Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

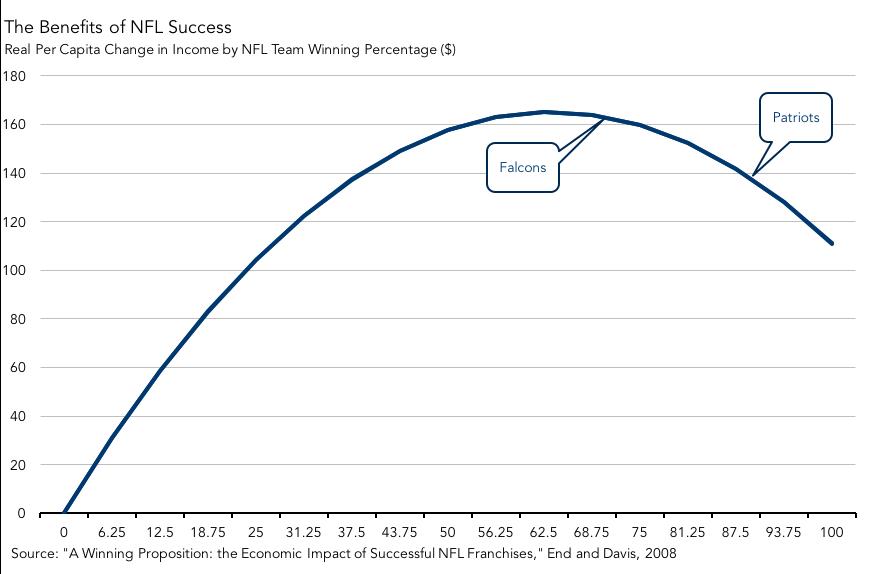

Just in Time for the Big Game: The Housing Benefit of Football Fandom

By

Mark Fleming on January 31, 2017

We all love our football, no more so than this weekend. But, it’s not just about cheering on your favorite team, guiltlessly eating wings, nachos or your favorite in-game football snack food, and gathering around that ever increasingly massive television (after all, it’s the second best time of the year to buy a television according to Consumer ...

Read More ›

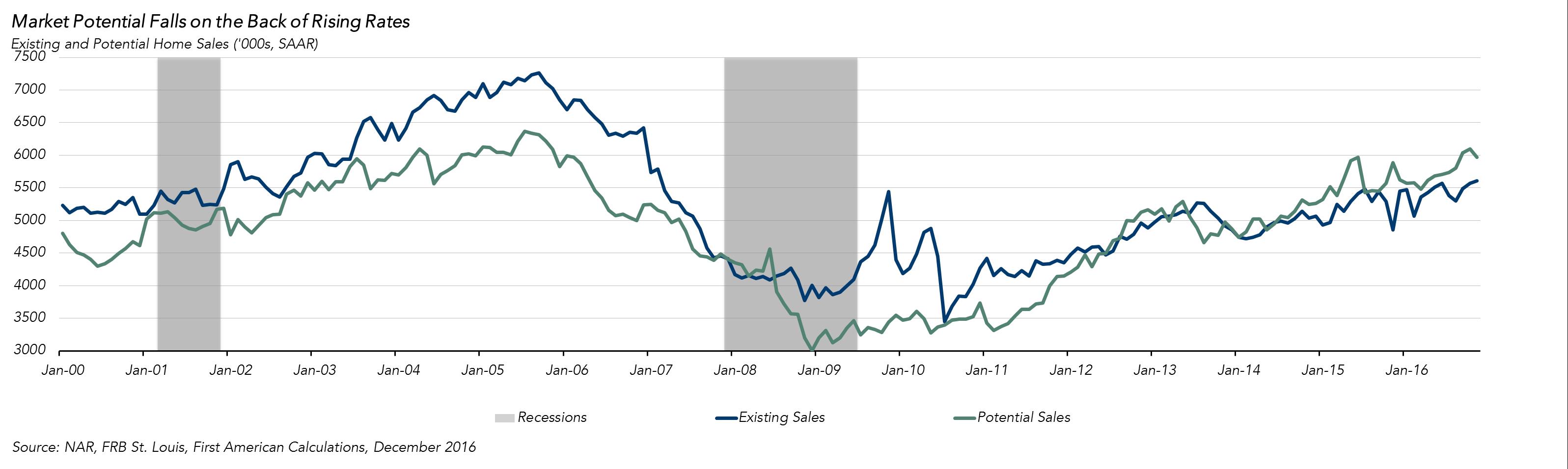

Rising Mortgage Rates Dampen Market Potential in December

By

Mark Fleming on January 23, 2017

First American's proprietary Potential Home Sales model examines December 2016 data and includes analysis from Chief Economist Mark Fleming on the impact of rising rates amid growing demand and limited inventory.

Read More ›

Three Reasons to Remain Bullish on Housing

By

Mark Fleming on January 17, 2017

Last week, I participated in the 2017 Housing Market Forecast and Homebuyer Trends webinar hosted by the American Land Title Association (ALTA). Jessica Lautz, a consumer research expert from the National Association of Realtors, and I discussed how the real estate market is changing and what we can expect. We tried to answer the question posed in ...

