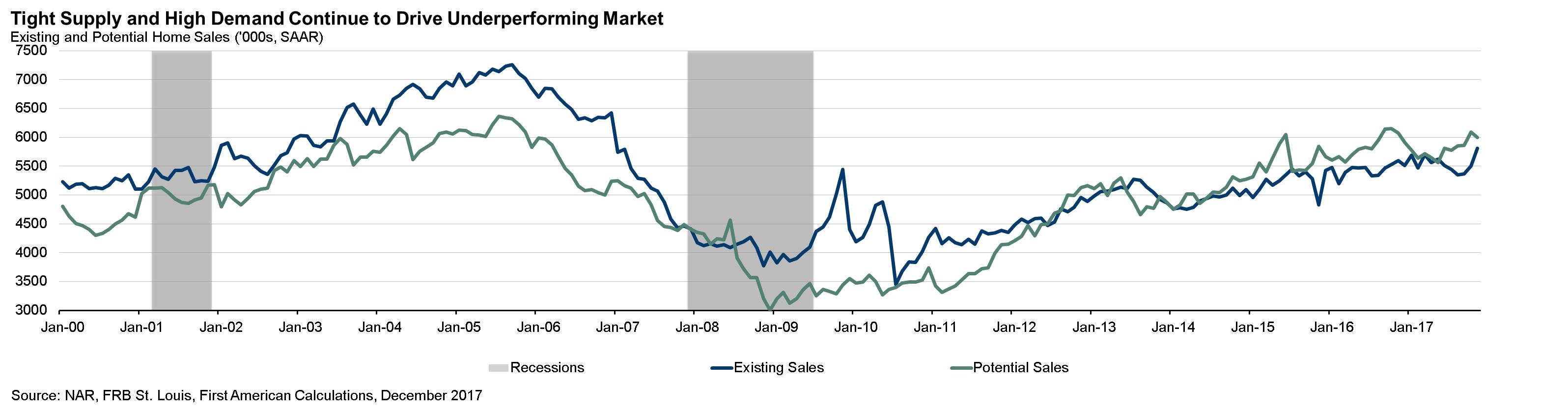

Housing Market Potential Little Changed, But Will the Supply Shortage Continue in 2018?

By

Mark Fleming on January 23, 2018

First American’s proprietary Potential Home Sales model examines December 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›

