Recent Posts by Odeta Kushi

More Homes for Sale Sparks Uptick in Housing Market Activity

By

Odeta Kushi on May 20, 2024

In the housing market, the seller and the buyer are, in many cases, the same. To buy a new home, you must sell the home you already own. For several years, a persistent and historic lack of supply has restrained the housing market, but a recent uptick in inventory is poised to boost sales activity as the spring home-buying season peaks. Our ...

Read More ›

Sales Activity Driven by the Five Ds Amid Persistent Market Headwinds

By

Odeta Kushi on April 10, 2024

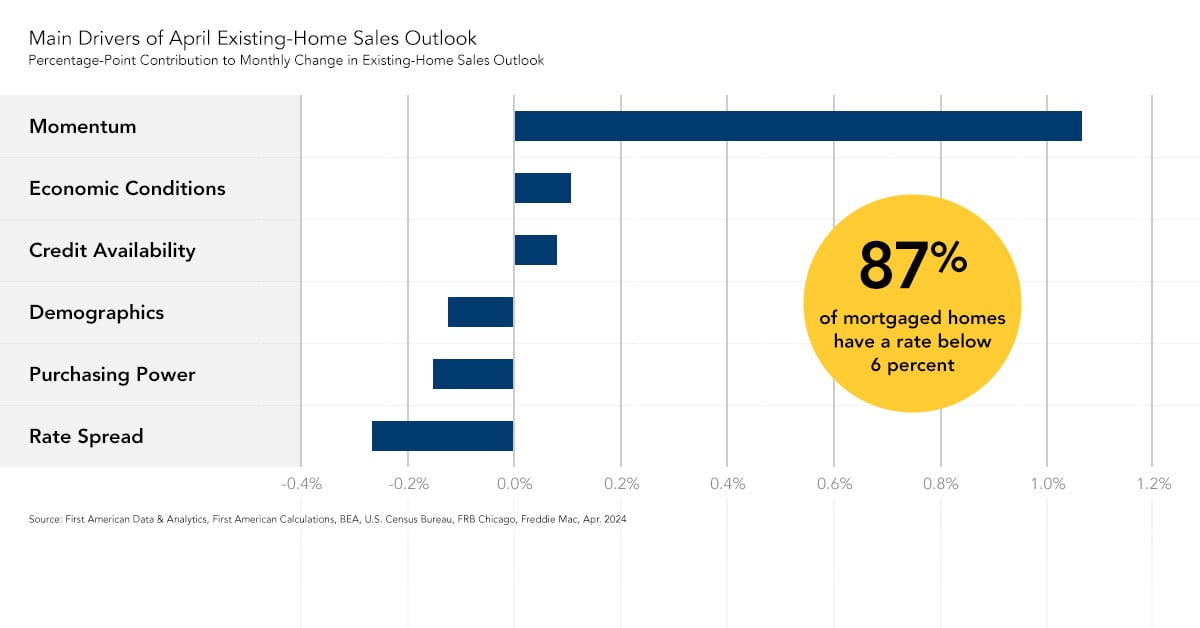

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power, and the prevailing financial and economic conditions. Based on our nowcast, we expect March existing-home sales to rise 1.7 percent compared with February, but remain approximately 16 ...

