Recent Posts by FirstAm Editor

CNBC Interview: Discussing the impact of the election on interest rates, future of technology in real estate finance

By

FirstAm Editor on November 22, 2016

First American Chief Economist Mark Fleming was interviewed yesterday on CNBC regarding the surge in interest rates following the U.S. presidential election and what it means for the housing market in the year ahead.

Read More ›

Millennial First-Time Homebuyer Demand Does Not Increase Defect, Fraud and Misrepresentation Risk

By

FirstAm Editor on October 31, 2016

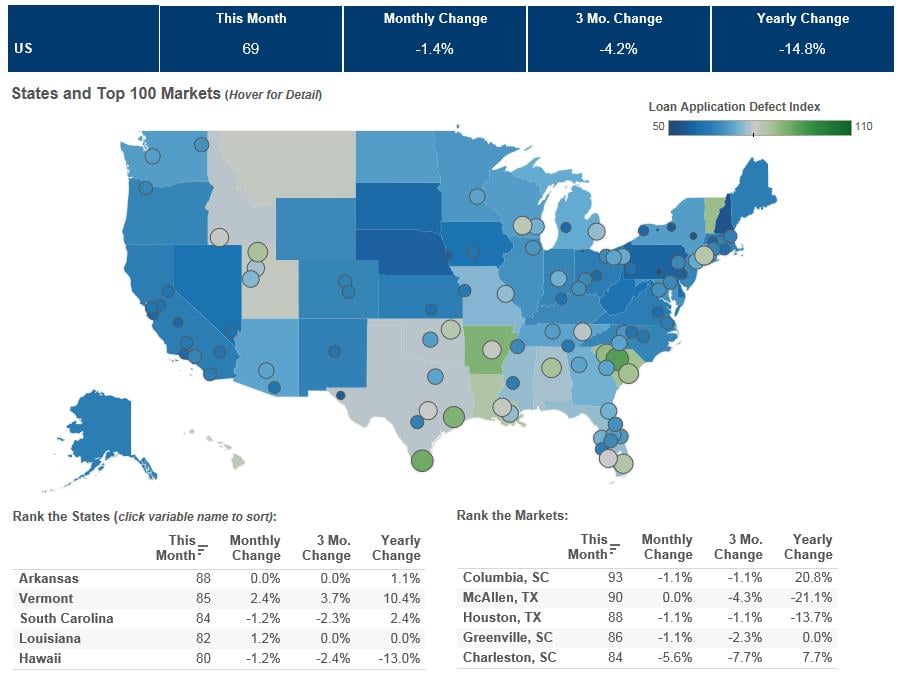

We’ve posted the September First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in September as compared with August and decreased by 14.8 percent as compared to September 2015. The ...

Read More ›

Bloomberg Radio Interview – Fleming says Housing is More Affordable

By

FirstAm Editor on October 26, 2016

First American Chief Economist Mark Fleming is interviewed on Bloomberg Radio to explain why housing is more affordable today than many people believe.

Read More ›

Low Rates and Increased Wages Increase Affordability for U.S. Home Buyers in Almost All Major Markets