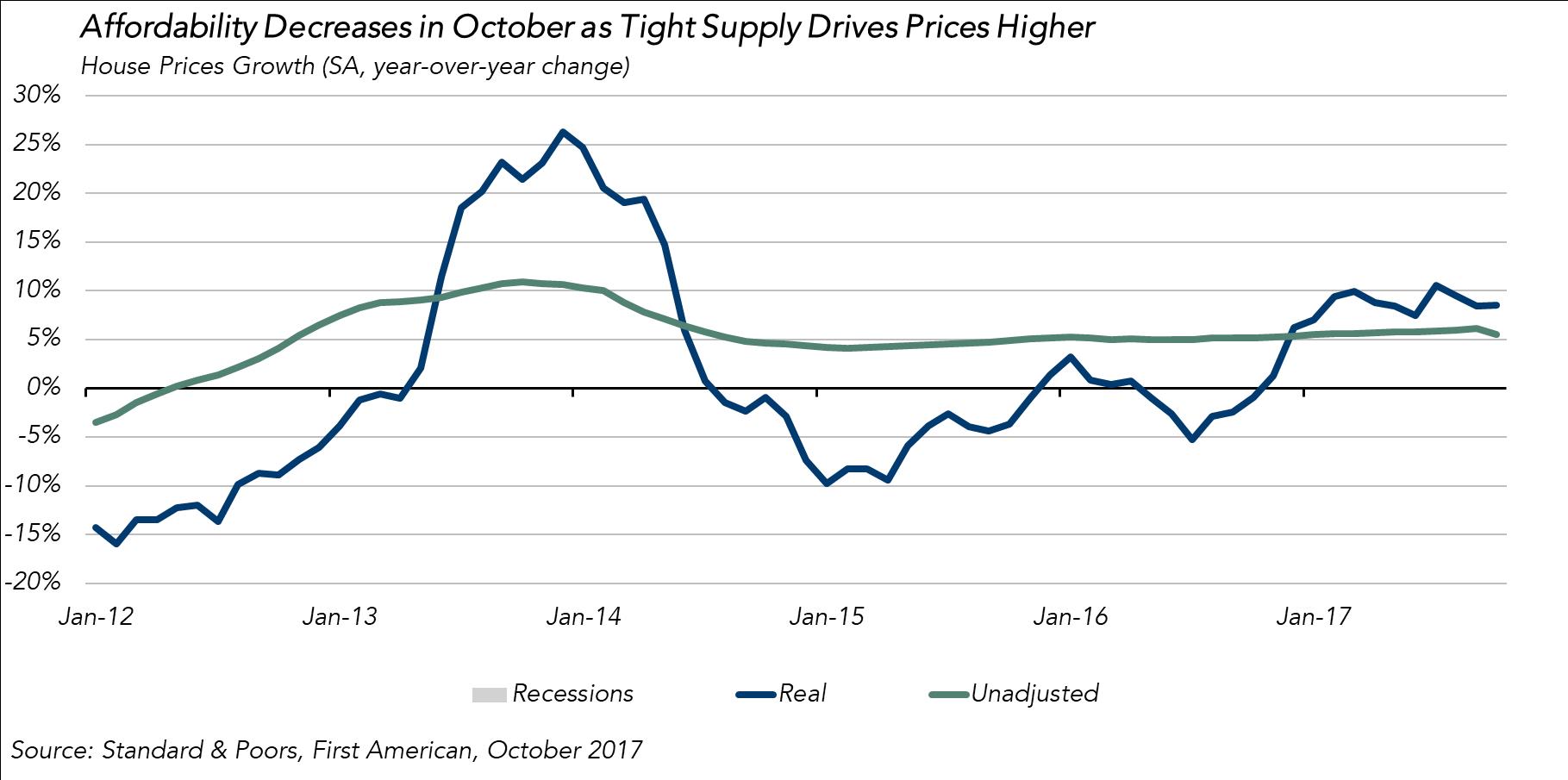

The Drag on Affordability Explained

By

FirstAm Editor on December 21, 2017

First American’s proprietary Real House Price Index (RHPI) looks at October 2017 data and includes analysis from First American Chief Economist Mark Fleming on the market forces that are keeping a lid on affordability.

