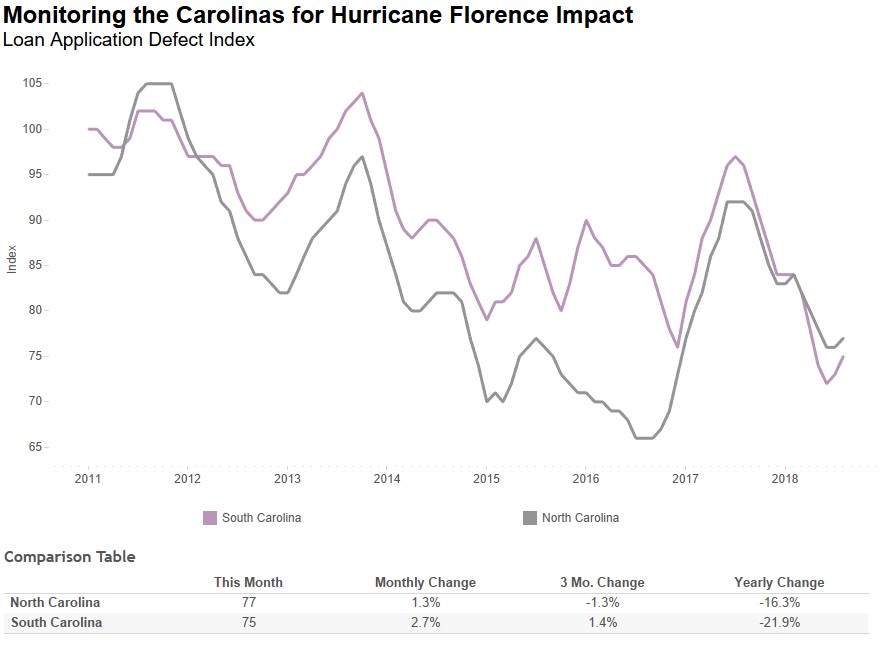

Do Hurricanes Influence Mortgage Fraud Risk?

By

Mark Fleming on September 26, 2018

Following seven straight months of declining defect risk, the Loan Application Defect Index for purchase transactions remained the same in August compared with the month before. Year over year, the Defect Index for purchase transactions decreased 13.2 percent as compared to August 2017. The Defect Index for refinance transactions is the same as ...

Read More ›

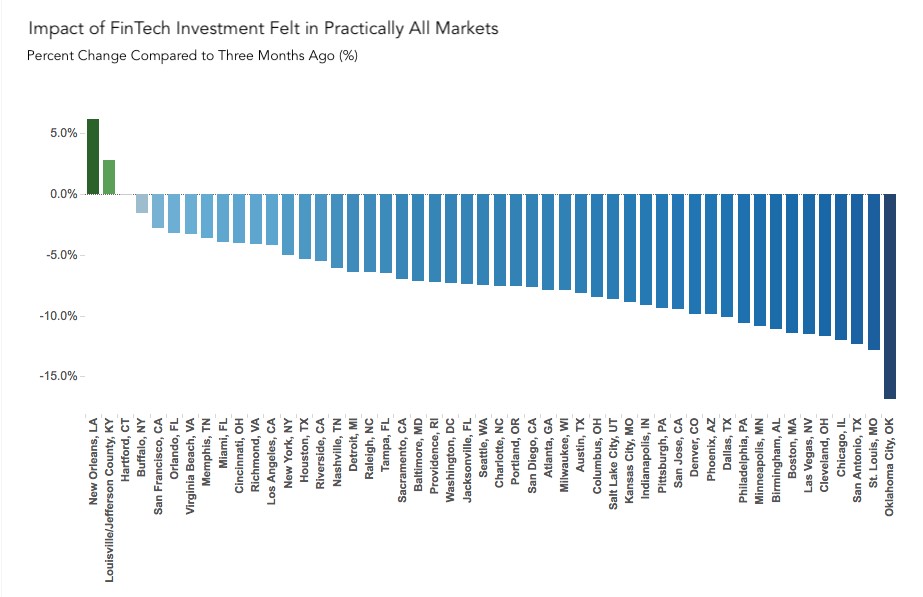

Impact of FinTech Investment Felt in Nearly All Markets

By

Mark Fleming on August 31, 2018

The Loan Application Defect Index for purchase transactions continued its downward trend, declining 1.3 percent in July compared with the month before, the seventh consecutive month defect risk in purchase transactions have fallen. Yet, is declining loan application misrepresentation, defect and fraud risk isolated to a few markets or is the trend ...

