What Cities Are the Most Affordability Friendly for First-Time Home Buyers?

By

Odeta Kushi on December 10, 2019

Housing affordability, or the lack thereof, continued to generate discussion and headlines in 2019. That’s unlikely to change in 2020, as strong demand, driven by low mortgage rates and wage growth, collides with limited housing supply. However, it’s easy to overlook that nearly two-thirds of Americans already own homes so, generally speaking, ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

Why the Time May Be Right for New Home Construction to Accelerate

By

Odeta Kushi on November 8, 2019

Thus far in 2019, the story of the housing market has been a tale of strong housing demand and limited supply. On the demand side, steadily rising house-buying power has fueled greater demand. Falling mortgage rates and rising household income sparked a nearly 12.6 percent increase in house-buying power year to date through September. The impact ...

Read More ›

Interview on Nightly Business Report: Discussing Surge in Potential Housing Supply

By

FirstAm Editor on September 24, 2019

First American Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week and discussed the dramatic jump in housing starts to a 12-year high, signaling the potential for some housing supply relief in the near future.

Read More ›

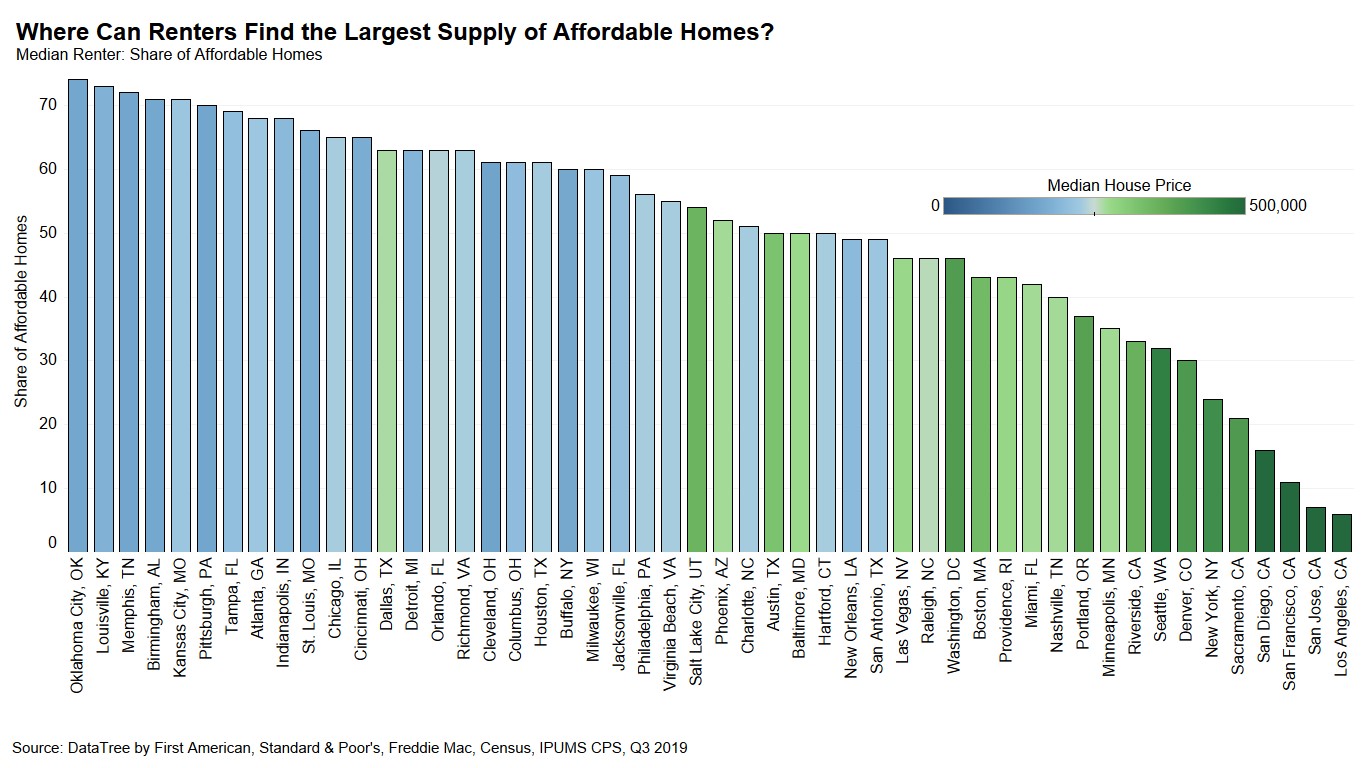

