In our most recent Potential Home Sales Model analysis, we noted that the housing market’s potential improved in April because falling mortgage rates and rising household income combined to increase consumer house-buying power more than enough than to offset house price appreciation. In other words, house-buying power won the tug of war with house prices.

“The reality is we expected this unexpected turn of appreciation ‘events.’”

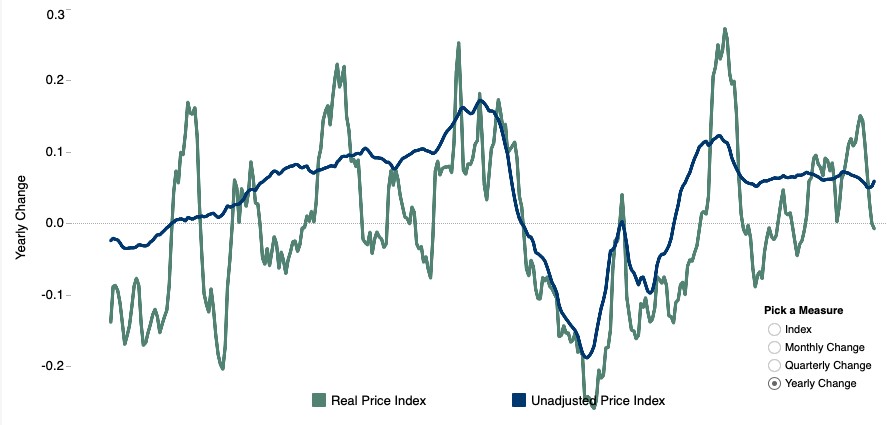

The proverbial tug of war between house-buying power and rising prices has been getting easier for house-buying power to “win” in recent months because the pace of house price appreciation has been slowing down. According to the S&P CoreLogic Case-Shiller national house price index, the rate of year-over-year appreciation peaked in March 2018 at 6.5 percent. Since then, it has steadily slowed and is now, a year later, 3.7 percent. Slower price appreciation makes it easier for house-buying power to offset or even, as happened in April, exceed the cost of higher prices.

Yet, is it reasonable to assume the year-long slowdown in house prices will continue? After all, increasing house-buying power makes homes more affordable. In fact, house-buying power was up 5.2 percent in March compared with a year ago. As you might expect, more house-buying power encourages more demand. And greater demand when supply remains relatively tight is “econ 101” for rising prices. Lo and behold, according to the Data Tree by First American measure of house prices that we use in our Real House Price Index (RHPI), the rate of unadjusted house-price appreciation increased in April for the first time since March 2018, reaching to 5.9 percent. This is what we refer to as a “preliminary” reading because the estimated growth rate will be revised as we collect over the next few weeks the trailing flow of data on transactions that closed in April.

Expect the Unexpected – Real and Unadjusted House Prices

The reality is we expected this unexpected turn of appreciation “events.” When demand increases for a scarce (limited or low supply) good, prices will rise faster. The difference between houses and other goods is that we buy them with a mortgage. So, it’s not the actual price that matters, but the price relative to purchasing power. We measure this relationship in our RHPI – how actual house prices are changing relative to purchasing (house-buying) power.

Now What?

That was the situation in April, but this is now June, and mortgage rates have fallen even further. The 30-year, fixed-rate mortgage averaged 3.99 percent in the last week of May – a level last seen in January 2018. That means that consumer house-buying power has only strengthened more since April. So, the signal from the housing market indicates another turn of housing market “events” and a greater likelihood of faster price appreciation.