Read More ›

Interest Rates Federal Reserve Mortgage Rates Existing-Home Sales

Will the Mortgage Rate Spread Narrow or Not? That is the Question

By

Odeta Kushi on September 12, 2023

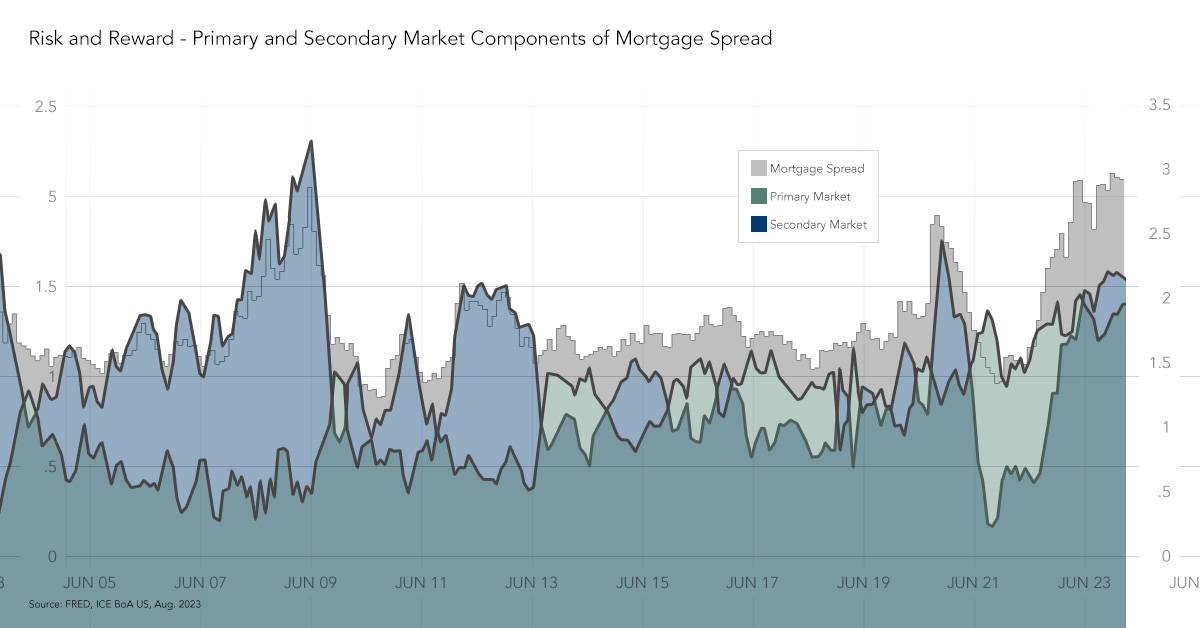

In August, the 30-year, fixed mortgage rate hit the highest level since the early 2000s. Higher mortgage rates have a dual impact on the housing market – reducing affordability for potential buyers and strengthening the rate lock-in effect for sellers. The outlook for the U.S. housing market is therefore heavily dependent on the path of mortgage ...

Read More ›

Are we Flirting with a Double-Dip Housing Recession?

