates, begging the question – what does this all mean for home buyers?

“So, home buyers have no fear, even in a rising rate environment, you hold the power — house-buying power, that is.”

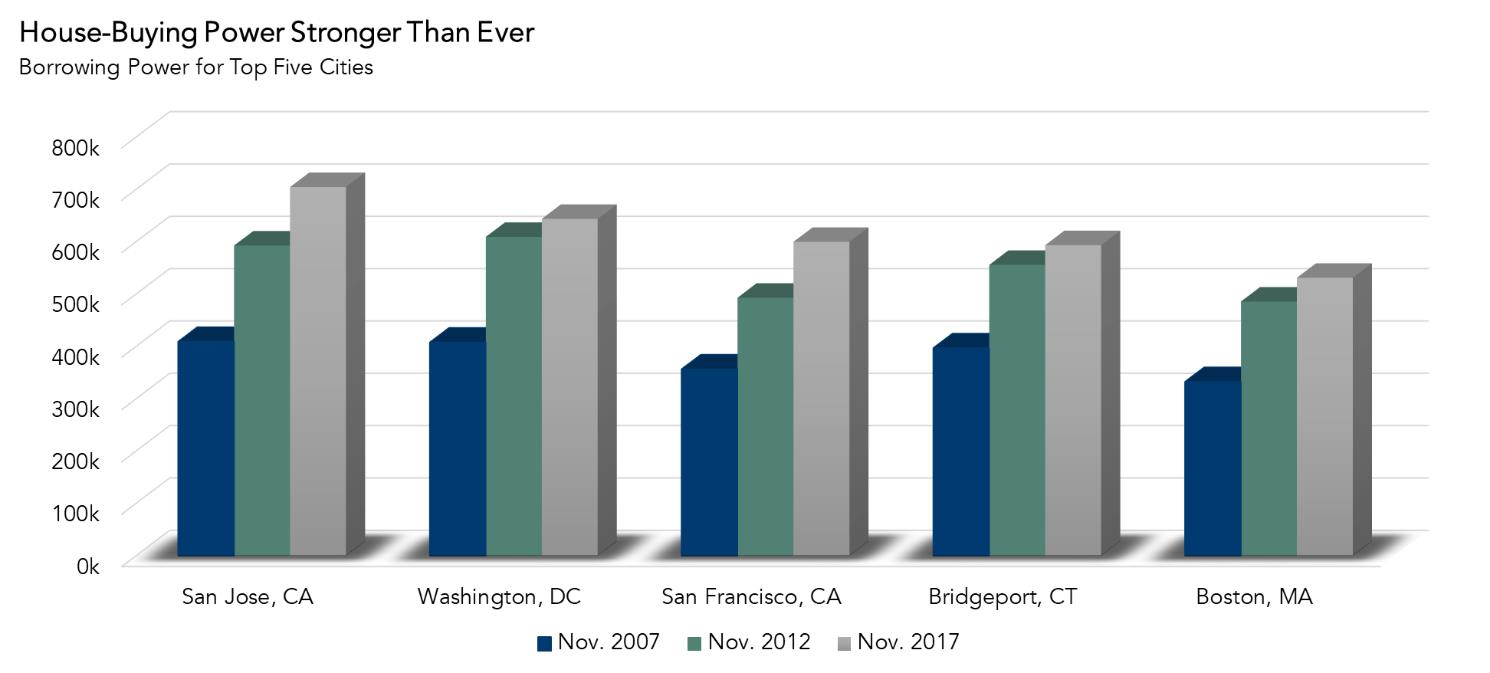

Monitoring changes in house-buying power, the combination of one’s income and the prevailing mortgage rate, provides an insightful view of affordability. At a national level, we find that house-buying power has increased significantly compared to 5 or even 10 years ago.

We can also compare how house-buying power differs between cities. Using a city’s annual median household income, assuming that a household spends one-third of their gross monthly pay on a mortgage, and the current 30-year, fixed-rate mortgage rate, the cities where you can reasonably borrow the most are:

- San Jose, CA: $704,298

- Washington, DC: $643,528

- San Francisco, CA: $599,628

- Bridgeport, CT: $593,269

- Boston, MA: $530,985

On average, these five cities have seen a 12.5 percent increase in house-buying power since 2012, and a 62 percent increase in house-buying power since 2007. California cities, such as San Jose and San Francisco, experienced the largest increases in house-buying power, 22 percent and 19 percent increases respectively, since November of 2012, as household incomes have grown dramatically in these cities. The increase in house-buying power between 2012 to today is slightly smaller in Boston, Bridgeport, and Washington D.C., with growth rates of 9.4 percent, 6.8 percent and 5.6 percent, respectively.

We discussed in an earlier post that potential increases in interest rates will not significantly impact renters, and consequently, first-time homebuyers. Home buyers have more house-buying power than five years ago. In fact, house-buying power has increased an average of 9 percent in the last five years among the top 100 markets. So, home buyers have no fear, even in a rising rate environment, you hold the power — house-buying power, that is.

Odeta Kushi contributed to this blog post.