How much does a cow weigh? Penelope the cow, to be specific. A seemingly simple question, with an answer that gives credit to the notion that aggregation of information in groups results in more accurate information than independent prediction. This particular question was posed by Planet Money to over 17,000 people of diverse ages and backgrounds. The average of all of the guesses was 1,287 pounds – a mere 68 pounds below the actual value. Interestingly, self-described “cow experts” were off by more than the average Joe. Independence of judgment is difficult to achieve, as humans are drawn to a “herd” mentality. This makes the study even more unique, as individuals did not have the opportunity to consult one another.

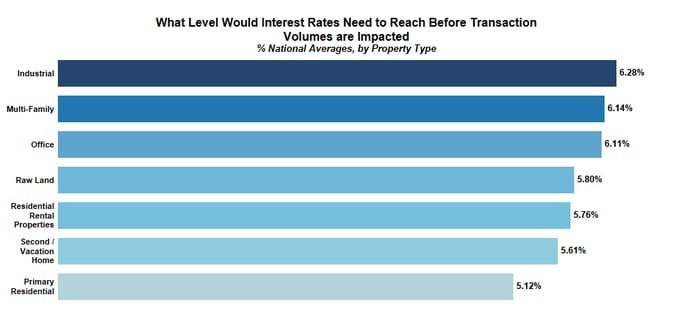

"Title agents make clear that transaction volumes of primary residential homes will only be impacted by rising rates if the rates hit 5 percent."

This study has been repeated in multiple disciplines ranging from behavioral economics to sociology, with the outcome leading to the notion of “collective wisdom.” This draws parallels to statistical sampling, and the culture of survey data. Recently, First American released the fourth quarter Real Estate Sentiment Index (RESI) – a quarterly survey of title agents that measures sentiment on a variety of key market metrics and industry issues. While a bit more mentally challenging than guessing the weight of a cow, the questions are posed individually to the title agent, and asks them to share their personal opinion.

The impact of rising interest rates on the real estate market was a point of debate for weeks before the recent interest rate increase by the Federal Reserve. However, title agents make clear that transaction volumes of primary residential homes will only be impacted by rising rates if the rates hit 5 percent. Judging by the logic of the “wisdom of the crowd,” there may be some truth behind this prediction. If that is the case, then the concerns regarding slowing home sales due to the increase in rates is unfounded. Perhaps, new homebuyers will be more likely to buy a smaller home, or buy less. Title agents also overwhelmingly determined that first-time homebuyers are most sensitive to an interest rate hike. This makes sense theoretically, as the other options pertain to current homeowners or those looking to buy a luxury residence. Those who currently own a home should not be as concerned about an increase in rates, especially if they are locked into a 30-year mortgage. On the other hand, first-time homebuyers are concerned, as the rates determine their home financing options.

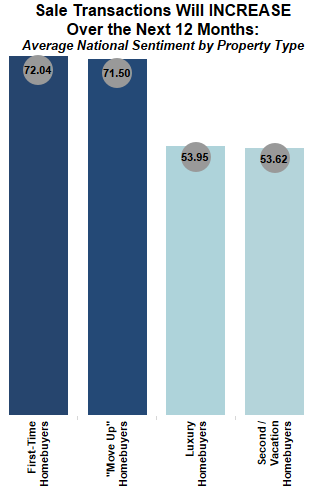

Sentiment in the RESI is measured by asking respondents to answer questions on a scale of negative, neutral or positive options. A RESI value above 50 indicates increasing positive sentiment and a RESI value below 50 indicates increasing negative sentiment. In the first figure, title agents overwhelmingly agree that sale transactions will increase for first-time homebuyers and move up homebuyers, but only modestly agree that it will go up for luxury homebuyers and second/vacation homebuyers.

In the second figure, title agents indicate the level that interest rates would need to reach in order to affect transaction volumes per property type. These values are the expectation based on the collective wisdom of title agents. Only time will tell if they are correct in their predictions. However, if a group of regular Joes can guess the weight of a cow, we have some reason to believe in the wisdom of the crowd as it pertains to the real estate market.

Odeta Kushi contributed to this post.