Read More ›

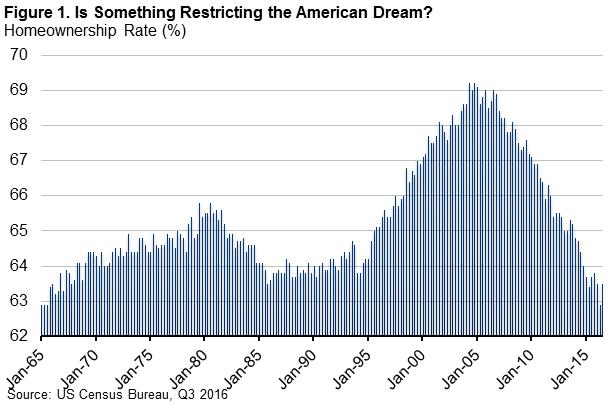

Home [ownership] for the Holidays

By

Mark Fleming on December 22, 2016

No matter your life stage, ‘tis the season to pack up your stuff and head home for the holidays. Home is where we congregate with family and friends over a hot meal, catch up on events, and maybe even ring in the New Year. But, home does not look the same for all. In fact, “home” doesn’t have to be the white picket fence with the smoking chimney ...

Read More ›

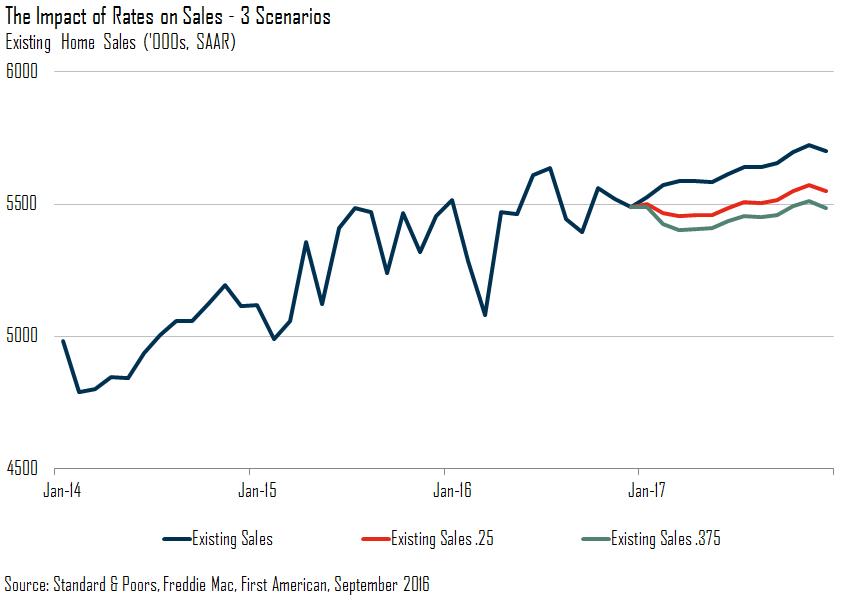

What a Difference an Election Makes

By

Mark Fleming on December 13, 2016

What a difference an election makes. Since the election, we have seen a pronounced increase in the popular 30 year-fixed mortgage rate. In the words of Federal Reserve Chairman Janet Yellen, financial markets expect that expansionary fiscal policy will accelerate U.S. economic growth and increase inflation. As a result, the 30-year fixed mortgage ...

Read More ›

Housing Interest Rates Real House Price Index Federal Reserve

Lack of Affordable Inventory Keeps Market Below Potential

By

Mark Fleming on November 21, 2016

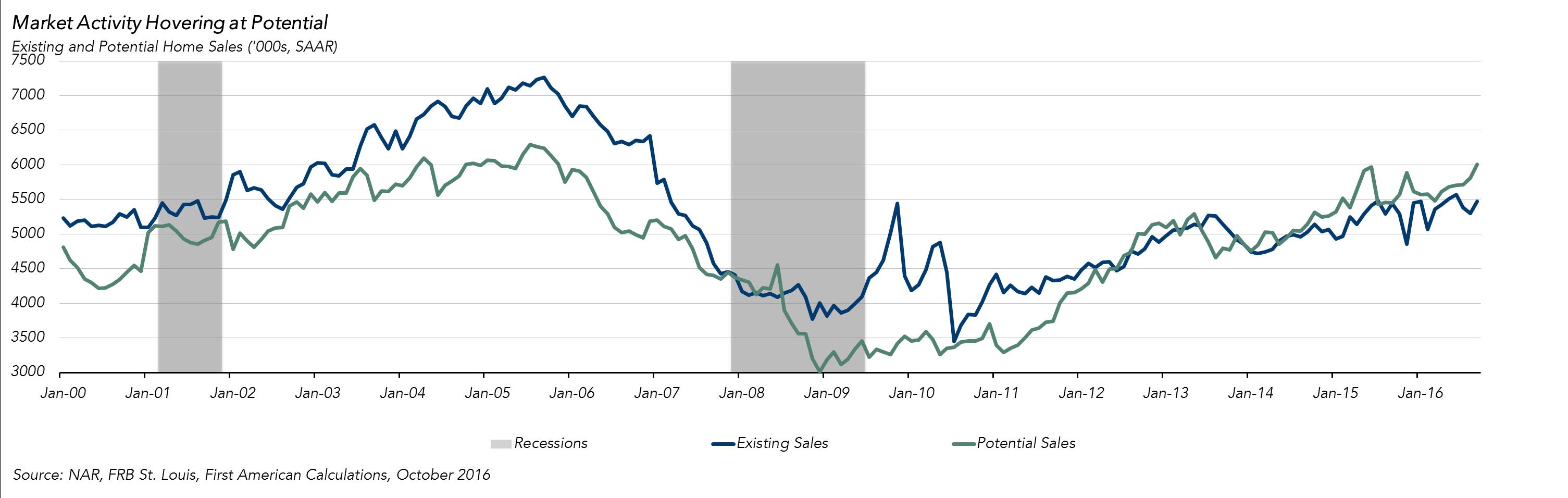

October 2016 Potential Home Sales

Read More ›