Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Market at Potential in Era of Low Interest Rates and Job Growth

By

Mark Fleming on July 20, 2016

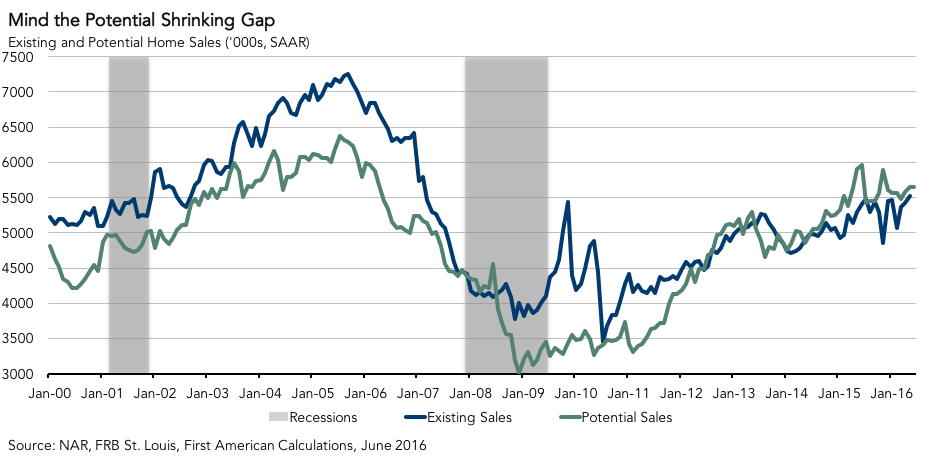

For the month of June, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by only 0.3 percent or an estimated 17,000 seasonally adjusted, annualized rate (SAAR) of sales, an improvement over last month’s revised performance gap of -3.1 percent or 180,000 (SAAR) ...

Read More ›

Market Activity Moves Closer To Potential

By

Mark Fleming on June 16, 2016

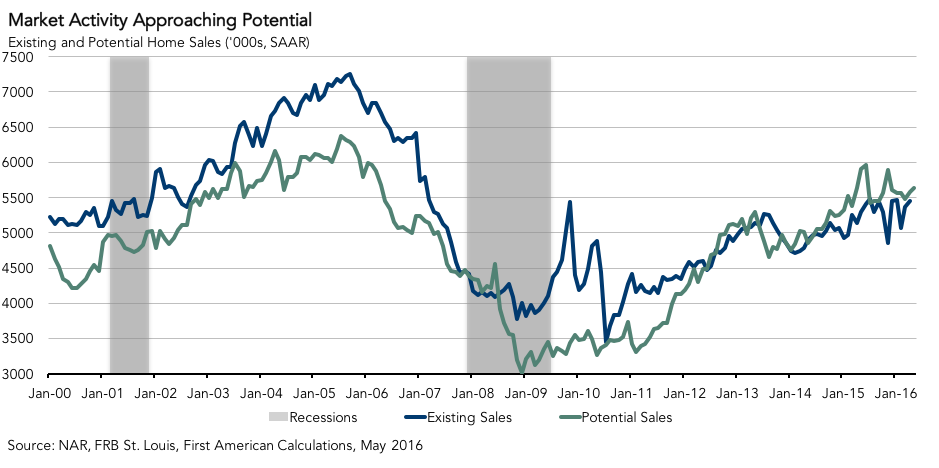

For the month of May, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by 2.8 percent or by an estimated 156,000 seasonally adjusted, annualized rate (SAAR) of sales. While still underperforming, this is an improvement over last month’s underperformance gap of ...

Read More ›

Really, How Important is That Rate Hike?

