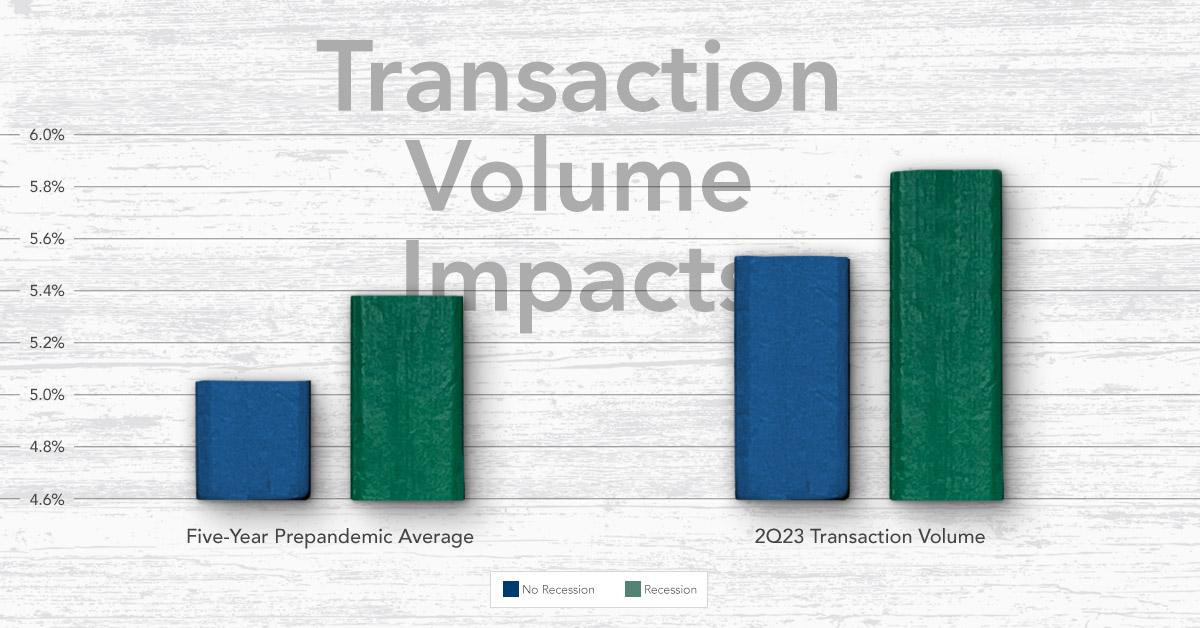

The primary driver of suppressed transaction volume in today’s commercial real estate (CRE) market is the gap in price expectations between prospective buyers and sellers. Falling prices and rising cap rates make buyers hesitant to jump into the market, since a better deal might be waiting in the near future. On the other side of the table, owners ...