Read More ›

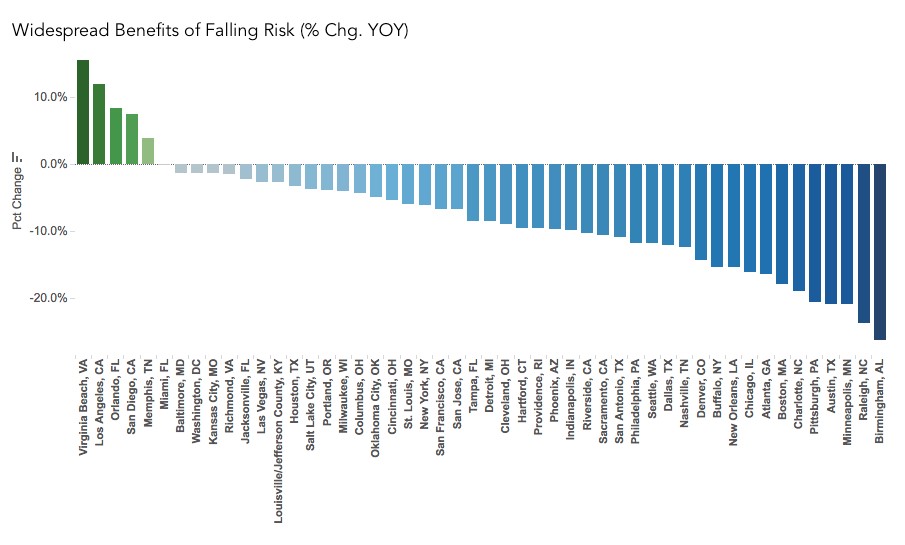

How Millennial Home Buying Expectations Unintentionally Reduced Loan Application Defect Risk

By

Mark Fleming on July 31, 2018

As the mortgage market has continued its transition away from refinances to a predominantly purchase-oriented loan market, the Loan Application Defect Index for purchase transactions has continued to decline, dropping 3.6 percent in the last month and 12.1 percent in the last year. This officially marks a six-month long decline in defect, fraud ...

Read More ›

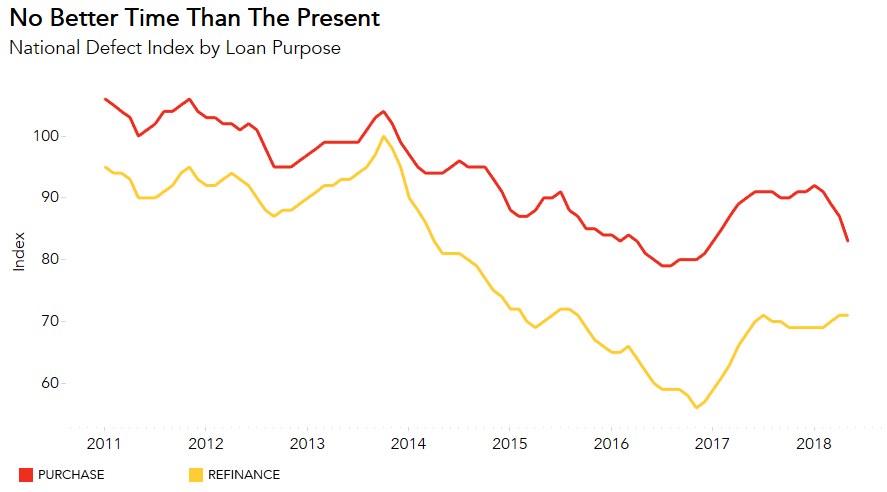

Good Timing: Loan Application Defect and Fraud Risk Drops as Home Purchases Take Higher Share of Mortgage Market

By

Mark Fleming on June 28, 2018

By now, everyone in the mortgage industry is aware that we are entering a market that will be dominated by purchase demand for the next several years. According to the latest Mortgage Bankers Association forecast, refinance transactions will make up 28 percent of total mortgages originated in 2018 and is forecasted to drop to 23 percent by 2020. ...

Read More ›

Why the Ability-to-Repay Rules are Like a Steering Wheel Lock

By

Mark Fleming on May 30, 2018

In January of 2013, the mortgage industry witnessed the birth of a new income-underwriting era. The Consumer Finance Protection Bureau (CFPB) published new requirements for mortgage lenders to carefully assess a consumer’s ability to repay their mortgage loan. The new standards were dubbed the “ability-to-repay” rules and were set to take effect ...

Read More ›

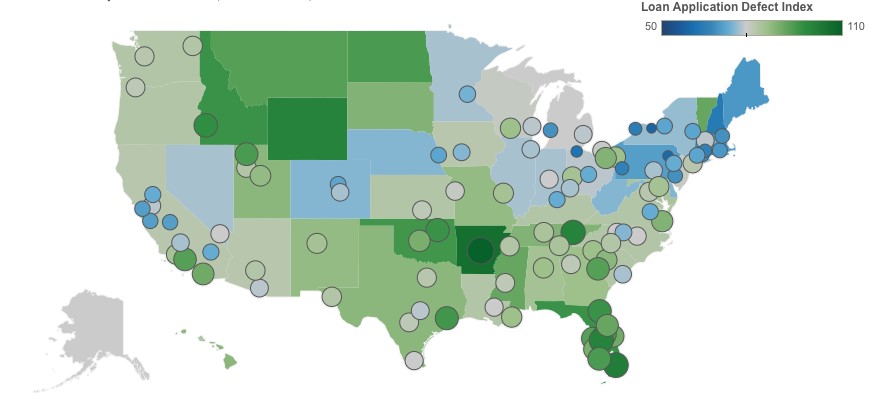

What Drives Loan Application Defect Risk at the Local Level?

By

Mark Fleming on April 27, 2018

A common adage about real estate is that it’s local. The dynamics of one housing market can be very different from another depending on the local economy and access to natural amenities, like mountains or water. The levels of loan application defect, fraud and misrepresentation risk vary greatly based on local conditions as well. In fact, ...

Read More ›