As pandemic-era restrictions and precautions eased, consumers began to spend the money that they had saved during the early parts of the pandemic. The resulting surge in consumer spending contributed, at least in part, to the runaway inflation that eventually triggered the Federal Reserve to hike interest rates at the fastest pace in decades. Consumers today, however, face meaningful headwinds that will likely limit their ability to spend at the rates they have since late 2021. In this X-Factor, we’ll take a closer look at what some of those headwinds are.

“You can’t spend money that you don’t have, and consumers are now running low on savings while facing a growing need to repay credit card and student loan debt.”

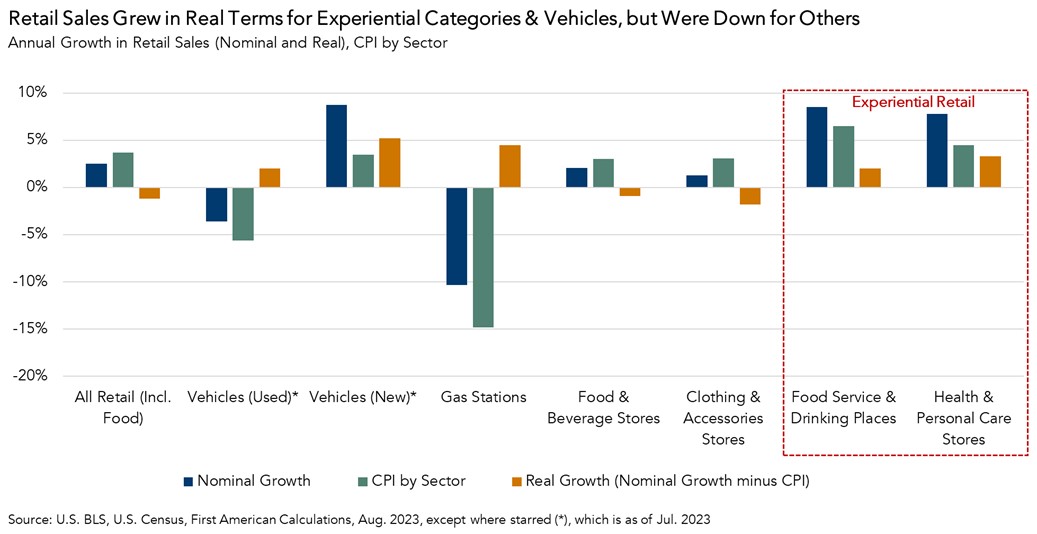

Real Retail Sales Down, Except for Experiential Locations

Real retail sales growth is a measure that adjusts headline, or nominal, retail sales growth by inflation, thereby more accurately gauging the true strength of the consumer. Without adjusting for inflation, any positive retail sales growth that’s observed could be due to a general increase in prices throughout the economy.

Though total real retail sales growth has been declining over the last six months, it increased for both vehicles and experiential retail locations in August. “Experiential” refers to locations that require the consumer to physically be there to receive the service they’re selling. (i.e., restaurants, bars, salons). Despite having less cash in the bank and more credit card debt, consumers continue to increase their real spending at locations that offer services.

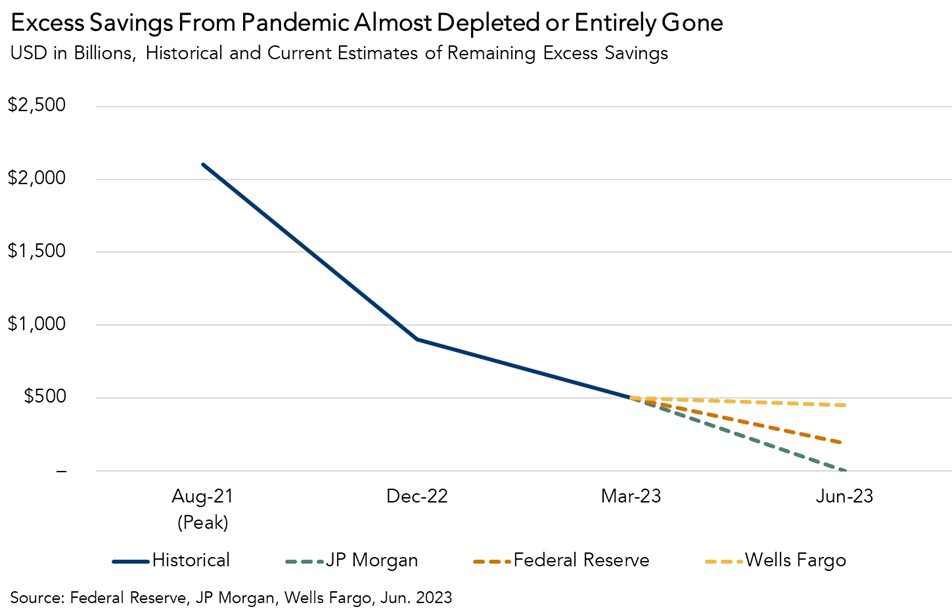

Consumers are Depleting Pandemic-Era Savings

Consumer spending surged in the aftermath of the pandemic, propelled by the excess savings that consumers accumulated during the pandemic. However, consumers’ excess savings is now near depletion. Based on estimates from the Federal Reserve, excess pandemic-era savings peaked at approximately $2.3 trillion in late 2021, and has been declining since then. By the end of 2022, JP Morgan estimated that the excess savings had declined to approximately $900 billion.

The latest estimates of the remaining excess consumer savings vary depending on the source, but the trend is clearly downward. Depending on the estimate, the excess savings is either running quite low or already completely depleted, meaning consumers will enter 2024 with less to spend.

