As rent growth has softened across all asset classes, property owners and operators have increased their focus on limiting expense growth. However, this has proven difficult for some line items, as both property insurance, and repairs and maintenance (R&M) expenses have increased significantly over the last three years. In this edition of the X-Factor, we’ll examine why these two common commercial property expenses have risen.

“With expenses well above pre-pandemic levels, expect a greater focus on limiting CRE expense growth in the years to come.”

Two Unavoidable Expenses

Two common expenses incurred when operating a property are R&M and the cost to insure the property against unanticipated, high-risk events, like natural disasters, equipment failure, and vandalism. While certain R&M expenses can at times be deferred, without property insurance the risk-reward tradeoff of a property investment changes drastically as an owner could potentially lose their entire investment if an unforeseen event severely damages the building.

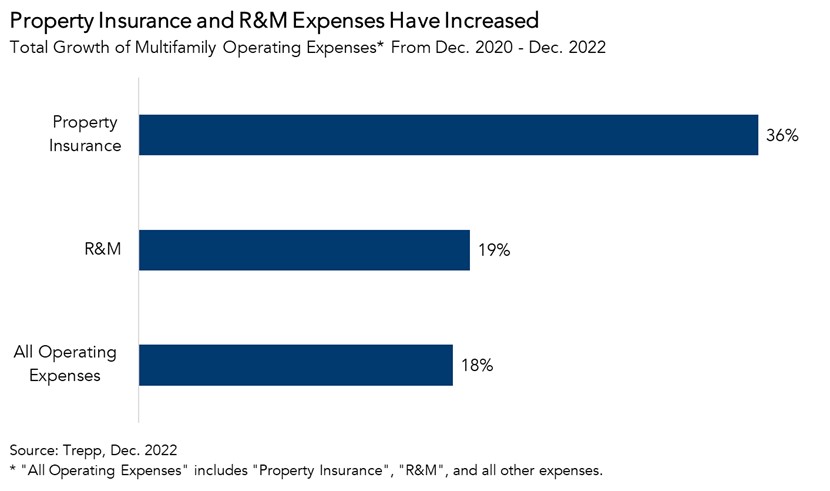

As shown in the chart below, R&M expenses and insurance premiums at multifamily properties increased meaningfully between December 2020 and December 2022. This trend was consistent across asset classes.

Higher Prices, Higher Premiums

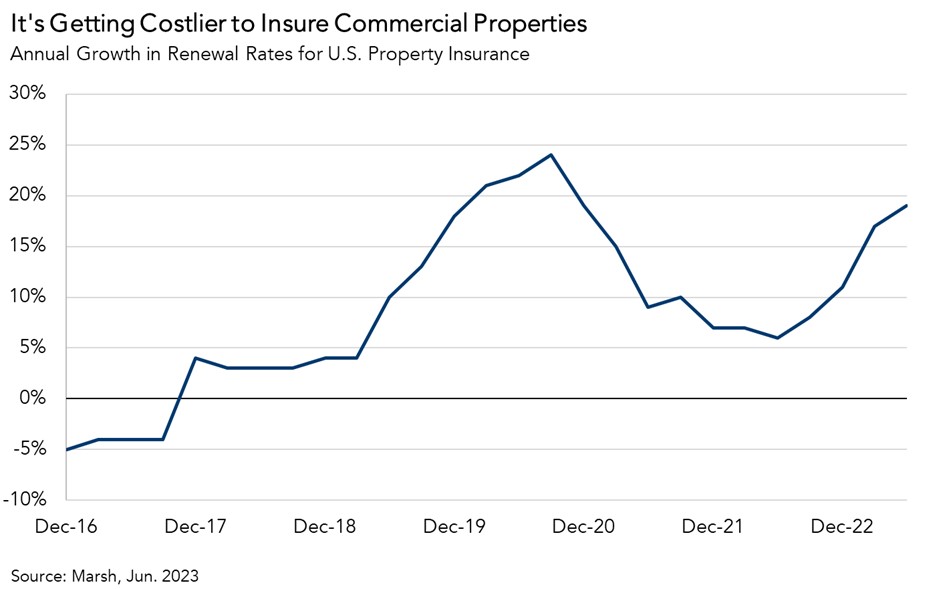

Across the country, renewal rates for commercial property insurance surged during the pandemic and continue to grow at a double-digit pace today. While some of these higher premiums are related to growing climate risk in certain geographies, there is also a more mundane dynamic at play. Due to the surge in property prices during the pandemic, insurance policies must now insure more expensive properties.