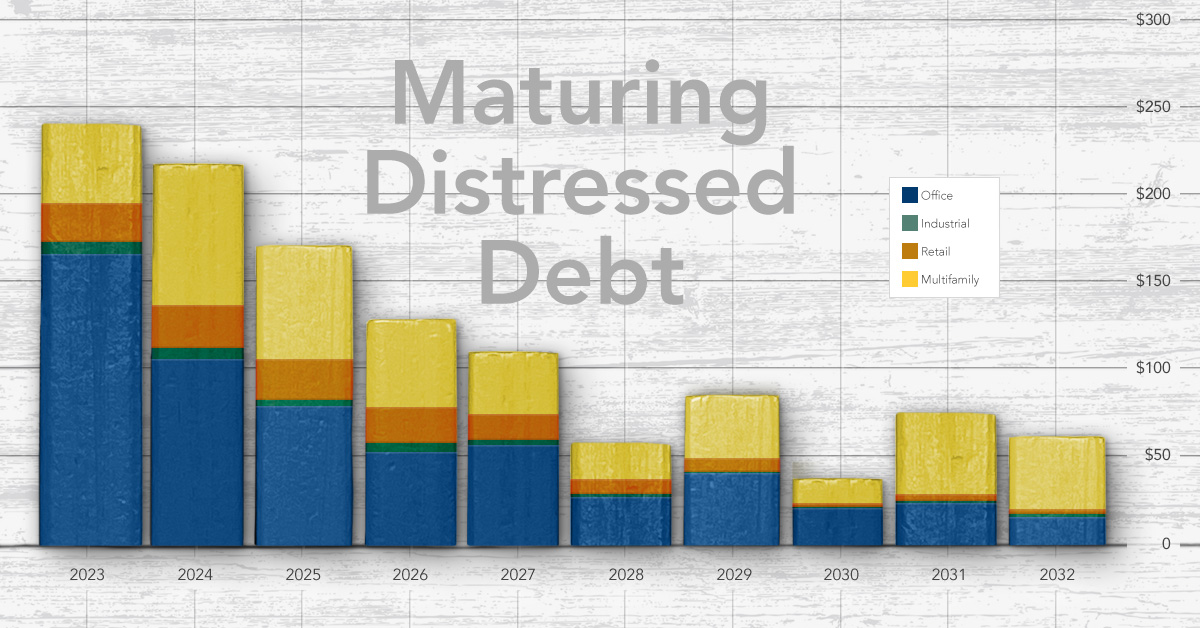

Read More ›Debt Maturities Driving Involuntary Sales Will Set the Pace of Price Discovery

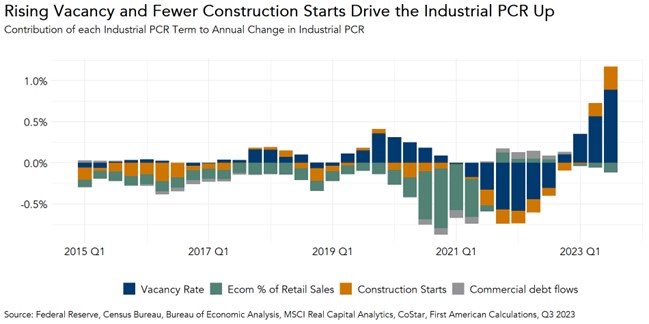

Pandemic Aftershocks Drive Industrial Cap Rates Higher

The state of today’s industrial commercial real estate (CRE) can largely be explained as the result of pandemic-related aftershocks. During the pandemic, e-commerce sales soared as millions of stuck-at-home consumers turned to online retailers to purchase goods. Meanwhile, COVID-19 disrupted global supply chains, which made it more difficult for ...