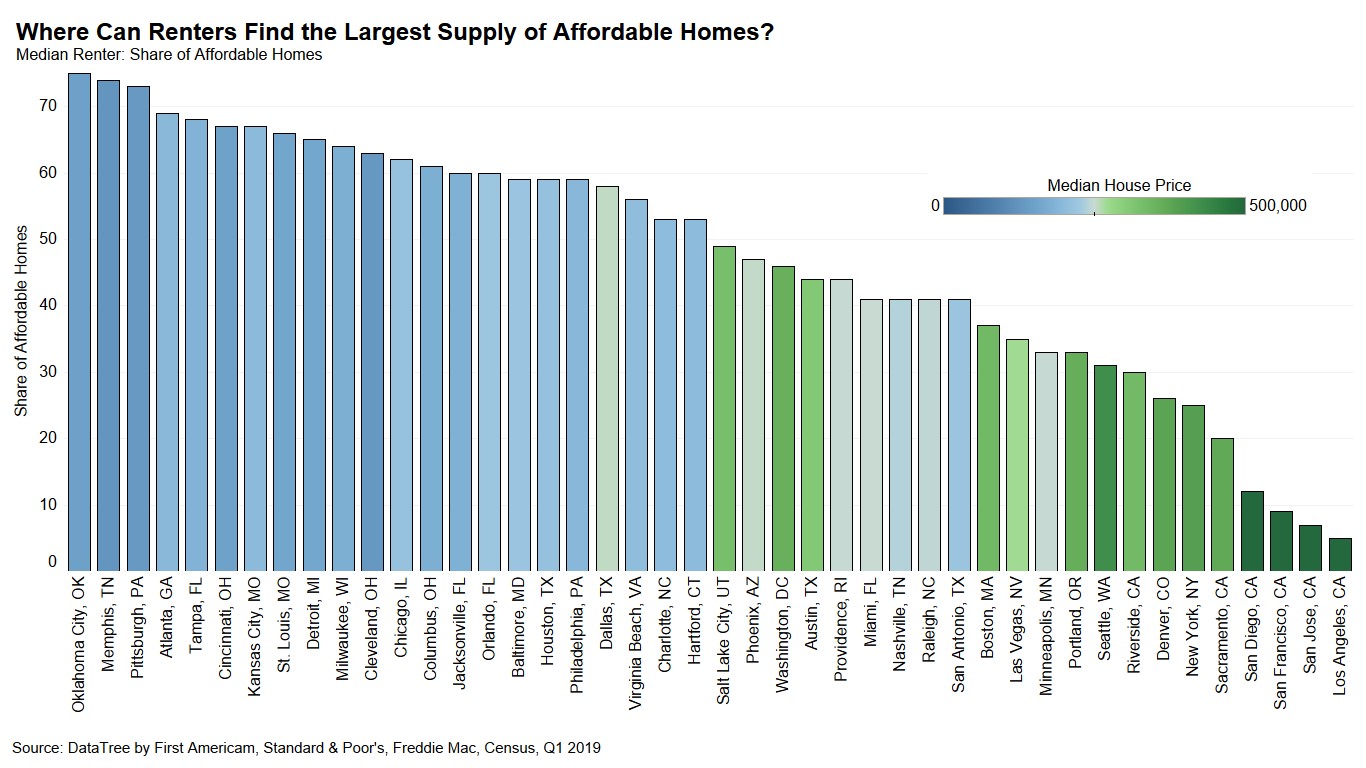

Where Do Renters Have an Edge in the Pursuit of Homeownership?

By

Odeta Kushi on September 5, 2019

Traditional measures of affordability can be misleading to potential first-time home buyers because they compare overall median household income with the income required to purchase a median-priced home. However, median household income includes existing homeowner households, which have significantly higher median income than renter households, so ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

Interviews on CNBC and Nightly Business Report: Discussing the Refinance Boom and Tailwinds Boosting the Housing Market

By

FirstAm Editor on September 3, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week, where they discussed the refinance boom driven by low mortgage rates and the tailwinds boosting the housing market.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability

Interviews on CNBC and Bloomberg TV: Discussing the Impact of Historically Low Rates and the Outlook for the Housing Market and the Economy

By

FirstAm Editor on August 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi on Bloomberg TV earlier this week and discussed the impact of historically low rates on the housing market, and what the Fed minutes indicate about the direction of rate policy and the economy.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability