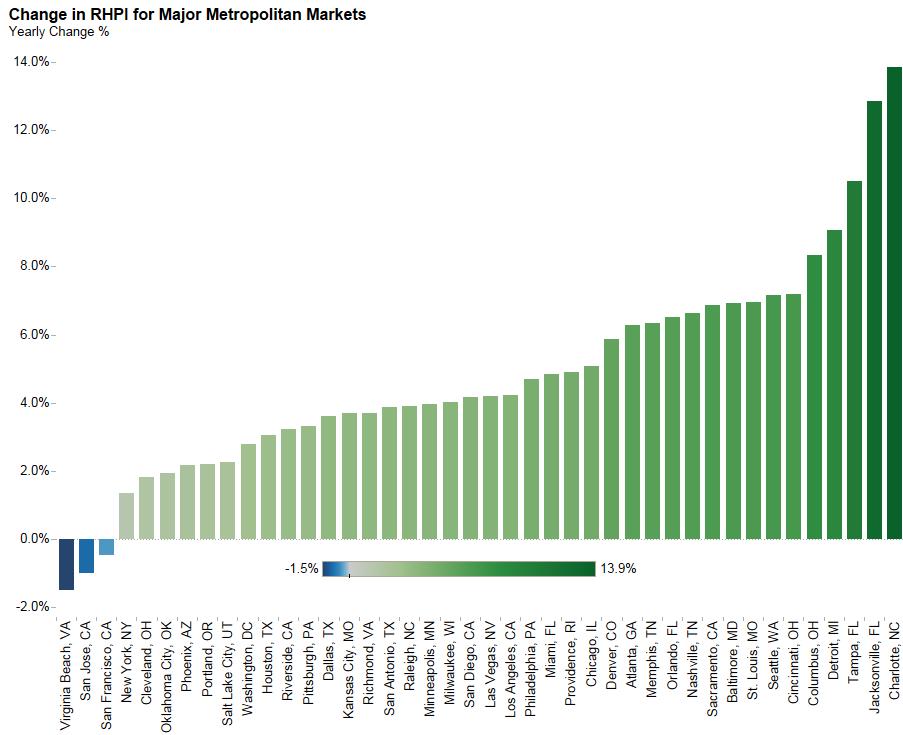

Rising Rates and Strong Nominal Price Growth Halt Six-Month Run of Increasing Affordability

By

FirstAm Editor on January 30, 2017

First American’s proprietary Real House Price Index (RHPI) looks at November 2016 data and includes analysis from First American Chief Economist Mark Fleming on a shift in affordability as real house prices increased for the first time in six months.

Read More ›

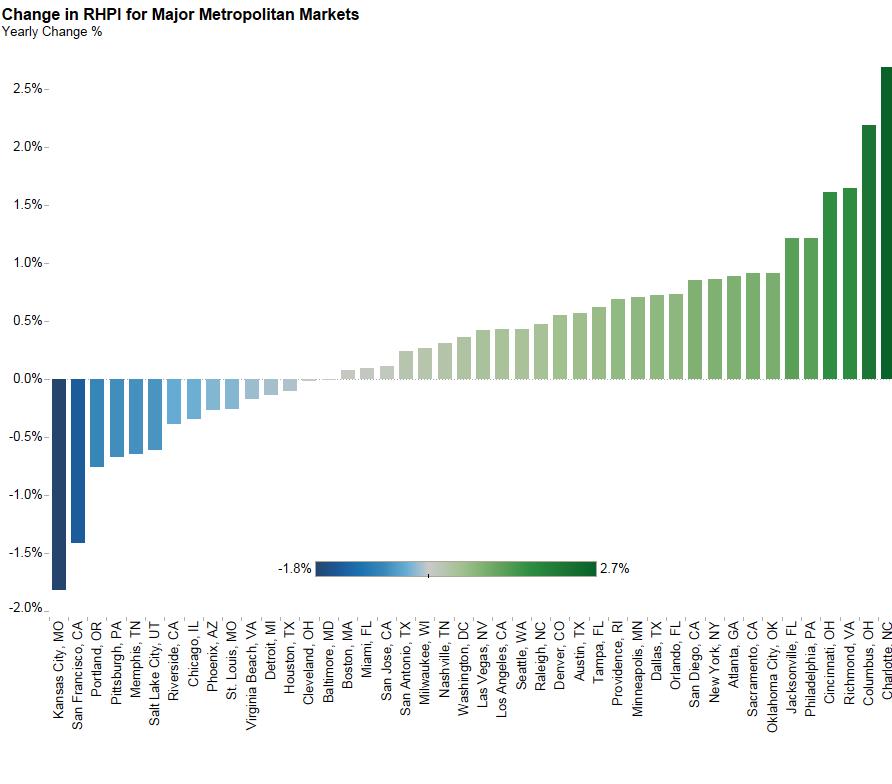

Affordability Improves Nationally Based on Wage Growth, Although Not for Many Major Markets

By

FirstAm Editor on December 26, 2016

First American’s proprietary Real House Price Index (RHPI) looks at October 2016 data and includes analysis from First American Chief Economist Mark Fleming on the impact of rising mortgage rates on consumer house buying power and affordability heading in to 2017.