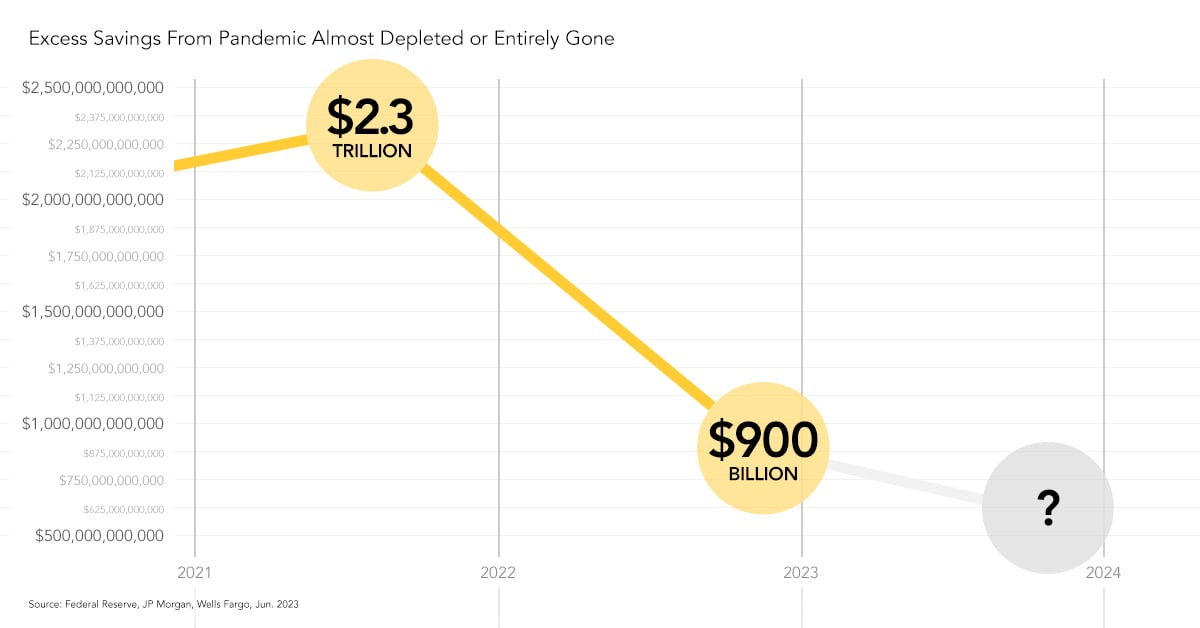

Read More ›CRE X-Factor - Consumers Face Headwinds Heading into 2024

As pandemic-era restrictions and precautions eased, consumers began to spend the money that they had saved during the early parts of the pandemic. The resulting surge in consumer spending contributed, at least in part, to the runaway inflation that eventually triggered the Federal Reserve to hike interest rates at the fastest pace in decades. ...

Read More ›What’s the ‘Real’ Story Behind the Strength of the U.S. Consumer?

In mid-September, coverage of the Census Bureaus’ latest monthly retail sales release focused on how the 2.5 percent year-over-year increase in retail sales in August was a sign of ongoing consumer strength. But the retail sales report is not inflation adjusted, it is expressed in nominal terms. This nominal 2.5 percent growth, therefore, excludes ...

Read More ›CRE X-Factor – The End of the Beginning for the CRE Adjustment?

With interest rates high, transaction volumes low, and property prices generally on the decline, it’s safe to say that the commercial real estate (CRE) market is undergoing an adjustment period. The market adjustment has triggered a process referred to as “price discovery,” in which many buyers are sitting on the sidelines waiting for lower entry ...

Read More ›Banks Continue to Report Tighter Lending Standards for CRE

With interest rates well above recent lows and commercial property prices declining, commercial real estate (CRE) credit remains tight. How tight, exactly, is one of the questions that the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) attempts to answer.

Read More ›CRE X-Factor – Why Operating Costs for Commercial Properties have Soared

