The primary driver of suppressed transaction volume in today’s commercial real estate (CRE) market is the gap in price expectations between prospective buyers and sellers. Falling prices and rising cap rates make buyers hesitant to jump into the market, since a better deal might be waiting in the near future. On the other side of the table, owners that would face a loss if they were forced to sell now will generally prefer to hold onto their asset rather than sell and crystallize the loss. As long as a building cash flows, and it can cover mortgage payments, holding and waiting remains an attractive option for many owners. When owners are no longer able to bide their time and wait out the market, such as when a loan comes due, involuntary transactions will increase.

"Since a significant amount of potentially troubled debt matures between now and the end of 2025, it seems reasonable to expect that, absent a rate cut, involuntary transactions will accelerate towards the end of 2024 and continue into the first half of 2026.”

When “Wait-and-See” Isn’t an Option

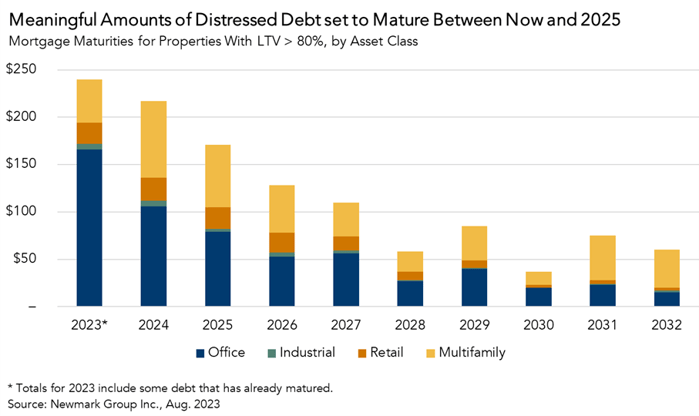

The option to hold disappears when mortgages mature, and there is a substantial quantity of “potentially troubled” debt that will come due in the remainder of 2023 and into 2024 and 2025. In this analysis, potentially troubled debt refers to loans on properties with a loan-to-value ratio of over 80 percent). According to data from Newmark, approximately $350 billion of this maturing debt is on office properties, and approximately $190 billion is on multifamily properties.

These debt maturities will eliminate the “wait-and-see” approach for many office and multifamily property owners. At that point, they’ll be forced to decide what to do with their property and mortgage, and there are only four options. Property owners could decide to refinance at a meaningfully higher interest rate, restructure the loan, sell the property, or hand the property over to their lender and take a total loss on their investment.

Which option a property owner pursues will depend on the strength of the particular asset. Some properties have a promising future but are dealing with near-term challenges. In these cases, owners are more likely to hold onto the building, refinance at the higher rate or attempt to work with the lender to restructure and obtain extended and revised terms. Put more simply, when the asset has a future, owners are more likely to stick it out until things turn around. In return, though, lenders may require owners to invest additional money into the property to ensure that they still have skin in the game.

However, for many buildings, particularly offices, whose future is less certain, investing additional capital makes less sense. After all, why chase bad money with good? In these cases, property owners are more likely to either sell, or walk away from the property, take the loss, and let the lender or special servicer figure out what to do with it. If the price of a property has fallen below the value of the existing loan, there remains little incentive for the current owner to pursue a sale, since that would require extra time and energy compared to letting the lender deal with it. When a lender must take possession of a property as collateral, it takes time for it to be turned around and sold. This means there’s a lag, approximately six-to-12 months, between when a default occurs and when a transaction ultimately materializes as a result.

I’ll Sell When I Have to, No Sooner

Debt maturities limit owners’ options, so the quantity of maturing loans and pace at which they mature, including a lag for working out troubled loans, will determine when and how quickly price discovery occurs. Since a significant amount of potentially troubled debt matures between now and the end of 2025, it seems reasonable to expect that, absent a rate cut, involuntary transactions will accelerate towards the end of 2024 and continue into the first half of 2026.