Read More ›

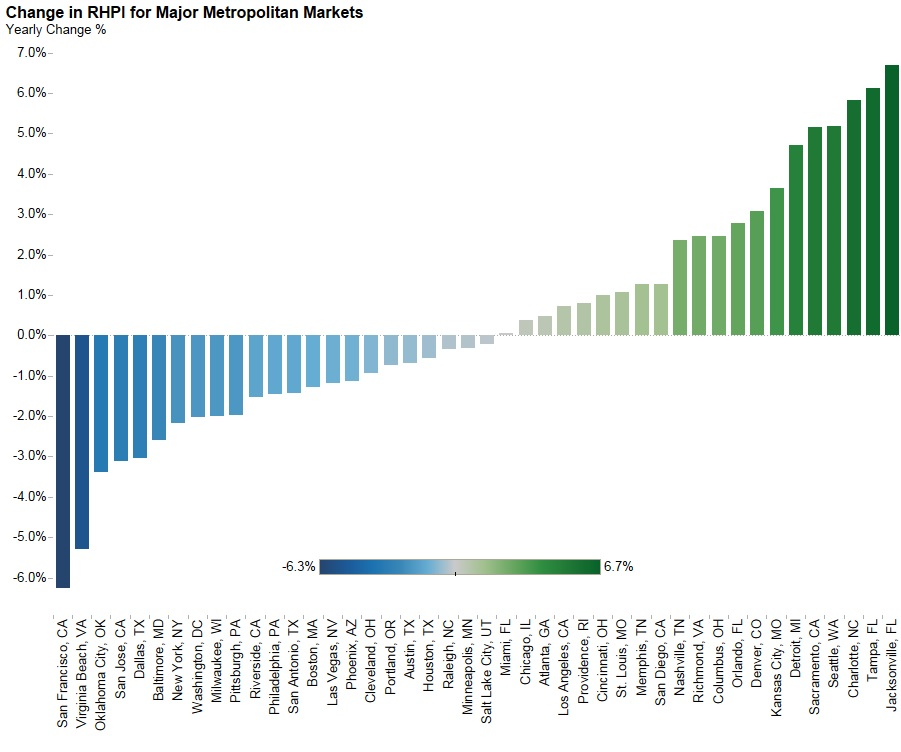

Wage Growth Contributes to Increased Affordability in Most Major Markets

By

FirstAm Editor on November 28, 2016

First American’s proprietary Real House Price Index (RHPI) looks at September 2016 data and includes analysis from First American Chief Economist Mark Fleming that includes comments on last week’s conforming loan limit increase.