By

Mark Fleming on June 13, 2016

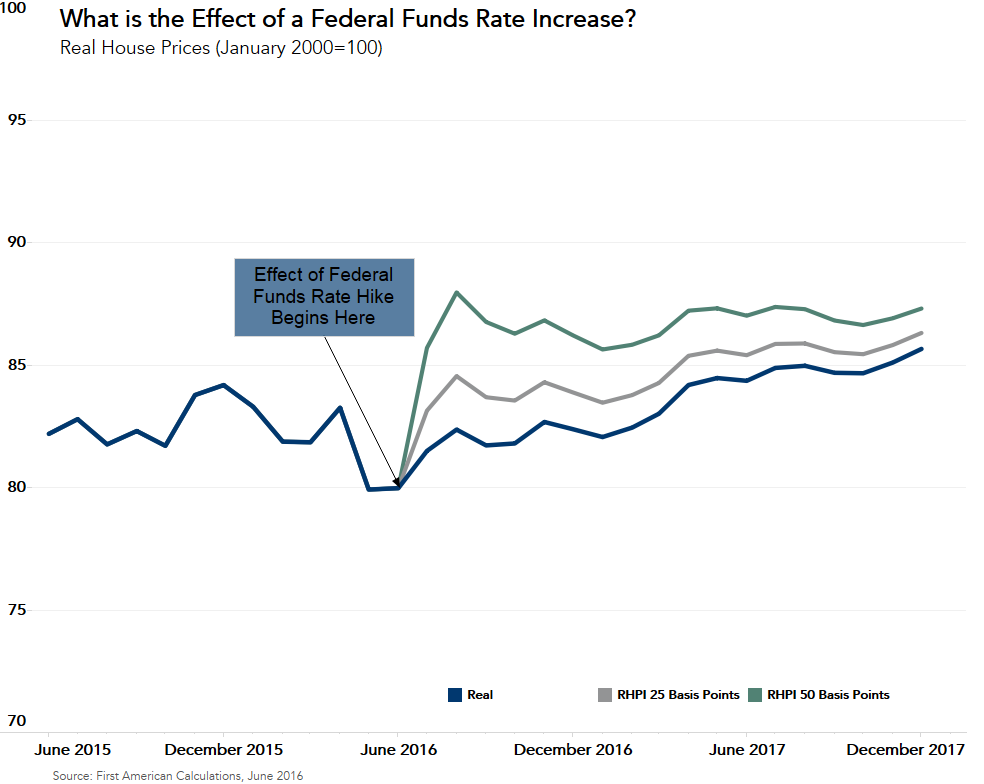

With the upcoming Federal Open Market Committee (FOMC) meeting this week, many are wondering if an interest rate hike is in the works. According to the CME FedWatch Tool, the current market expectation of a 0.50 percent rate increase in June is extremely low – 4 percent. However, the likelihood jumps to 27 percent in July. But, whether the Fed ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Income

Home Sellers Who Don't Want to be Buyers

By

Mark Fleming on May 31, 2016

Earlier this month, I had the opportunity to appear on the Lykken on Lending Blog Talk radio show. On the broadcast, we discussed the National Association of Realtors (NAR) existing-home sales numbers that are released monthly. As you may be aware from my recent comments here and here, I believe that existing home sales have been underperforming ...

Read More ›

Market Activity Impeded from Potential

By

Mark Fleming on May 18, 2016

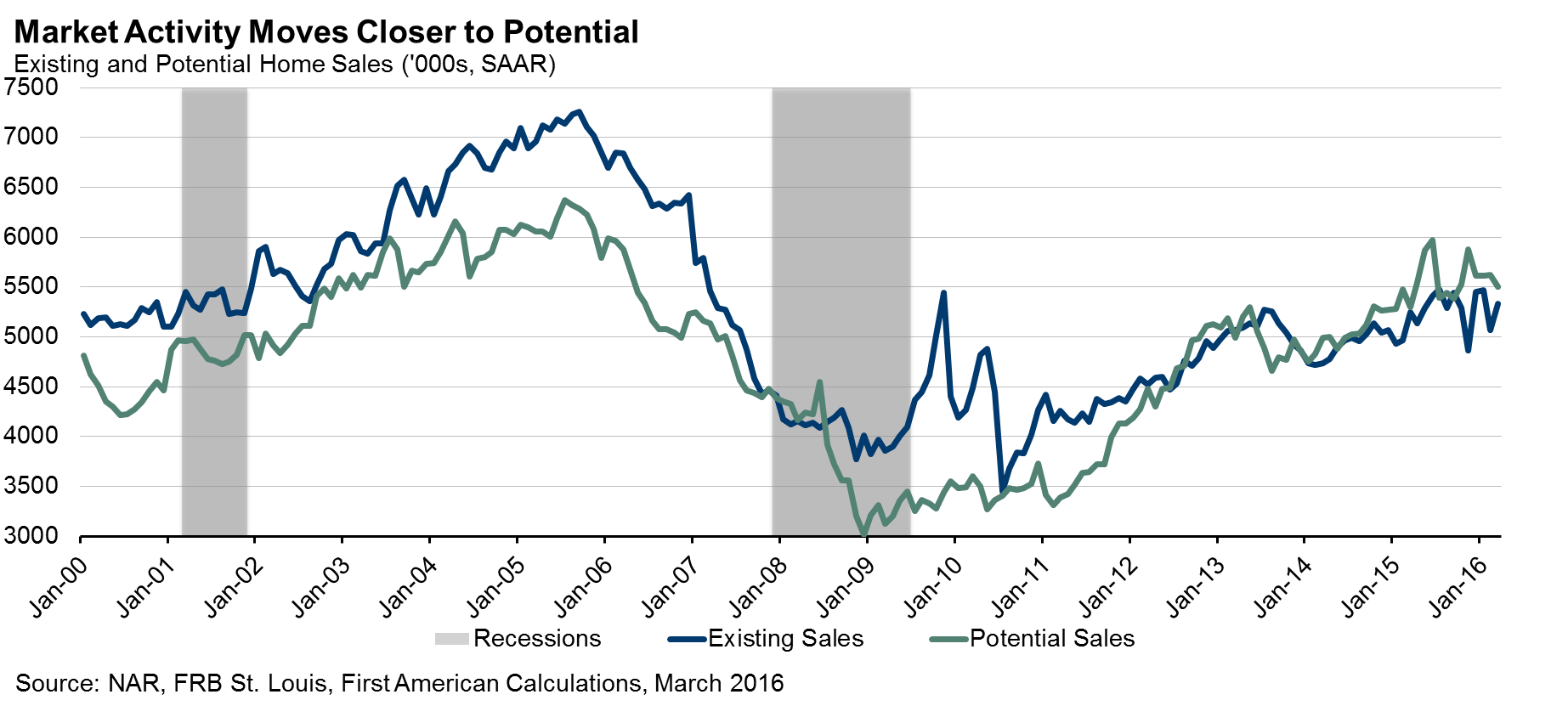

For the month of April, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by 4.1 percent or an estimated 232,000 seasonally adjusted, annualized rate (SAAR) of sales, an improvement over the last month’s revised performance gap of -7.6 percent or 418,000 (SAAR) ...

Read More ›

A Tale of Two Economies – Investing in U.S. Commercial Real Estate

By

Mark Fleming on May 12, 2016

We typically, actually almost exclusively, focus on residential real estate in the Economics Center. But, today it’s time to broaden our horizons. Focusing on residential real estate misses all the shops, restaurants, warehouses, hospitals and offices like the one I am sitting in right now writing this. In short, focusing on residential real ...

Read More ›