Read More ›

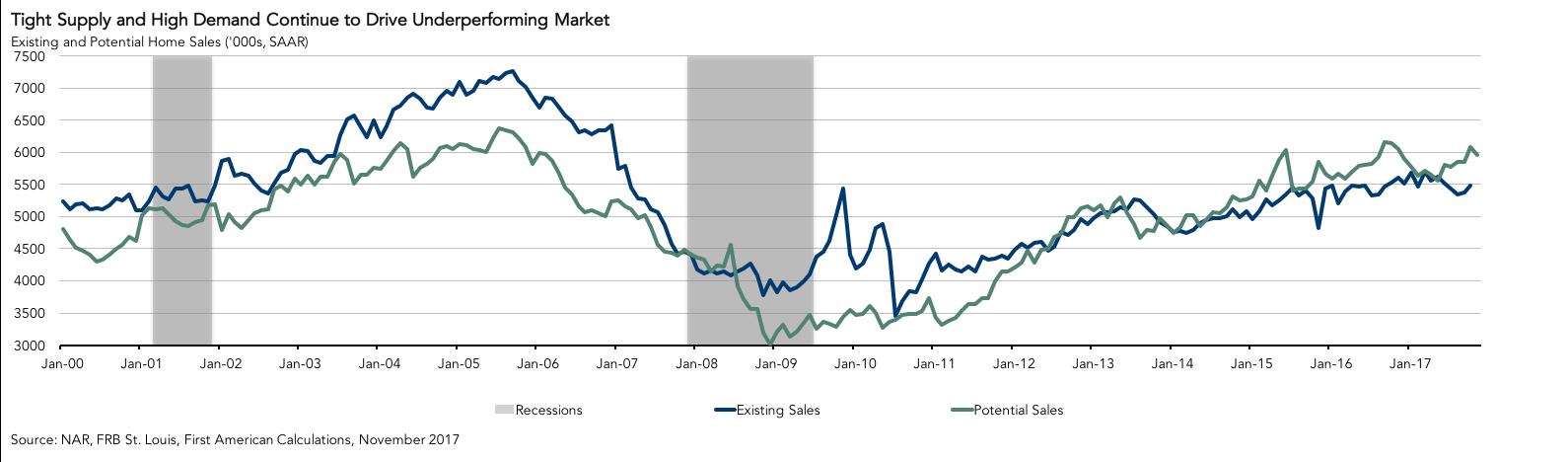

Tightening Supply Squeezes Market Potential

By

Mark Fleming on December 19, 2017

First American’s proprietary Potential Home Sales model examines November 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›

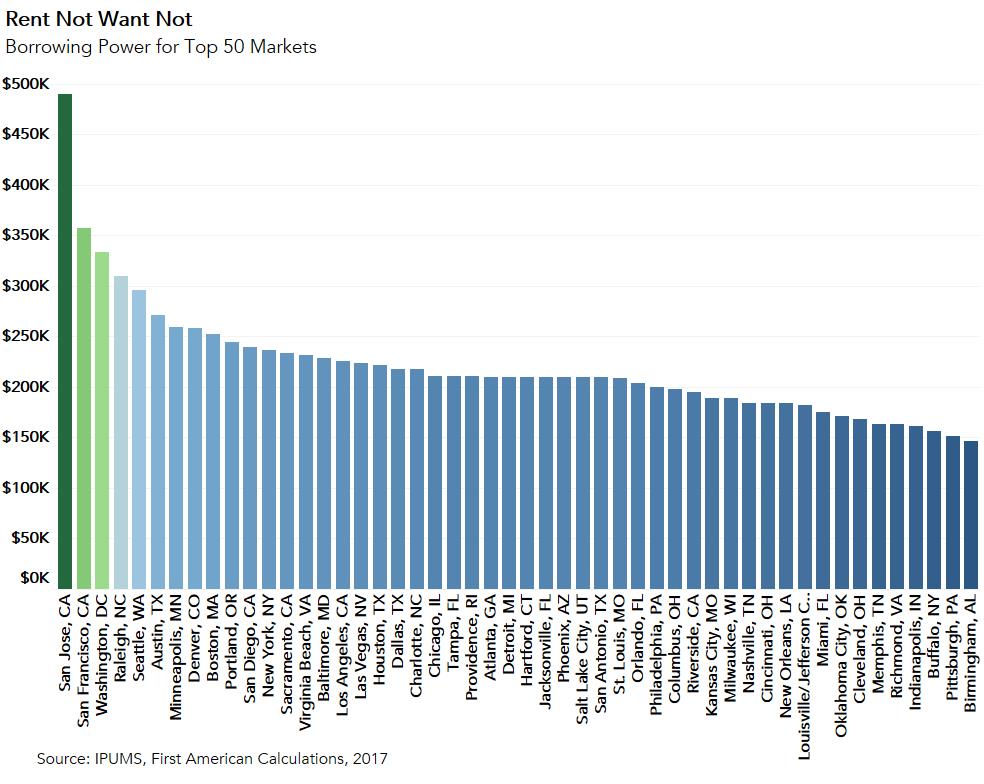

Best Cities to Maximize Borrowing Power for First-Time Home Buyers

By

Mark Fleming on December 11, 2017

It’s a near certainty that the Federal Open Market Committee (FOMC) will raise the short-term Federal Funds rate this week. The CME group estimates the probability of a 25 basis-point increase at 90.2 percent. Some may fret about how this will impact the housing market, but they are missing the point on mortgage rates and affordability for ...

