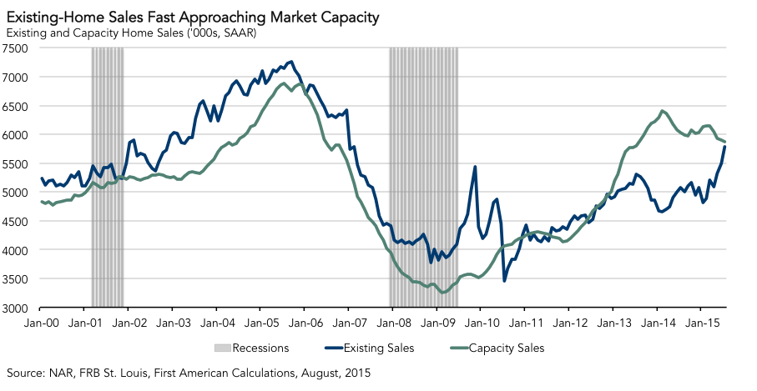

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-homes sales are under capacity or over capacity based on current market fundamentals. For the month of July, the EHS-C seasonally adjusted, annual rate of sales decreased by 23,000, a decreased of 0.4 percent compared to June and a decrease of 2.5 percent compared to a year ago. The seasonally adjusted, annualized rate (SAAR) of existing-home sales capacity is up 80.5 percent from the low point of sales reached in February 2009*.

Labor market conditions and interest rate levels remain favorable to the housing market and these factors are keeping the market capacity for existing-home sales steady, nearing an equilibrium rate just below six million sales. Pent-up supply is being released and existing owners are feeling more confident to place their homes on the market, helping to drive the actual sales level higher and close the gap between market capacity and actual existing-home sales quickly.

According to our proprietary EHS-C model, an expected move by the Federal Reserve this fall to raise rates will have a moderating, but not devastating impact on the market capacity for existing-home sales. Additionally, rising rates are an indication of stronger labor market conditions, which is beneficial to the housing market.

EHS-C is down 531,000 (SAAR) from the most recent peak in February 2014, meaning the gap between market capacity and actual existing-home sales continues to improve. The current underperformance gap is an estimated 90,000 existing-home sales at a seasonally adjusted annual rate, significantly reduced compared to the sales capacity gap of 1.7 million existing-home sales in February 2014.

As house price appreciation continues to remain strong and improve the equity positions of existing-home owners across the country, pent-up supply is being released and more sales are occurring. This is one of the primary reasons that we are observing such a significant reduction in the production gap between market capacity and actual existing-home sales this summer. Many markets have already surpassed their prior peak price levels, but others still have to recover. The result is significant progress toward a full recovery.

Early forecasts for July existing-homes sales predict an increase to 5.64 million seasonally adjusted at an annual rate. This would be an increase of 2.7 percent over June and a further indication that, while market capacity is declining, the conditions that are causing the underperformance gap are moderating. Such a significant increase would add more credence to the argument that the housing market continues to strengthen. Earlier this week, news on housing starts from the Commerce Department indicated the highest level of new-home construction in almost eight years. This is particularly good news because the under-production of new housing units is viewed by many as a potential long-run risk to the housing market as Millennials form more households and increasingly want to buy a home.

It’s just a matter of time before the Millennial first-time homebuyer becomes a more significant source of demand in the housing market. Making the lifestyle decisions to get married and have children will likely be the most influential choices determining the decision to buy a home.

Next EHS-C release: September 17, 2015 for August EHS-C

*Previous EHS-C releases referred to November 2011 as the low point of sales. The model used to generate existing-home sales capacity has been enhanced to more accurately reflect the dynamic relationships between sales, prices, interest rates, and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About Existing-Home Sales Capacity

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-homes sales are under capacity or over capacity based on current market circumstances. The EHS-C rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and coops, are outperforming or underperforming based on current market fundamentals. The seasonally adjusted annualized EHS-C estimates the historical relationship between existing-home sales and the U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of existing-home sales above the level of the EHS-C indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of existing-home sales below the level of the EHS-C indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the capacity rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent EHS-C estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The EHS-C will be published prior to National Association of Realtors Existing-Home Sales report each month.