First American’s proprietary Real House Price Index (RHPI) looks at September 2017 data and includes analysis from First American Chief Economist Mark Fleming on the market forces that sparked a surprising increase in affordability in September.

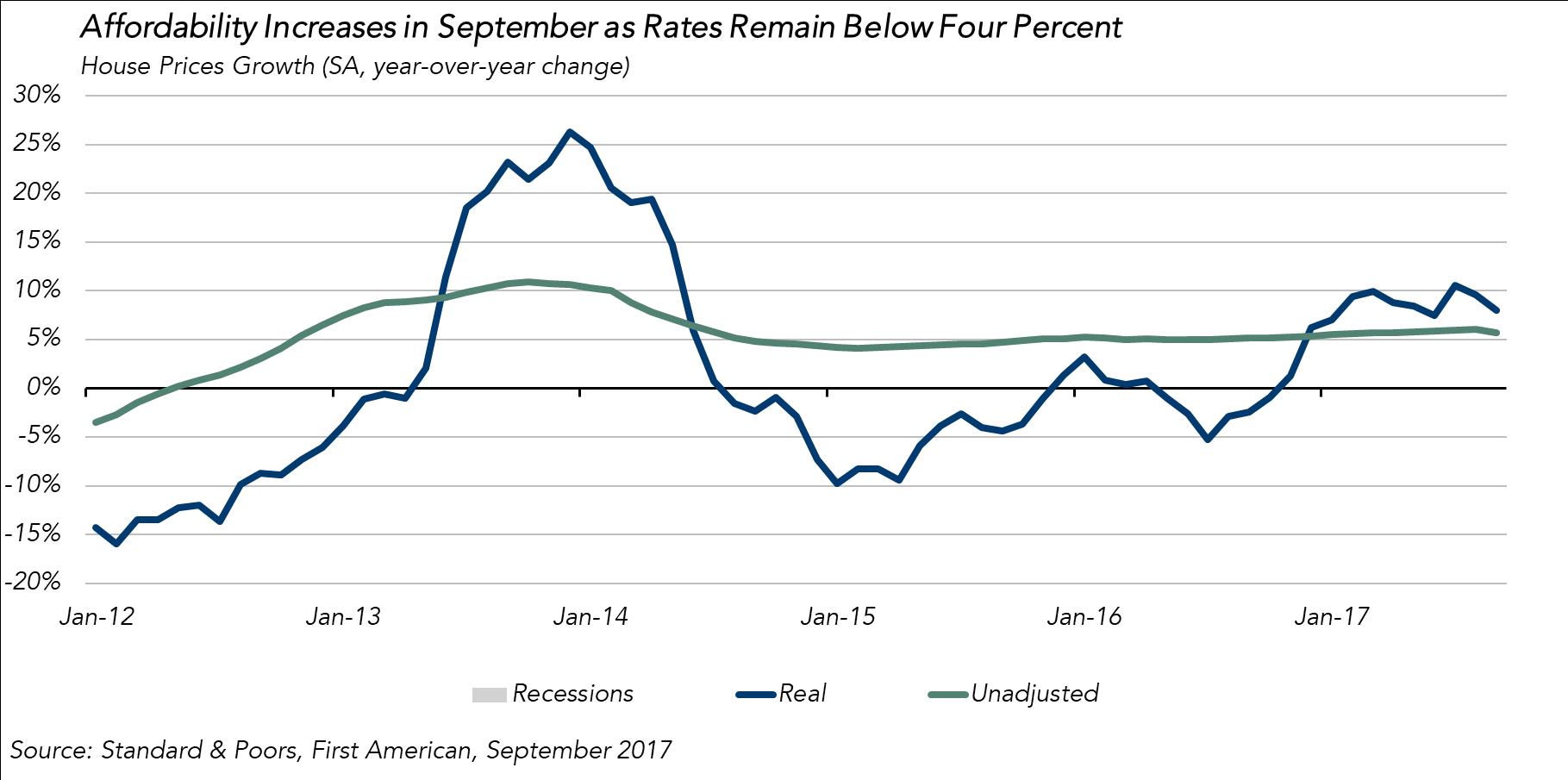

“Consumer house-buying power improved in September due to a combination of slightly lower rates and rising wages compared with August. However, over the past 12 months, affordability has declined by 8 percent as nominal prices have increased faster than buying power. Demand continues to outpace supply as existing homeowners remain reluctant to list their homes for sale for fear of not being able to find a home to buy, while home buyers, enticed by low mortgage rates, continue to enter the market,” said Mark Fleming, chief economist at First American.

“This short-term boost for home buyers is not expected to last, as supply constraints continue to drive unadjusted prices higher.”

For Mark’s full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what really matters to potential buyers - their purchasing power, or how much they can afford to buy. The RHPI adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of December 21, 2017.