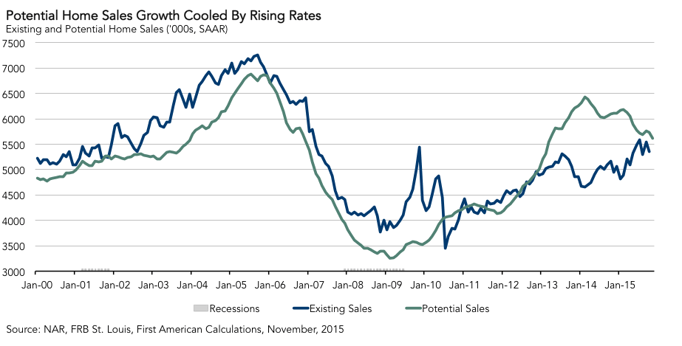

For the month of November, First American’s proprietary Potential Home Sales model (previously called the Existing-Home Sales Capacity model) showed that the market potential for existing-home sales decreased by 2.1 percent compared to October and decreased by 8.0 percent compared to a year ago. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals.

The price of admission for homeownership will rise, in part because of the leverage-assisted asset inflation caused by the low-rate environment, says Chief Economist Mark Fleming

According to the model, the seasonally adjusted, annualized rate (SAAR) of potential existing-home sales is up 72.6 percent from the low point reached in February 2009*. The rate of potential home sales in the model decreased by 118,500 (SAAR) in November. The potential home sales rate is down 810,000 (SAAR) from the most recent peak in February 2014.

The model’s current underperformance gap is an estimated 147,000 (SAAR), which is significantly less than the sales potential gap of 1.7 million existing-home sales in February 2014.

Analysis: The Price of Admission for Homeownership Will Rise

The model indicates the housing market’s potential for existing-home sales continued to pre-adjust to the increase in the Federal Fund Rate announced yesterday by the Federal Reserve. While the increase in the short-term rate only indirectly influences long-term interest rates, the Fed signaled a continued modest path of rate increases. According to the model, a modest path of rate increases will moderately increase the cost of mortgage financing and reduce the pace of house price appreciation in 2016. The rise in interest rates combined with a continued, yet slower, pace of appreciation were the most important market fundamentals that reduced the potential home sales rate in the model this month.

Earlier this week, I published an analysis of the change in affordability in 2016 for first-time homebuyers titled, “The Price of Admission to Homeownership.” Until yesterday, rates had not increased since before the iPhone was invented. Yet, the impact of yesterday’s events on first-time homebuyer affordability moving forward remains small. Our Real Estate Sentiment Index (RESI) indicated that first-time homebuyers are the most likely to be impacted by rising rates, but that their home-buying decisions will likely be unaffected until mortgage rates surpass 5 percent. Existing homeowners, mostly with fixed-rate loans, will be less impacted by any potential increase in long-term mortgage rates.

With or without Federal Reserve intervention, the income a first-time homebuyer will need to buy today’s starter home a year from now will increase. Yet, I estimate the difference to be only $700 dollars more in 2016 as the Fed starts to raise rates. The price of admission for homeownership will rise, in part because of the leverage-assisted asset inflation caused by the low-rate environment. The time for rock-bottom mortgage rates needed to end and the end of this era will only have a very modest impact on affordability for the first-time homebuyer.

In the year ahead, I expect existing-home sales to reach 5.5 million (SAAR) by the end of 2016. Housing demand will be dominated by emerging ethnically diverse first-time homebuyer households, as older existing homeowners will have a reduced incentive to sell their homes in a higher rate environment.

Next Potential Home Sales release: January 20, 2016 for December data

*Previous Potential Home Sales releases referred to November 2011 as the low point of sales. The model used to generate existing-home sales potential has been enhanced to more accurately reflect the dynamic relationships between sales, prices, interest rates and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model (previously called the Existing-Home Sales Capacity model) provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model will be published prior to the National Association of Realtors’ Existing-Home Sales report each month.