By

Odeta Kushi on August 2, 2023

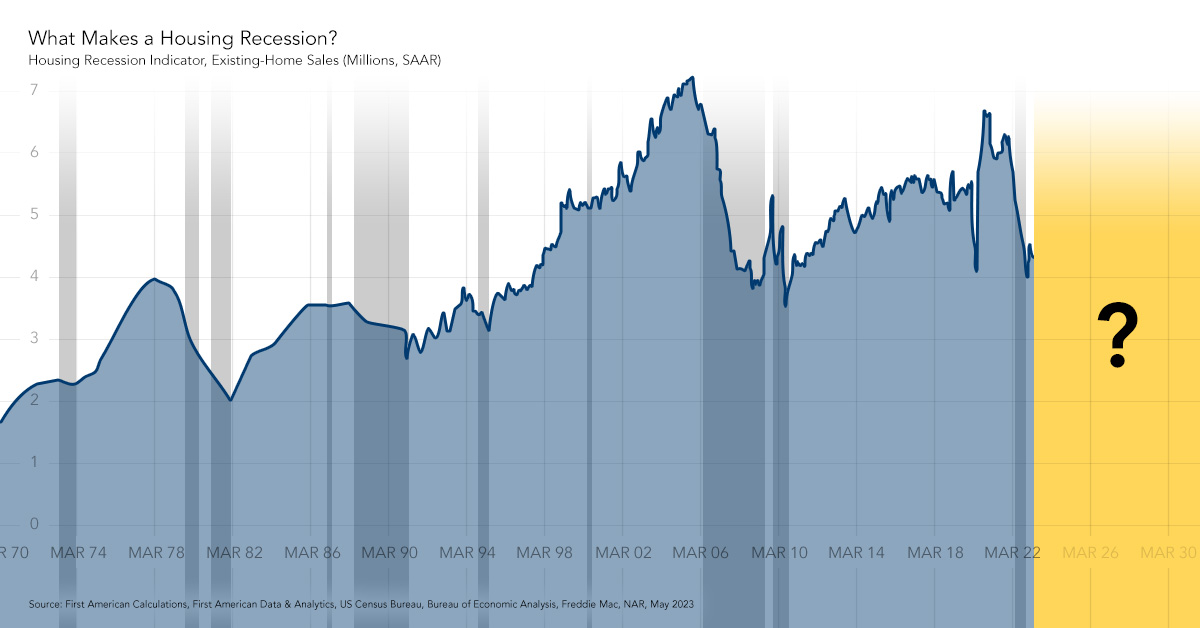

What defines a housing recession? While some rules of thumb exist, there has never been general agreement on a definition. If you look at today’s housing market, existing-home sales have struggled to gain any momentum during what is usually the housing market’s busiest season. New home sales, on the other hand, have exceeded all expectations. So, ...

Read More ›

Mind the Gap Between Mortgage Rates and the 10-Year Treasury Yield

By

Odeta Kushi on May 24, 2023

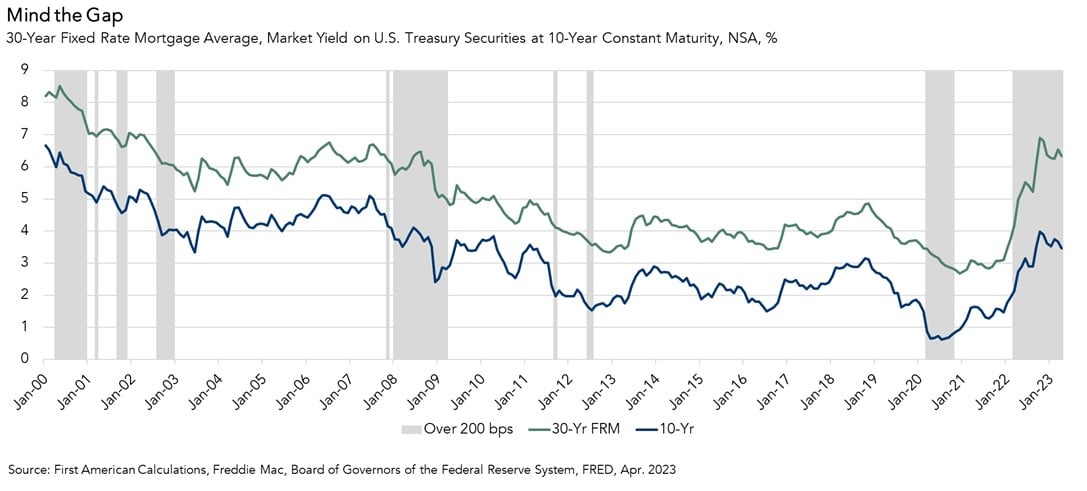

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury bond. Since the end of the Great Recession, the 30-year, fixed mortgage rate has on average remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield. Yet, this spread is not always consistent. It usually widens during ...

Read More ›

Why Free-and-Clear Homeowners Hold the Key to Unlocking More Housing Supply

By

Odeta Kushi on February 17, 2023

As mortgage rates rose rapidly last year, the golden handcuffs of low mortgage rates, otherwise known as the rate lock-in effect, was frequently cited as a primary culprit for the ongoing housing supply shortage. And, rightfully so, as according to third-quarter 2022 Federal Housing Finance Agency data, 84 percent of all outstanding mortgages have ...

Read More ›

.jpg)