We’ve said it before and we’ll say it again – the shortage of houses on the market is making it difficult for Americans to find homes to buy, which is especially concerning for the Millennial first-time home buyer. There are many possible reasons for the housing supply shortage, ranging from fear of paying a higher mortgage rate to insufficient equity keeping sellers at bay. Frequent readers of this blog will be familiar with our “prisoner’s dilemma” theory for the housing supply shortage.

Most markets have a seller and a buyer who make their decisions independent of one another. In the housing market, however, the seller and buyer are often the same economic actor. In other words, existing homes have homeowners living in them who are also considering what they want to buy. If two homeowners each decide not to sell their home because of the risk of not being able to find something they can afford to buy, this further limits the supply of homes, contributing to rising home prices and reduced affordability. This scenario, referred to as a non-cooperative outcome, is currently playing out in many housing markets.

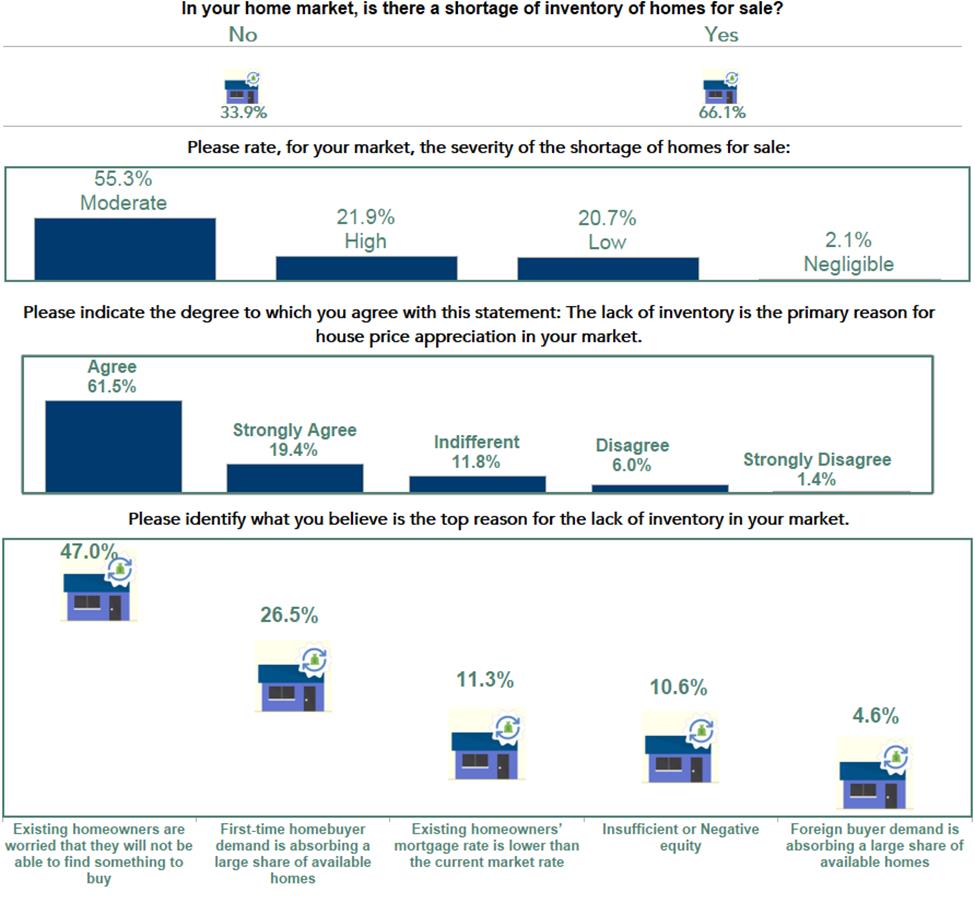

But, don’t take our word for it. In the most recent release of the First American Real Estate Sentiment Index (RESI), we asked title agents and real estate professionals several survey questions on supply to test the prisoner’s dilemma theory. After all, it is often said that the wisdom of the crowd results in more accurate information than independent prediction. In the RESI survey, we asked the basic question of whether title agents and real estate professionals agree that there is a shortage of inventory of homes for sale – 66 percent agreed that this was true in their home markets. Of those who agreed, 77 percent of title agents and real estate professionals characterized the severity of the shortage of homes for sale as moderate or high. In fact, 81 percent of title agents and real estate professionals agreed that the lack of inventory is the primary reason for house price appreciation in their market, with 20 percent of those strongly agreeing with this statement.

“The crowd has spoken, and it seems in many markets home buyers and sellers alike are ‘imprisoned’ by the lack of housing inventory."

