Recent Posts by FirstAm Editor

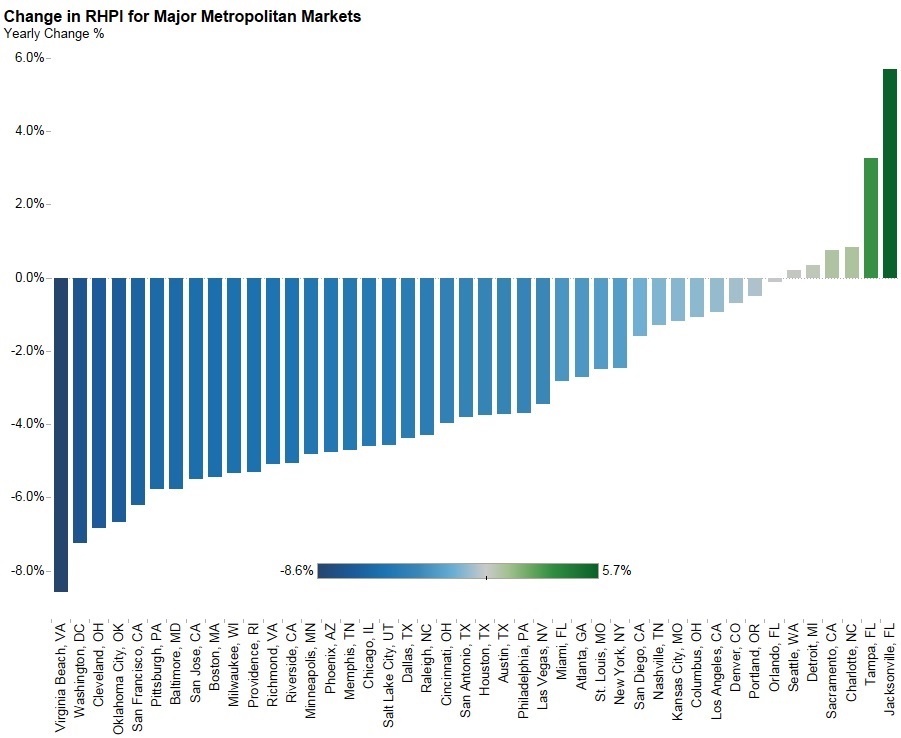

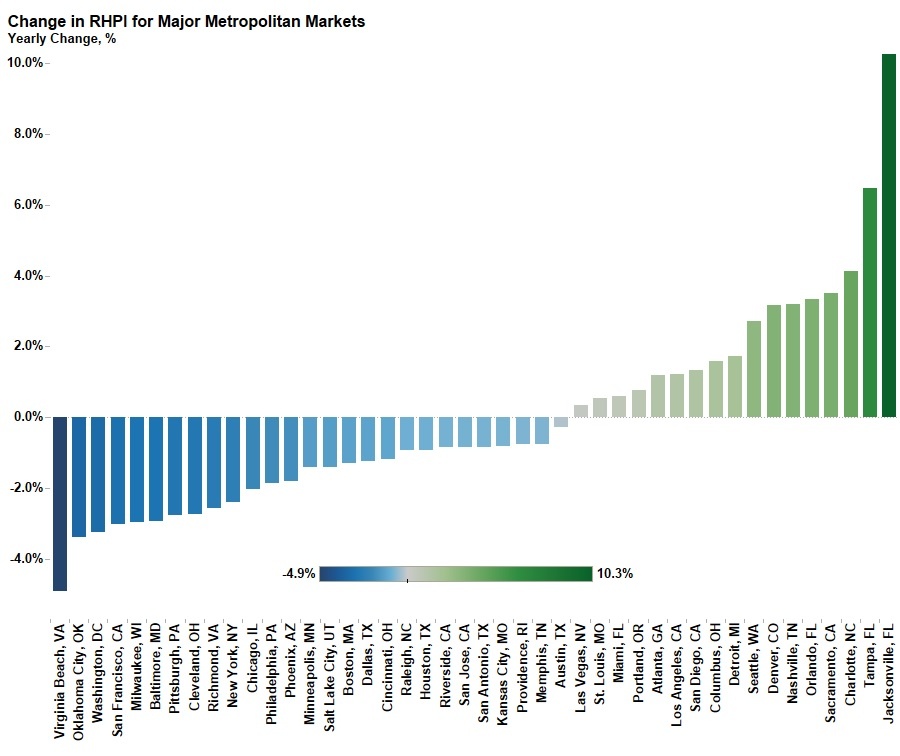

Affordability in Almost All Major Markets Continues to Improve in July

By

FirstAm Editor on September 26, 2016

First American’s proprietary Real House Price Index (RHPI) looks at July 2016 data and includes analysis from First American Chief Economist Mark Fleming the explains how rising incomes and low interest rates are contributing to increased affordability in most major U.S. markets.

