Why Declining House Prices and Softening Labor Market Will Not Trigger a Foreclosure Tsunami

By

Mark Fleming on April 21, 2023

Affordability has now improved for four straight months, yet remains down 32 percent since February 2022, according to the Real House Price Index (RHPI). Recently falling mortgage rates have overpowered the affordability-dampening effects of higher nominal house prices. Nominal house price appreciation has slowed dramatically in response to ...

Read More ›

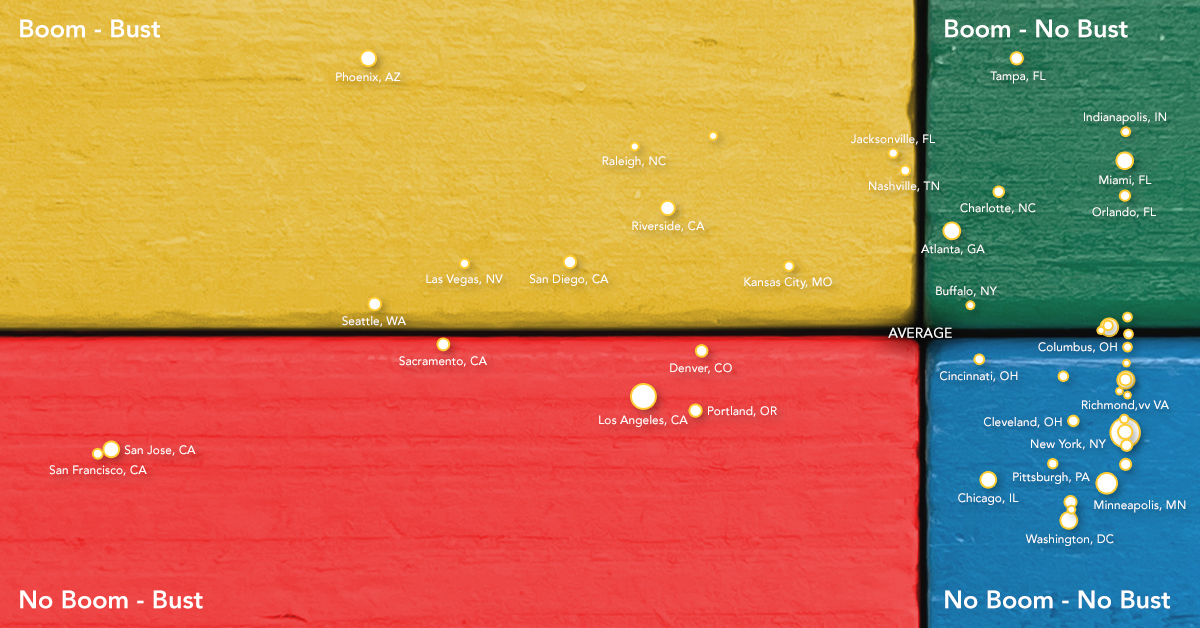

What Makes a Boom-Bust Market?

By

Mark Fleming on March 30, 2023

Affordability has now improved for three straight months, yet remains down 39 percent since January 2022, according to the Real House Price Index (RHPI). Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March 2022 at 21 percent, but has since ...

Read More ›

Housing Affordability Improved for Second Consecutive Month in December

By

Mark Fleming on February 28, 2023

While affordability has fallen 48 percent since December 2022, as measured by the Real House Price Index (RHPI), affordability has improved for two straight months. Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March at 21 percent but has since ...

Read More ›

Why Mortgage Rates Hold the Key to Improved Affordability in 2023

By

Ksenia Potapov on February 3, 2023

By all respects, 2022 was a tumultuous year for the housing market. Annual house price appreciation remained at a double-digit pace for most of the year, mortgage rates increased by nearly 4 percentage points in less than 12 months and, as a result, affordability plummeted. By October, housing affordability had declined by a record 68 percent ...

Read More ›

House Prices Declining Fastest in Overvalued Markets

By

Mark Fleming on January 31, 2023

In November 2022, the Real House Price Index (RHPI) increased by 60 percent on an annual basis. This rapid annual decline in affordability was driven by two factors -- a 7.6 percent annual increase in nominal house prices and a 3.7 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though ...

Read More ›

What to Expect from the 2023 Housing Market

By

Odeta Kushi on January 10, 2023

Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records ...

Read More ›

.jpg)