Typically, when prices rise, homeowners have greater incentive to sell their home. Since we’re not seeing this in many markets, we asked title agents and real estate professionals to rate the top reason for the lack of inventory in their markets. Almost half of the respondents cited that existing homeowners are worried that they will not be able to find something to buy as the main reason. Another 26 percent cited that first-time homebuyer demand is absorbing a large share of available homes as their top reason. This was followed by existing homeowners’ mortgage rate is lower than the current market rate (11.3 percent), insufficient or negative equity (10.6 percent), and lastly, foreign buyer demand is absorbing a large share of available homes (4.6 percent).

The survey findings confirm that that the prisoner’s dilemma phenomenon is real (humble brag for the economists!) Demand for existing homes continues largely due to the influx of first-time home buyers, while sellers are increasingly unwilling to sell for fear of not being able to find something to buy.

What About That Other 34 Percent?

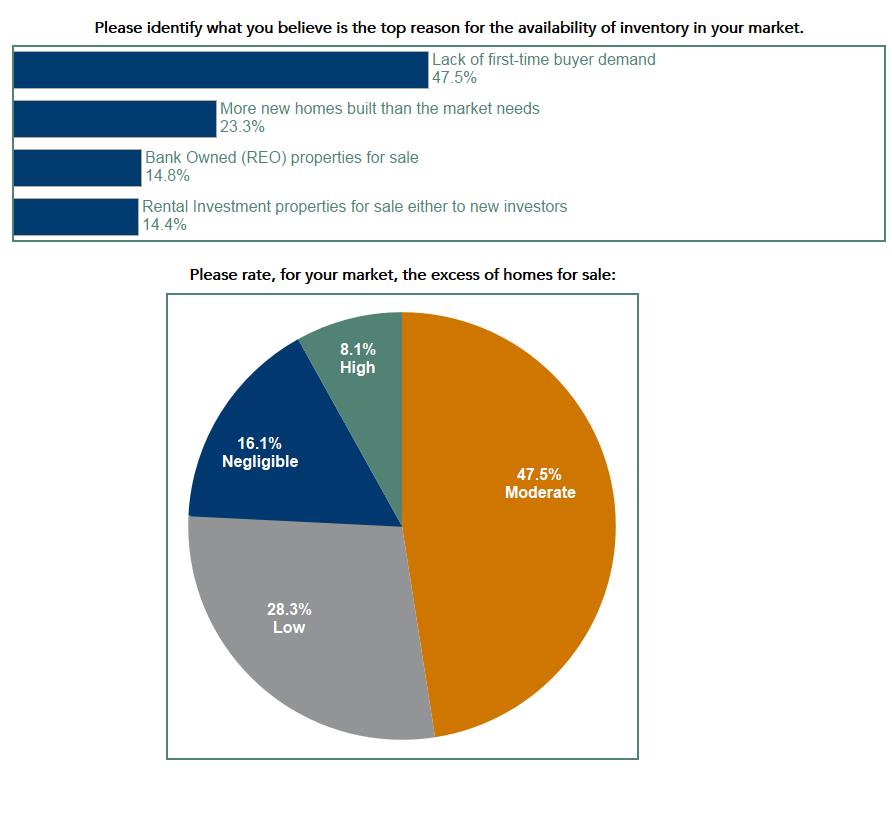

Yet, according to survey results, there are some markets confronted with excess inventory. About one third of the title agents and real estate professionals who participated in the survey don’t believe that there is a shortage of inventory of homes for sale. Furthermore, 55.5 percent characterized the excess supply of homes for sale as high (8 percent) or moderate (47.5 percent).

When asked to identify the top reason for the availability of supply in their markets, 47.5 percent of title agents and real estate professionals surveyed indicated the lack of first-time home buyer demand as the main reason. Most of the survey respondents that cited lack of first-time home buyer demand as the reason came from Connecticut, Louisiana, West Virginia, and Florida. Markets that are not seeing demand increases do not have a tightening supply issue. Those that want to sell their homes are not pushed into bidding wars, and prices may be more moderate in these markets, so the fear of not being able to find something to buy doesn’t exist.

The Crowd Confirms It

The crowd has spoken, and it seems in many markets home buyers and sellers alike are “imprisoned” by the lack of housing inventory. Perhaps rather than focusing on existing homes, a rise in new construction would best serve these supply restricted markets. New construction isn’t susceptible to the prisoner’s dilemma phenomenon. With first-time home buyer demand only expected to rise, a solution is necessary – and quickly.

Odeta Kushi contributed to this blog post.