By

FirstAm Editor on October 25, 2016

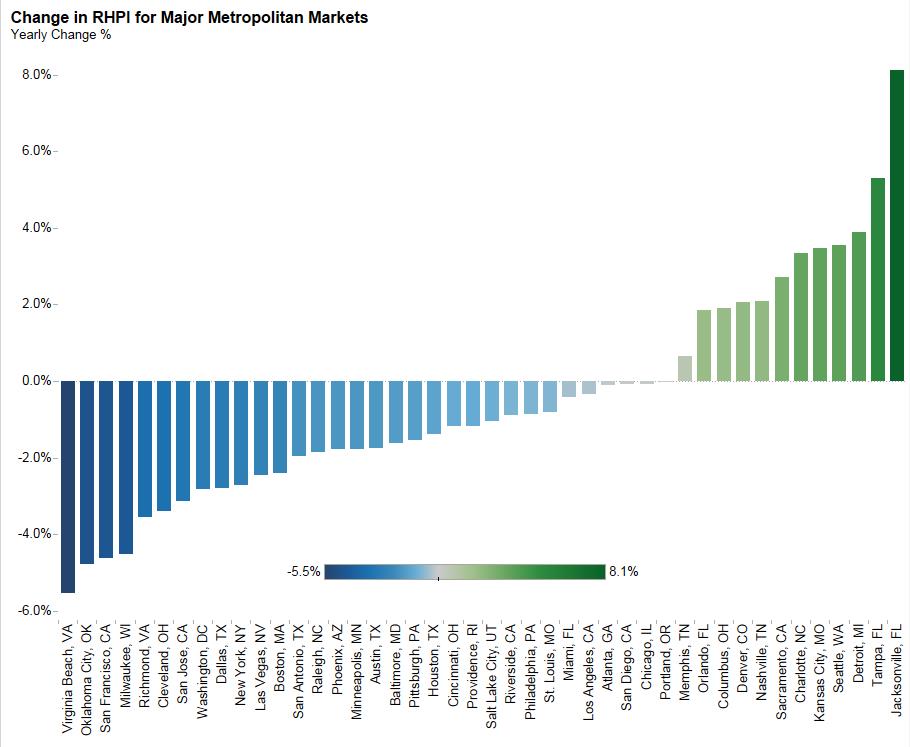

First American’s proprietary Real House Price Index (RHPI) looks at August 2016 data and includes analysis from First American Chief Economist Mark Fleming that explains that counter to conventional wisdom, affordability for home buyers in many markets is increasing due to low interest rates and increasing wages.

Read More ›

Interview on Bloomberg TV: Discussing Housing Starts, Millennial Home Buying and More

By

FirstAm Editor on October 19, 2016

First American Chief Economist Mark Fleming was invited to share his perspective on housing starts, Millennial home buying and more on Bloomberg Markets this morning. Mark commented on the tipping point signaled in today’s housing start numbers.

Read More ›

Loan Application Defect and Fraud Risk Declines Due to Increased Demand for FHA Purchase Loans

By

FirstAm Editor on September 30, 2016

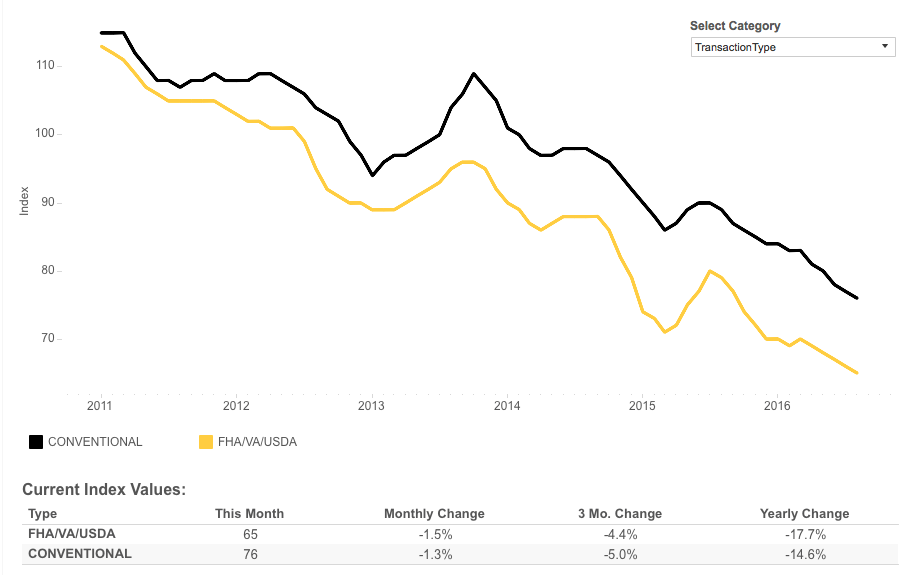

We’ve posted the August First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained unchanged in August as compared with July and decreased by 14.6 percent as compared with August 2015. The Defect ...

Read More ›