In mid-September, coverage of the Census Bureaus’ latest monthly retail sales release focused on how the 2.5 percent year-over-year increase in retail sales in August was a sign of ongoing consumer strength. But the retail sales report is not inflation adjusted, it is expressed in nominal terms. This nominal 2.5 percent growth, therefore, excludes the most obvious challenge the American consumer has faced over the last year: inflation.

“Though slowing real retail spending will invariably impact demand for retail properties, there are meaningful mitigating factors that are likely to limit the impact on retail real estate net operating incomes.”

A Real Measure of Consumer Spending

Retail spending is one useful measure of the strength of the American consumer. Higher consumer spending is an indication of growing demand for goods and services. However, to be a truly useful measure of consumer strength, retail sales growth must be adjusted to account for inflation. When you subtract inflation from retail sales growth, the result is a measure called real retail sales growth. Without accounting for inflation, any growth in headline retail sales could be due to general, economy-wide price growth.

Everything's More Expensive Now

An example can help clarify how adjusting for inflation provides a clearer read of consumer strength. Imagine a car costs $10,000 today, and in a year from now that same car costs $12,000. By waiting a year, you’re stuck paying an additional 20 percent, but the economic activity generated by that sale is unchanged since you’re still receiving the same car. By this logic, real retail sales growth gives a clearer sense of the changes in consumer spending patterns, since most goods and services today cost more than they did a year ago.

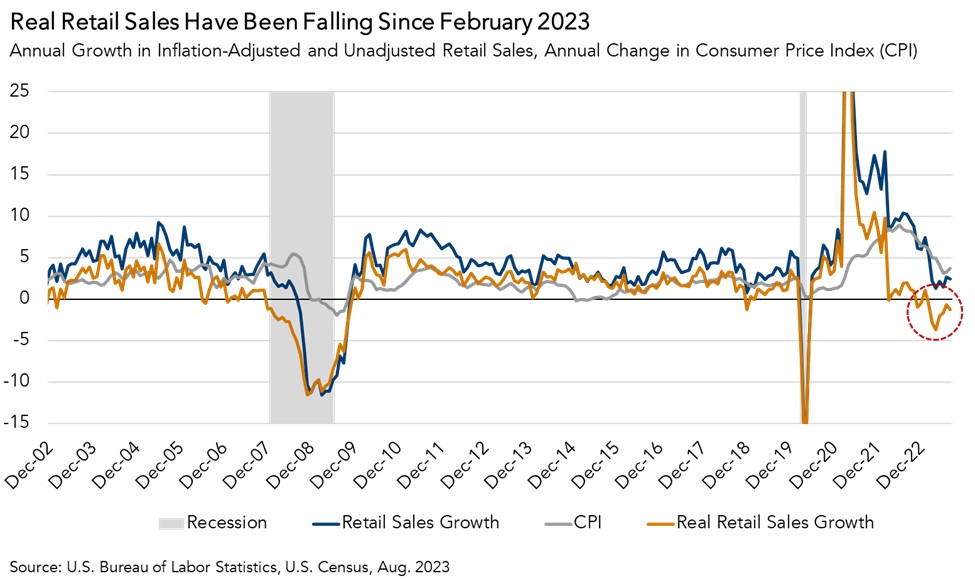

So, what do retail sales tell us about the strength of the American consumer today? Though nominal figures seem at first glance to indicate continued consumer strength, after adjusting retail sales growth for inflation, the data tells a different story: real consumer spending declined 1.2 percent compared with a year ago.

This isn’t a new phenomenon – real retail sales have been falling on an annual basis since February. In the early stages of the pandemic, real retail sales declined briefly but sharply due to pandemic restrictions. Excluding the pandemic, the last time there was a prolonged annual decline in real retail sales was during the Great Financial Crisis in 2008-2009.

The 'Real' Retail Impact

For retail businesses, declining real retail spending activity creates pressure on sales. If real sales fall enough to impact retailers’ bottom lines, that could in turn translate into diminished demand for retail space. While falling demand for retail space creates upward pressure on retail vacancy rates, the relatively limited supply of retail space currently available, as well as the low amount of new retail space currently under construction, somewhat limits the degree to which retail vacancy can increase in the near term.

Taken together, though slowing real retail spending will invariably impact demand for retail space, there are meaningful mitigating factors that are likely to limit the impact on retail real estate net operating incomes, unless real retail sales continue fall for a prolonged period of time.