When is the best time to sell my house? It is one of the most common questions I am asked as an "expert" in housing. Assuming that one has the choice of timing the decision to sell one’s home, much of the decision has to do with the amount of equity that has built up since purchasing the house, the return on the investment. Traditional measures of house prices, such as the plethora of house price indices, will tell you how much typical houses in a general market have appreciated over a fixed time frame. Yet, it is rarely the same time frame as the one since your own home purchase.

"Homeownership is supposed to be an economic engine of wealth creation."

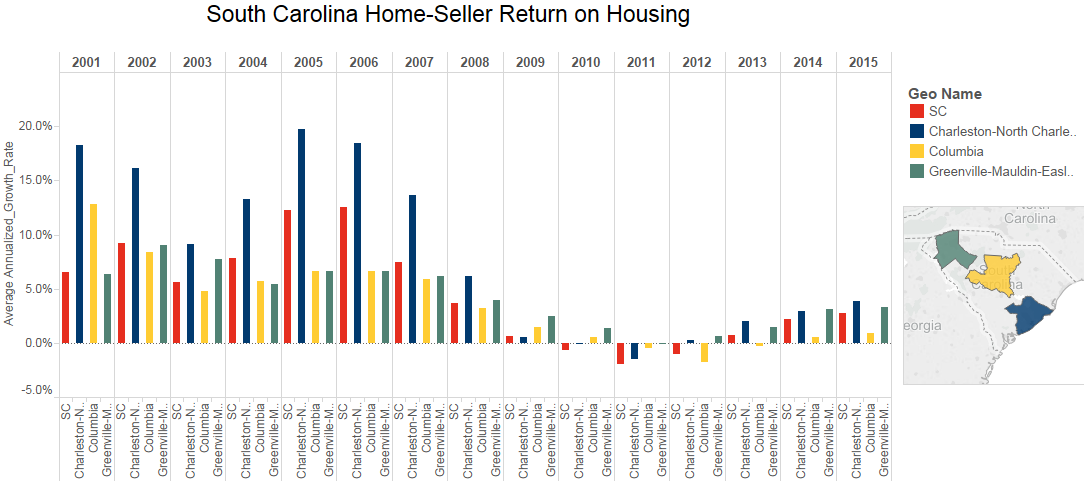

There is an alternative method for measuring house prices that can be helpful in estimating return on investment. In this method, we use houses that have transacted two or more times. Traditional repeat-sale home price indices use these same houses too. But, in this method, rather than measure the change in price, we simply calculate the annualized return between the first and second sale in a pair, measured in the year of the second sale. This is the home-seller’s annualized return on their investment in housing.

The chart below shows the average annualized returns for home-sellers in South Carolina and its three largest metropolitan areas, the site of the next primary election.

You can see that prior to the housing crisis sellers did very well with annualized returns exceeding 10 percent at the peak. Residents in Charleston did even better, almost reaching an average annualized home-seller return of 20 percent in 2005. When the housing crisis hit, home-sellers did not fare well. Between 2010 and 2012, they actually lost money.

More recently, South Carolina home-sellers have only eked out very modest gains. In fact, if inflation were any higher, the seller gains on real estate would be negligible. Homeownership is supposed to be an economic engine of wealth creation, but analysis using this method shows that engine has been sputtering recently in South Carolina. Most middle- and lower-class Americans generate the vast majority of their wealth from homeownership. Will South Carolina voters look to primary candidates for solutions to rev up this all-important engine of wealth creation?

Sindy Qui contributed to this blog post.