The Price of Admission to Homeownership

By

Mark Fleming on December 14, 2015

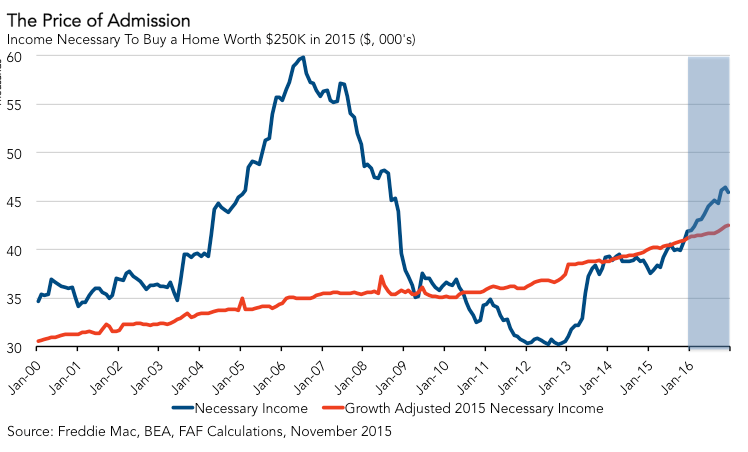

Will Janet Yellen’s Christmas gift to the housing market be a rate increase on December 16? According to the CME Group FedWatch tool, the probability that the Federal Reserve will raise interest rates for the first time since 2006 is now over 80 percent. For perspective, let’s think about 2006: the iPhone did not exist, MySpace was the leading ...

Read More ›

Homeownership Has a New Home

By

Mark Fleming on December 10, 2015

This week, Representative Loretta Sanchez (D-Ca) spoke on the floor of the US House of Representatives about the leadership forum, “Achieving the American Dream,” that was held on the Hill in late October. Her short speech highlighted the importance of homeownership as a source of wealth creation for middle-class Americans and its role in ...

Read More ›

The Bust of the Dakota “Oil Rush”

By

Mark Fleming on December 9, 2015

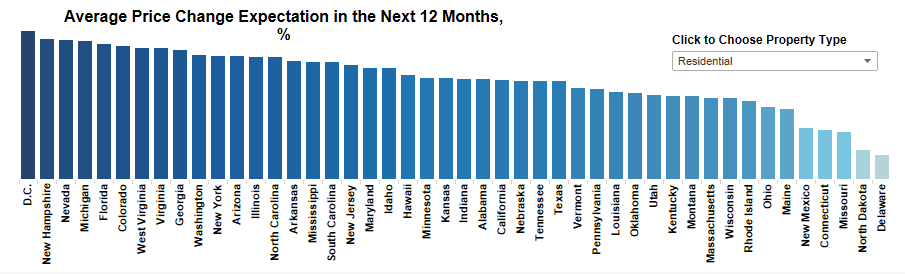

“One of these things is not like the other,” is an adage we learn as children to teach us how to identify outliers. This phrase maintains its relevance as adults, especially in the age of “big” data. This week’s release of the First American Real Estate Sentiment Index (RESI) is one such example of its use.

Read More ›

Real Estate Sentiment Index: Title agents feel a Fed rate increase will impact first-time homebuyer demand most

By

FirstAm Editor on December 8, 2015

We’ve posted the fourth quarter 2015 First American Real Estate Sentiment Index, which measures title agent sentiment on a variety of key market metrics and industry issues. It’s based on a quarterly survey of title agents that do business with First American. More than 3,000 title agents from 50 states have participated in the first two editions ...

Read More ›

Based on FHFA Adjustment Technique, Loan Limit Not Likely To Increase

By

Mark Fleming on November 25, 2015

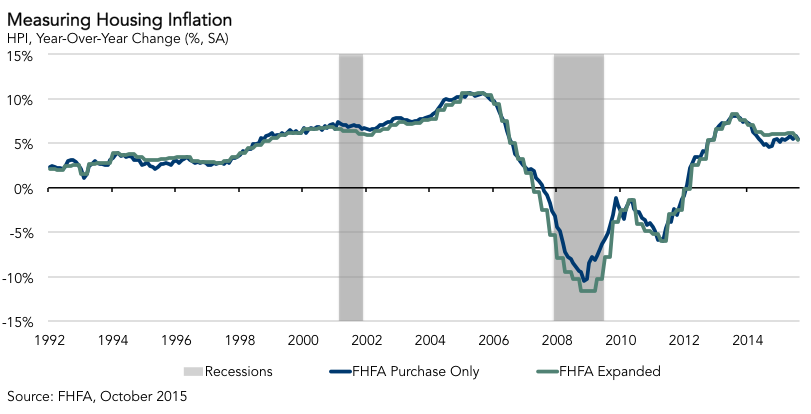

Last week, I posted an analysis of the GSE Conforming loan limit and my expectation for how it might change in 2016. I based the analysis on my interpretation of the Housing and Economic Recovery Act of 2008 (HERA). Specifically, Section 1124 of the law, which states, “If the change in the house price index during the most recent 12-month or 4 ...

Read More ›

Ability-to-Pay Rules Reduce Income-Related Fraud Risk

By

FirstAm Editor on November 24, 2015

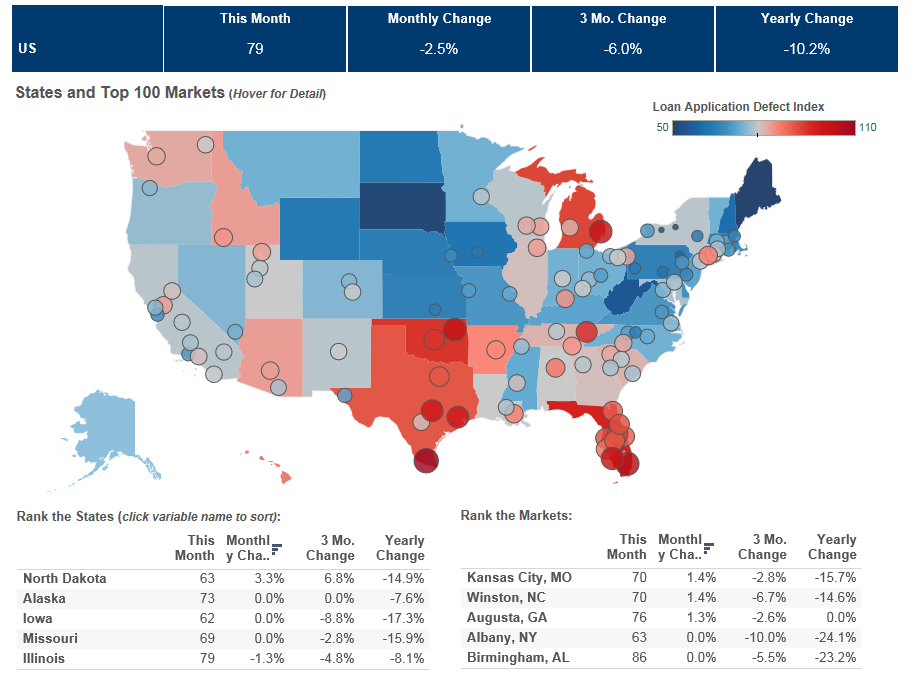

We’ve posted the October First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. Overall, the index fell 2.5 percent in October as compared with September and decreased by 10.2 percent as compared with October 2014.

Read More ›