Read More ›

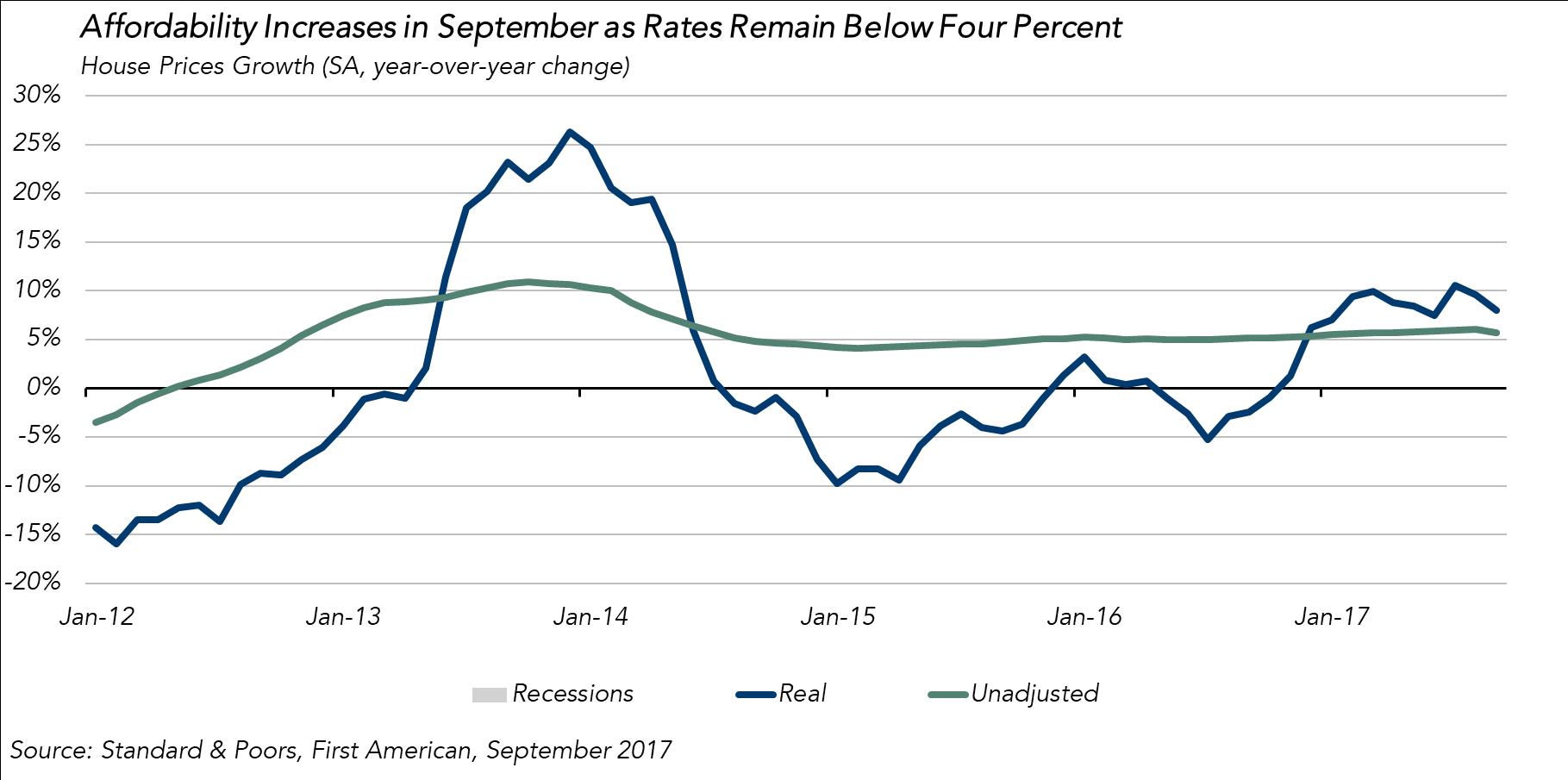

What’s Behind September’s Surprise Increase in Affordability?

By

FirstAm Editor on November 27, 2017

First American’s proprietary Real House Price Index (RHPI) looks at September 2017 data and includes analysis from First American Chief Economist Mark Fleming on the market forces that sparked a surprising increase in affordability in September.

Read More ›

What's Keeping the Market Below Potential?

By

Mark Fleming on November 20, 2017

First American’s proprietary Potential Home Sales model examines October 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›