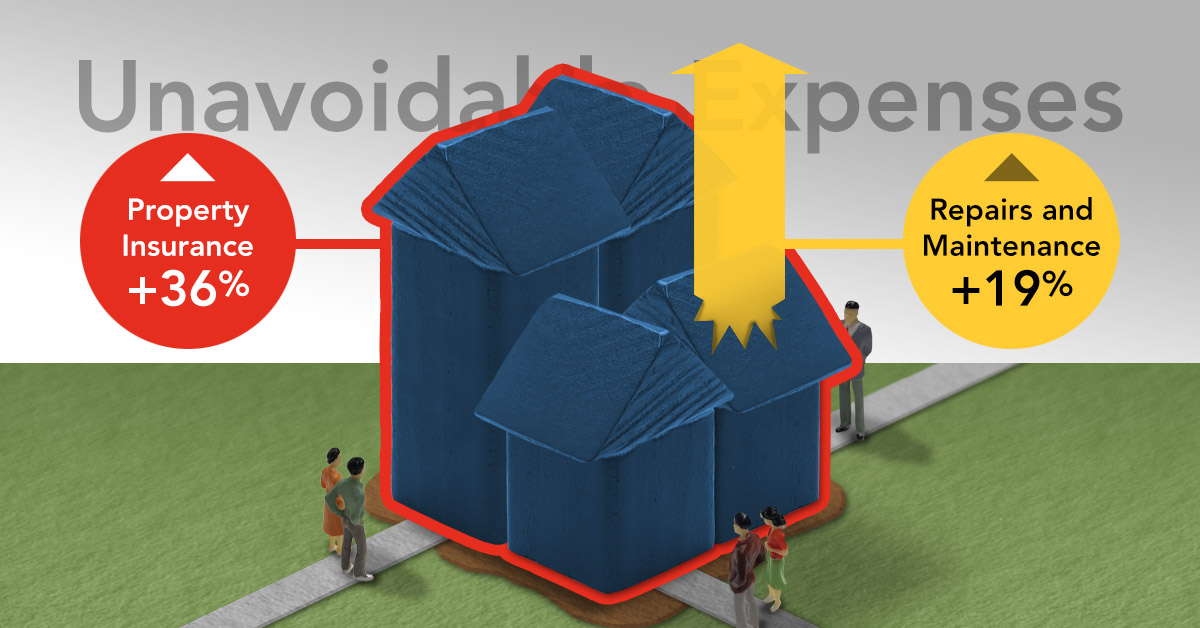

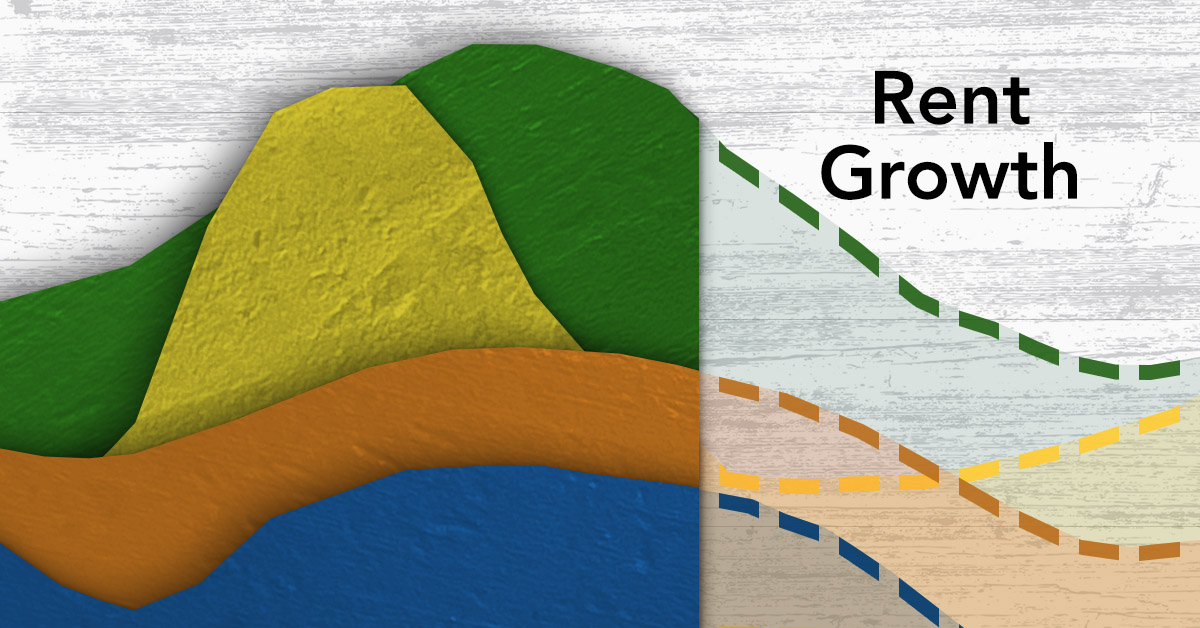

As rent growth has softened across all asset classes, property owners and operators have increased their focus on limiting expense growth. However, this has proven difficult for some line items, as both property insurance, and repairs and maintenance (R&M) expenses have increased significantly over the last three years. In this edition of the ...

Read More ›What Happens to Cap Rates if…

Multifamily capitalization (cap) rates have now increased for three consecutive quarters, the first time since the Great Financial Crisis. This is a sign that investors are requiring higher yields today in order to purchase a property.

Read More ›CRE X-Factor – Assessing the State of the CRE Reset

The commercial real estate (CRE) market is in a reset. Deal activity is down, and property prices are declining. We recently examined what clues history can provide about the potential length and depth of CRE price declines. Today, let’s examine what current CRE fundamentals can tell us about where we are in the process of resetting.

Read More ›CRE X-Factor - When Will Commercial Property Prices Recover?

The data is clear – commercial real estate (CRE) property prices are undergoing an adjustment. With that in mind, many industry professionals and investors are asking the next logical questions – how far will prices fall and when will prices bottom out and recover. Examining historical CRE data offers some clues, but, as the old adage goes, ...

Read More ›