Additionally, construction material prices have grown substantially over the last three years. Higher construction material costs lead to higher property replacement costs, which is the amount the insurer would have to pay to replace the property from the ground up if it were completely destroyed. These higher replacement costs today are translating into higher CRE insurance premiums.

The Good News and Bad News About R&M Expense

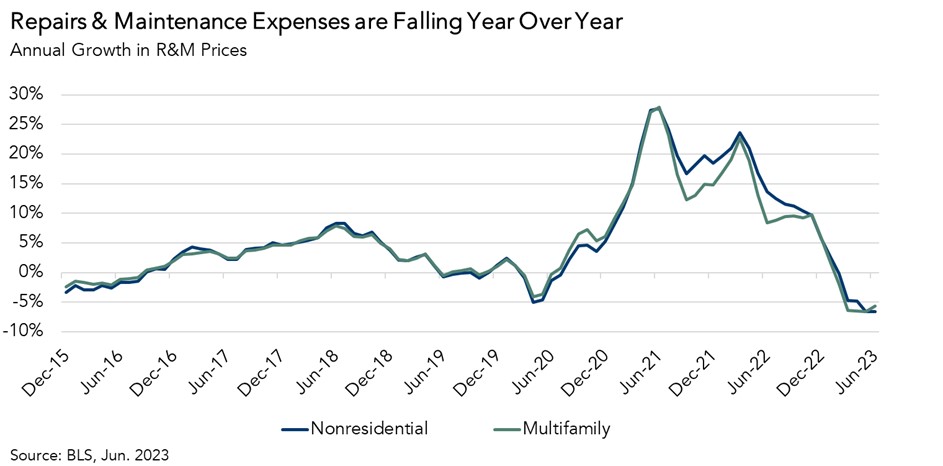

Everything, they say, is a matter of perspective. The latest release of the Producer Price Index (PPI) for R&M expense, which is a measure of inflation in R&M expenses, tells two tales.

The good news: On an annual basis, R&M expense has declined for multiple consecutive months for both non-residential and residential properties.

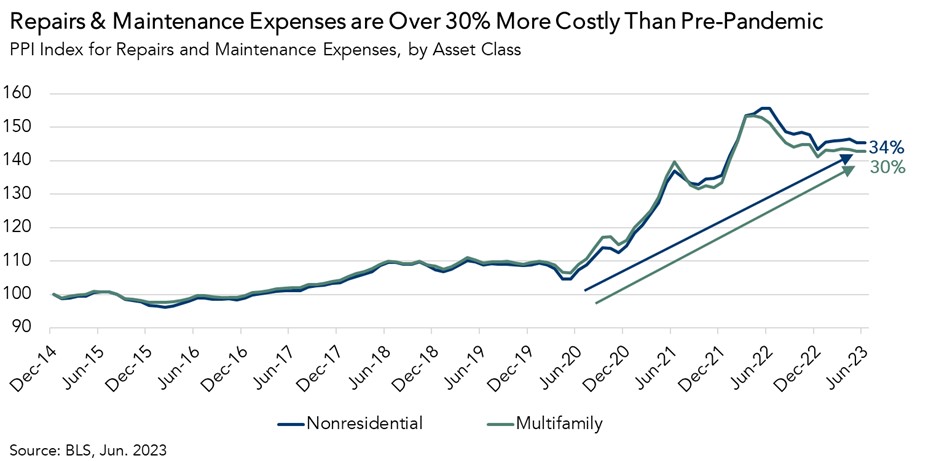

The bad news: Even with the recent price declines, R&M expenses are far costlier today than they were pre-pandemic due to a combination of higher material prices and labor costs.

So, What’s the X-Factor?

For commercial properties, there are two ways to grow the bottom line: increase rents and limit expenses. Over the last two years, rents have surged. Today, rent growth, while still in transition, is returning to more normal levels. That leaves expense management as a crucial tool in the CRE operator’s toolbox to maintain building profitability. With expenses well above pre-pandemic levels, expect a greater focus on limiting CRE expense growth in the years to come.