What's the Outlook for Housing Market Potential Amid Rising Mortgage Rates?

By

Mark Fleming on June 18, 2018

With the Federal Reserve Open Market Committee (FOMC) decision to increase the Federal Funds Rate last week, the prospect of higher mortgage rates remains top of mind among real estate professionals and continues to generate headlines. Yet, changes to the short-term rate matter little to the housing market.

Read More ›

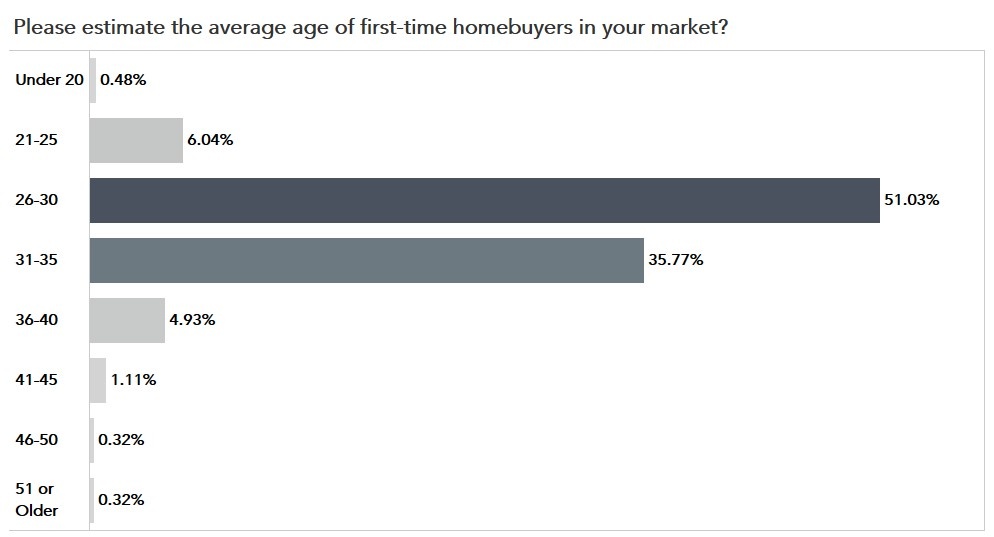

Will First-Time Home Buyer Demand Withstand Rising Rates?

By

Mark Fleming on June 12, 2018

Given the strong likelihood of rising mortgage rates in 2018, many savvy real estate market observers are curious how rising rates may impact demand, especially among millennial first-time home buyers. As part of our quarterly First American Real Estate Sentiment Index (RESI), we recently surveyed title insurance agents and real estate ...

Read More ›

Quoted on Forbes.com: Rising Rates Can Increase Housing Demand

By

FirstAm Editor on June 7, 2018

First American Chief Economist Mark Fleming was quoted Tuesday in a feature article on Forbes.com, explaining how rising rates can increase housing demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