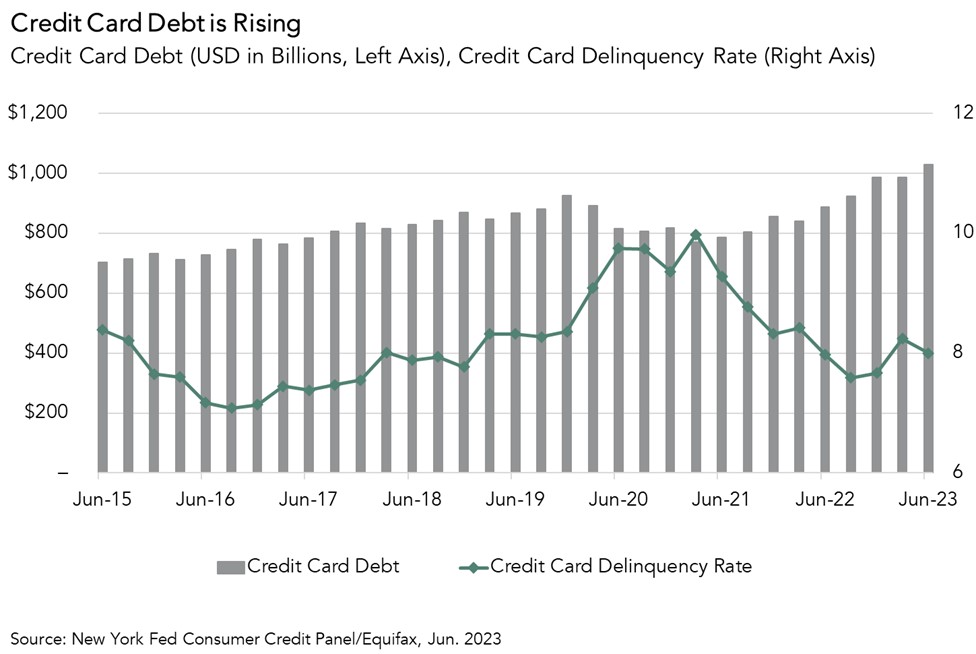

Credit Card Debt on the Rise

As consumers spent their excess savings, they’ve simultaneously accumulated more credit card debt at ever-increasing interest rates. In the second quarter of 2023, credit card debt outstanding hit a new record, exceeding $1 trillion for the first time. Credit card debt bottomed out earlier in the pandemic, at $770 billion in the first quarter of 2021, and has been gradually rising since then.

While debt levels have risen, credit card delinquency rates have risen from pandemic lows. Delinquency rates reached a low of 7.6 percent in the third quarter of 2022, increased to 8.2 percent in the first quarter, yet retreated to 8.0 percent in the second quarter. Given the decline in the second quarter, delinquency rates bear watching, but regardless of the trend consumers face more debt at higher interest rates, which will make it difficult for some to service their credit card debts.

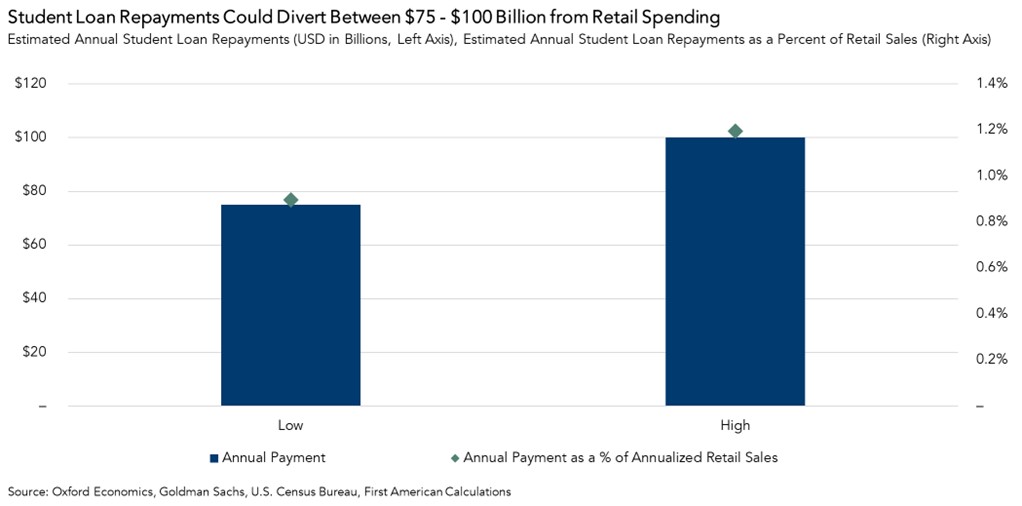

Student Loan Repayments Another Pressure on Consumers’ Wallets

The resumption of student loan payments in the fourth quarter of this year will also sap consumer spending power heading into 2024. While estimates of the total amount of spending that may be diverted away from other expenditures toward student loan repayment vary, they tend to range between around $75 billion and $100 billion per year. This is money that may otherwise have been spent on retail goods and services.

To get a sense of the potential impact that the resumption of student loan payments might have on consumer spending, these payment estimates can be viewed as a percent of total retail sales. On the low end of these estimates, student loan payments would amount to approximately 0.9 percent of all retail sales, and about 1.2 percent at the high end. In total, this represents a small, but non-trivial diversion from potential future retail spending.

So, What’s the X-Factor?

You can’t spend money that you don’t have, and consumers are now running low on savings while facing a growing need to repay credit card and student loan debt. As 2024 approaches, these dynamics will dampen consumers’ ability to spend.