Read More ›

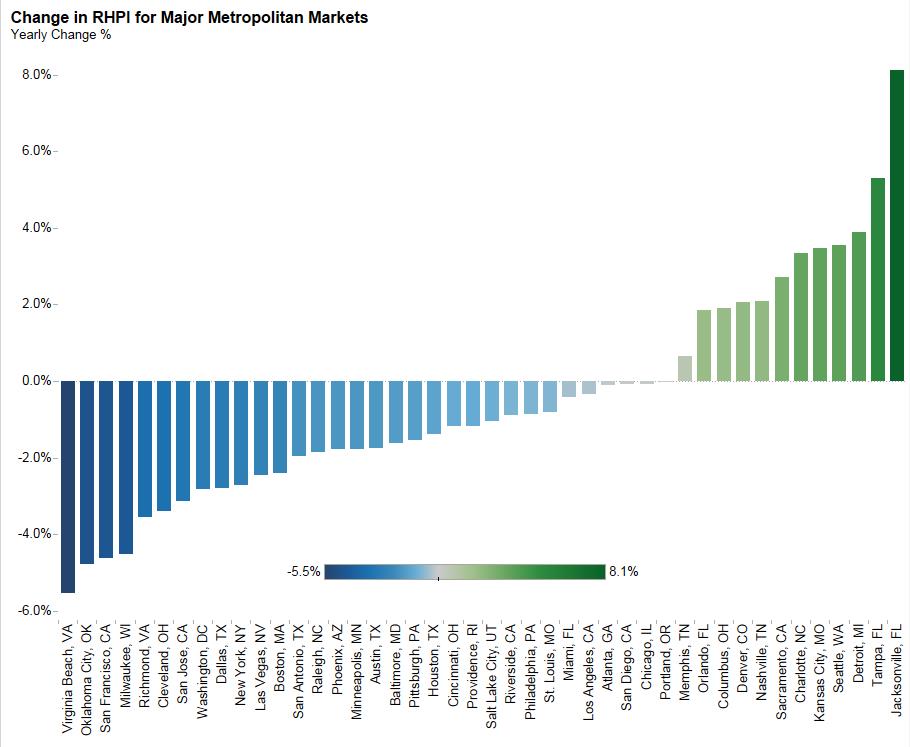

Low Rates and Increased Wages Increase Affordability for U.S. Home Buyers in Almost All Major Markets

By

FirstAm Editor on October 25, 2016

First American’s proprietary Real House Price Index (RHPI) looks at August 2016 data and includes analysis from First American Chief Economist Mark Fleming that explains that counter to conventional wisdom, affordability for home buyers in many markets is increasing due to low interest rates and increasing wages.

Read More ›

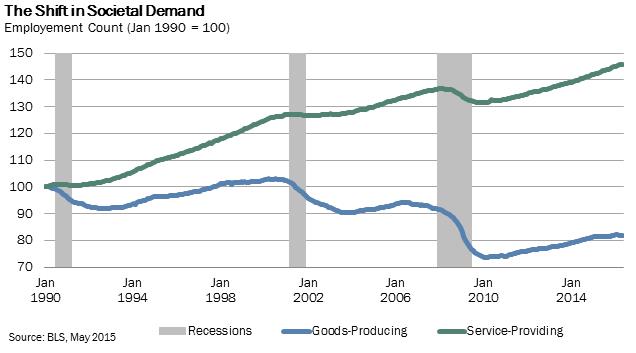

Automation Angst – The Polarization of the Labor Market in the 21st Century

By

Mark Fleming on October 11, 2016

Success achieving the American Dream of homeownership is, in large part, dependent on the ability to earn a good income. For much of the last century, a job in manufacturing provided a stable and solid income. In fact, after World War II, the United States was the manufacturer to the world, as America’s post-war economic boom changed the way we ...

Read More ›

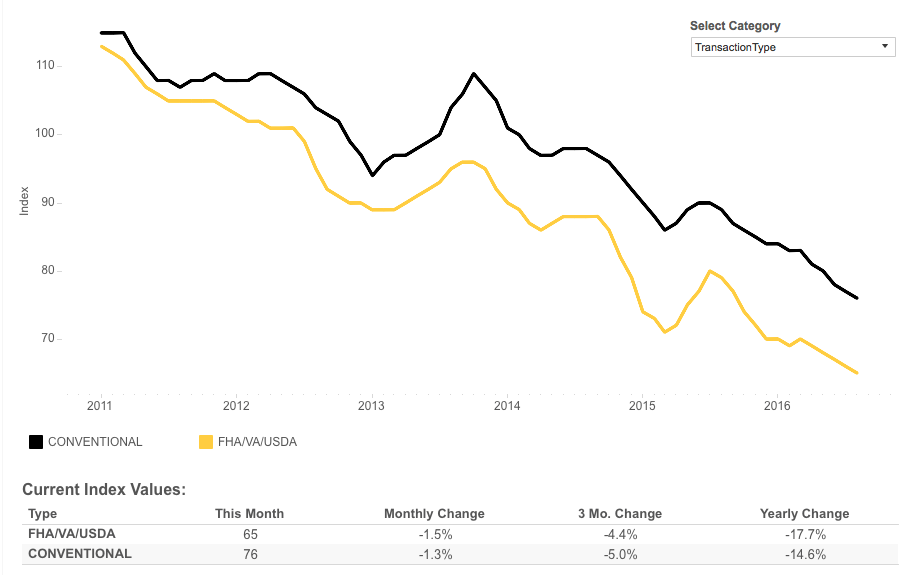

Loan Application Defect and Fraud Risk Declines Due to Increased Demand for FHA Purchase Loans

By

FirstAm Editor on September 30, 2016

We’ve posted the August First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained unchanged in August as compared with July and decreased by 14.6 percent as compared with August 2015. The Defect ...

Read More ›