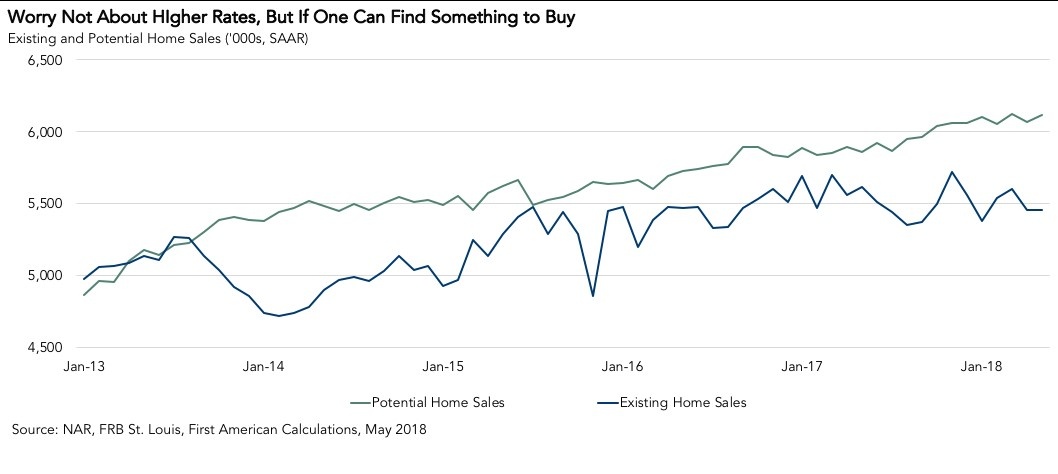

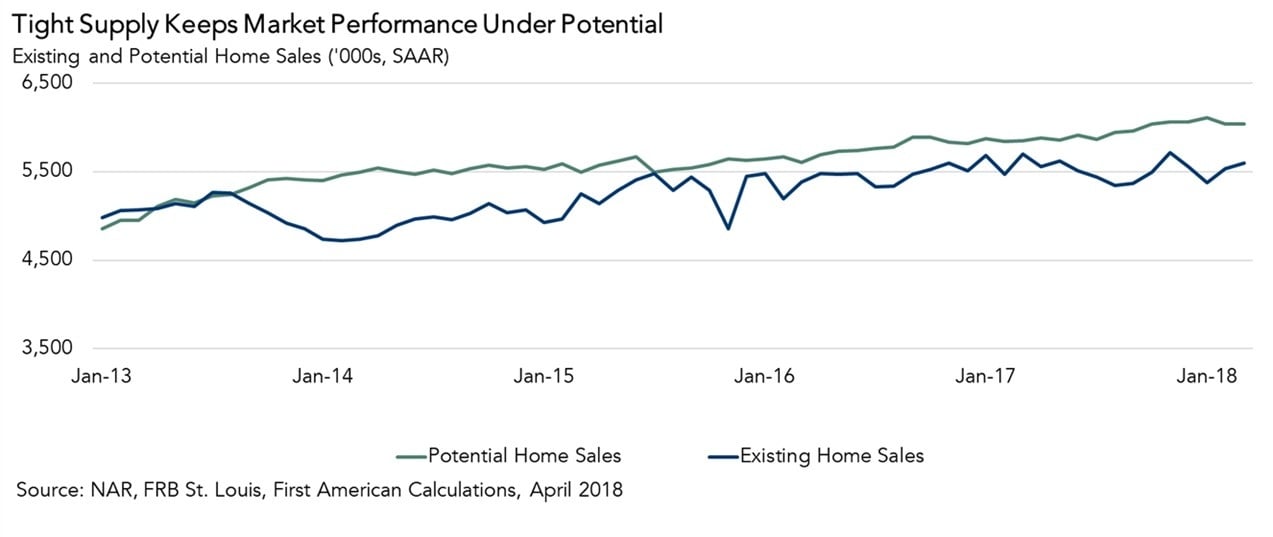

The Surprising Impact of Rising Rates on Market Potential

By

Mark Fleming on May 23, 2018

In April, the housing market continued to underperform its potential. Existing-home sales were 6.5 percent below the market’s potential for existing-home sales, according to our Potential Home Sales Model. Lack of supply remains the primary culprit. The inventory of homes for sale in most markets remains historically low, yet demand continues to ...

Read More ›

Interview on CNBC: Explaining the Link Between Rising Rates, Housing Supply and Affordability

By

FirstAm Editor on May 18, 2018

First American Chief Economist Mark Fleming was interviewed yesterday on CNBC and explained the link between rising rates, housing supply and affordability.

