With the upcoming Federal Open Market Committee (FOMC) meeting this week, many are wondering if an interest rate hike is in the works. According to the CME FedWatch Tool, the current market expectation of a 0.50 percent rate increase in June is extremely low – 4 percent. However, the likelihood jumps to 27 percent in July. But, whether the Fed raises rates in June, July or later this year, how much impact would it have on the current housing market?

“Even if mortgage rates suddenly increased half a percent, real house prices would still be as low as they were in 1999.”

Recent federal fund rate increases have shown that the influence of the Fed on mortgage rates isn’t necessarily very strong. In fact, when the Fed target rate was increased in December, mortgage rates in the following 7 days actually declined from 3.97 percent to 3.96 percent. Increasing the federal funds (short) rate does not necessarily mean a significant change in the mortgage (long) rate. Studies show that foreign demand and other macroeconomic indicators are much more influential in determining what happens to long rates. In the coming months, global uncertainty due to events like the “Brexit” or other forms of geo-political unrest may have more influence on mortgage rates, than domestic Fed actions.

Even if Fed actions do eventually begin to influence long mortgage rates, the housing market is not doomed. As we discussed in a post last year, the Fed raises rates because the economy is getting stronger, in particular if income growth begins to accelerate, which actually increases consumer house-buying power. This benefit can counter the reduced buying power caused by higher mortgage rates.

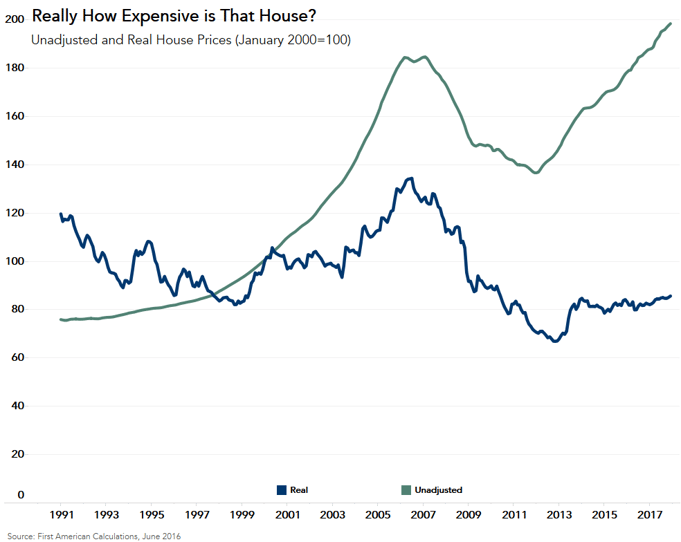

The First American Real House Price Index (RHPI) is a measure of both consumer house-buying power and housing affordability – showing the price changes of single-family properties throughout the U.S. and adjusting for the impact of income and interest rate changes on consumer house-buying power over time. Shifts in income and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases.

As unadjusted or nominal prices continue to outpace income growth, consumers may experience sticker shock when house-hunting. But in real terms, prices are in fact much lower than home buyers realize, mostly due to the current environment of historically low mortgage rates. Our latest analysis shows that real house prices, nationally, are 39.1 percent below the housing boom peak and 18 percent below even the price level in 2000, more than 15 years ago. Unadjusted and real house prices since 1991 are shown below.

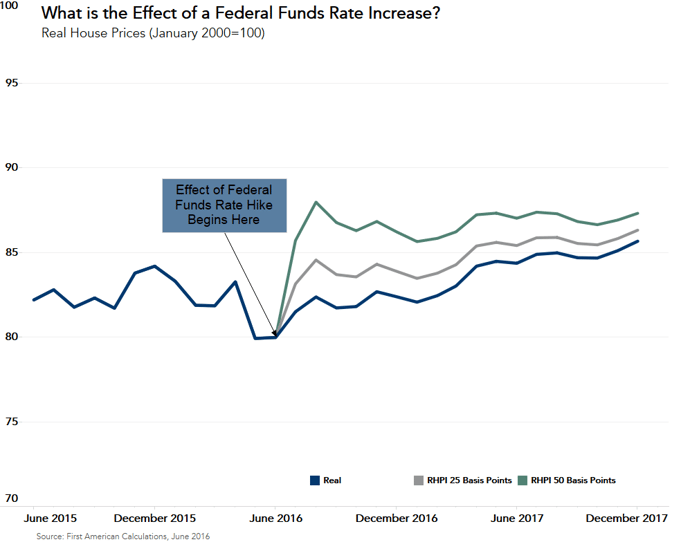

In order to see what the impact of increasing mortgage rates is on real house prices, we forecasted what real house prices would do over the next 18 months if there is no change to mortgage rates, a 25 basis point increase, and a 50 basis point increase.

When adjusting for a rate increase of 25 basis points, the RHPI from June to July increases by 4 percent over the no change scenario. When the rate change is increased to 50 basis points, there is a 7 percent increase in the RHPI. While a 7 percent increase seems significant, it is important to recognize that the real house prices will still be as low as they were in 1999.

The message is clear – even assuming that an increase in the Fed funds rate will increase mortgage rates, a hike in June does not spell disaster for home buyers. If mortgage rates increased suddenly by half a percent, real house prices would still be at historic lows. So, really, how important is that rate hike?