Read More ›

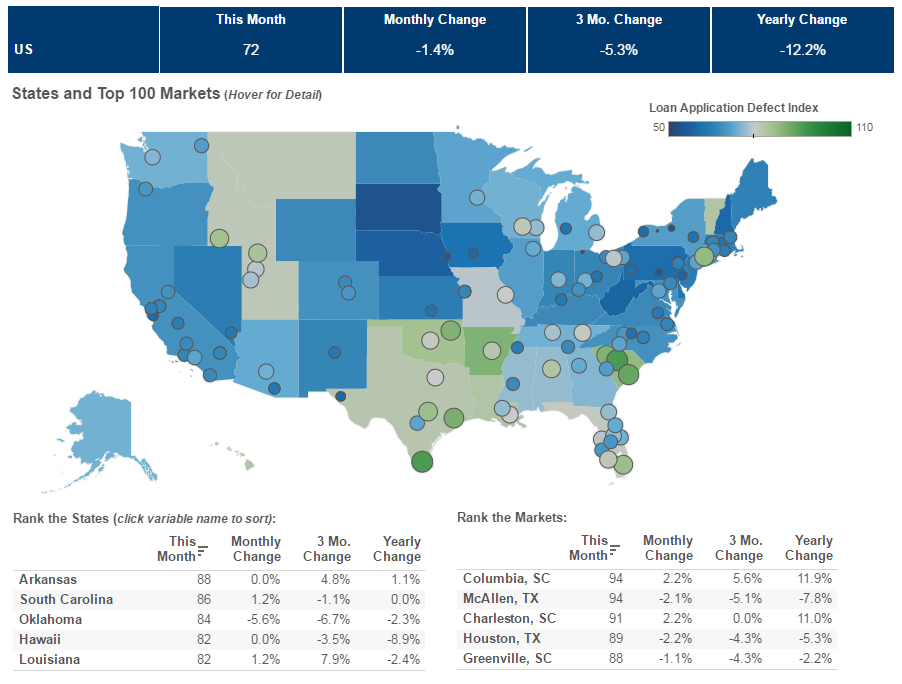

Refinance Boom and Compliant Loan Production Processes Keeping Loan Defect Rate at Low Point

By

FirstAm Editor on August 31, 2016

We’ve posted the July First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 2.8 percent in July as compared with June and decreased 16.7 percent as compared with July 2015. The Defect Index is ...

Read More ›

Business Insider Interview - 13 Markets Where Affordability is Declining

By

FirstAm Editor on August 26, 2016

Business Insider interviewed First American Chief Economist Mark Fleming on affordability and used First American’s Real House Price Index to develop a list of the top 13 markets where affordability is declining.

Read More ›

Foreign Monetary Stimulus a Positive for U.S. Consumer House-Buying Power

By

FirstAm Editor on August 26, 2016

First American’s proprietary Real House Price Index (RHPI) looks at June 2016 data and includes analysis from First American Chief Economist Mark Fleming explaining the influence of foreign monetary stimulus on U.S. mortgage rates and its impact on consumer house-buying power.

Read More ›

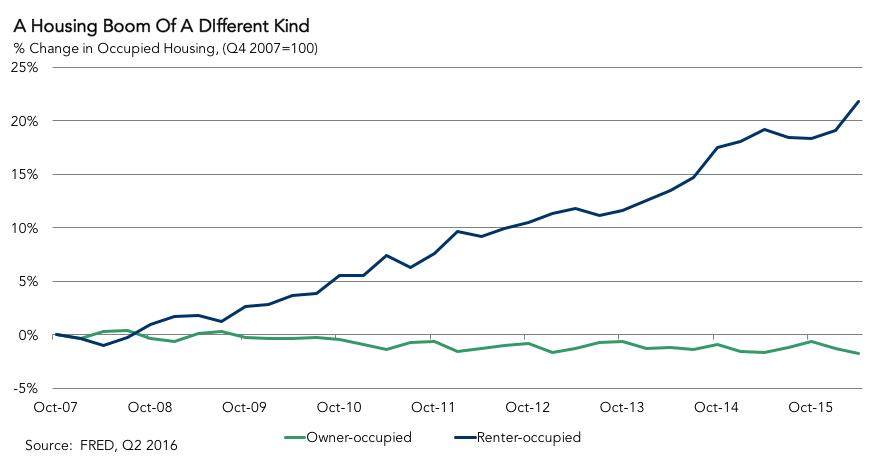

HousingWire - This is Why Homeownership Hit an All-Time Low

By

FirstAm Editor on August 9, 2016

First American Chief Economist Mark Fleming explains in an article on HousingWire why reaching a low point in homeownership is no reason to panic about the housing market.

Read More ›

Loan Application Defect and Fraud Risk Declined Due to Benefits of Low Mortgage Rates

By

FirstAm Editor on July 29, 2016

We’ve posted the June First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in June as compared with May and decreased by 12.2 percent as compared with June 2015. The Defect Index is ...

Read More ›