Read More ›

Housing In The News Interest Rates Millennials Affordability

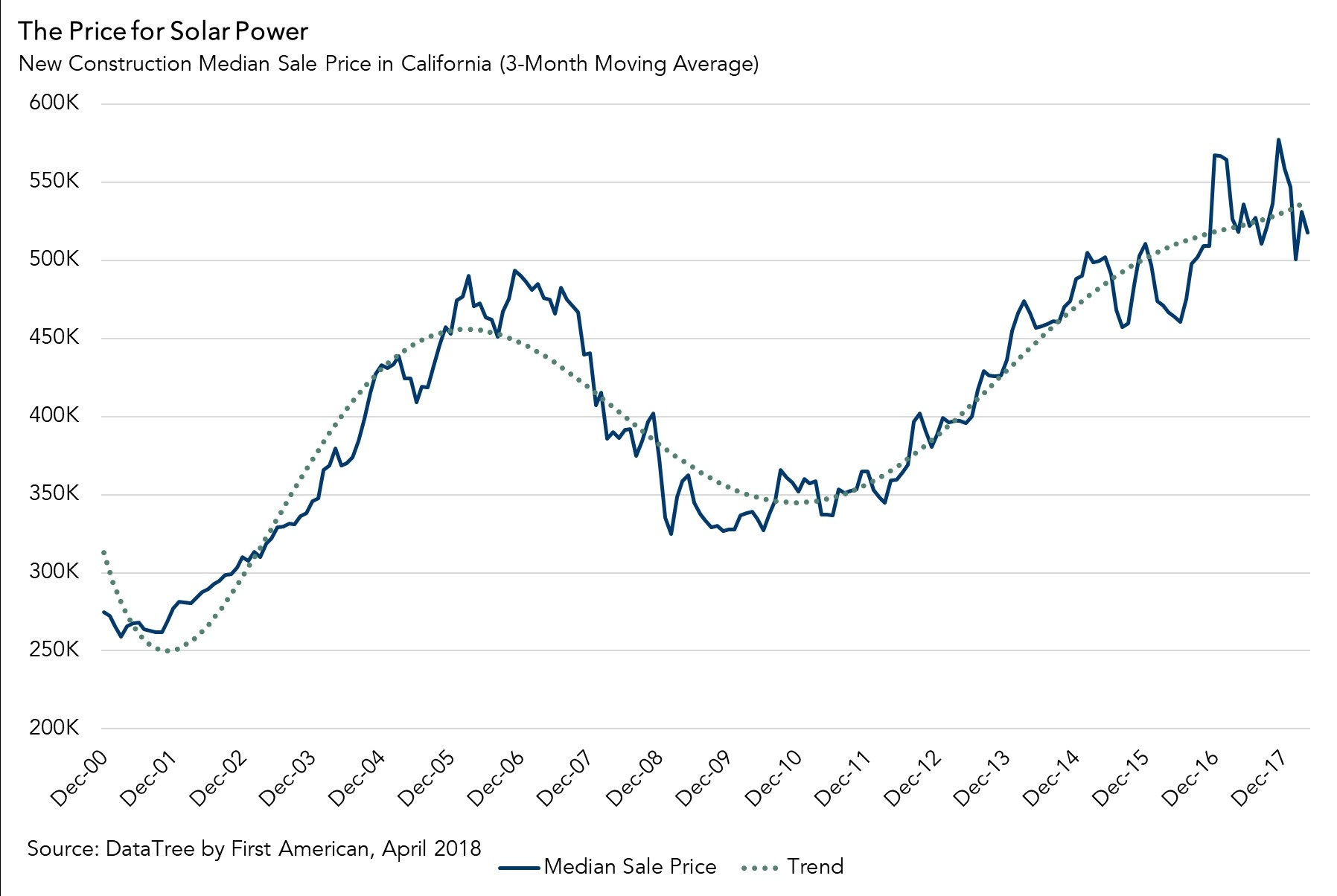

What Does California's Solar Panel Mandate Mean for Affordability, and April Housing Starts Data Signal Optimism

By

Mark Fleming on May 17, 2018

California moved to the center of the new residential construction solar system last week as it became the first state to mandate solar panels on new residential homes. The mandate is part of California’s “Energy Efficiency Strategic Plan,” which includes the goal that both residential and commercial construction be zero net energy by 2030. The ...

Read More ›