In several of our recent blog posts, we have touched on Millennials and their various characteristics, from the sizeable Hispanic representation, to the importance of education when it comes to owning a home. We have seen that Millennials are the most diverse generation to date. There is also an ever-increasing need for higher education in today’s economy and housing market. In this post, we are going to focus specifically on how Millennials compare to previous generations across various dimensions.

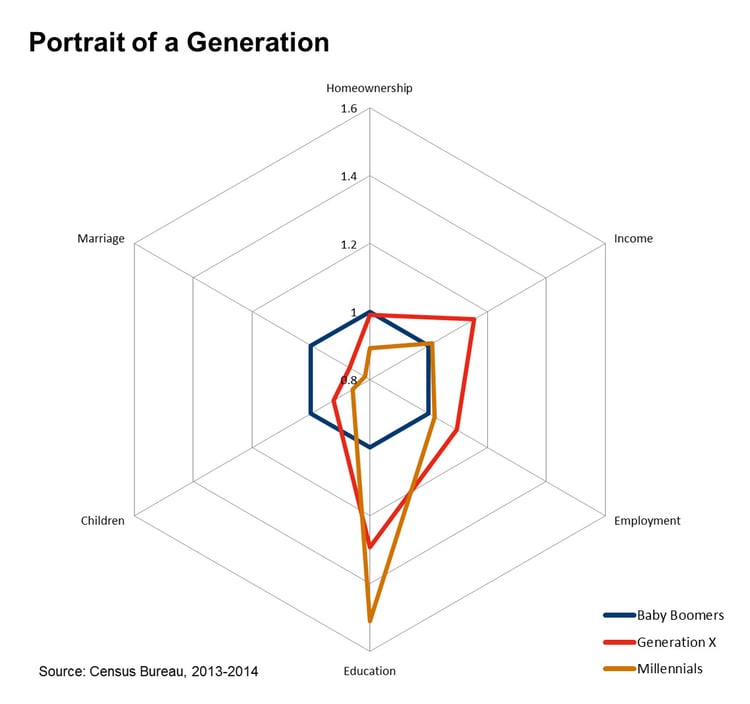

These differences are expressed in the figure below, measuring Millennials, Generation X, and Baby Boomers. There are two kinds of metrics present: the financial metrics of homeownership, income, and employment; and the lifestyle metrics of educational attainment, children, and marriage. The data is measured for 25-34 year-olds in 1980, 2000, and the present for Baby Boomers, Gen X, and Millennials respectively and is displayed as a ratio to Baby Boomers’ levels for successive generations.

"Young singles without familial obligations have less reason to want to buy a home than someone of the same age who is getting married or having children.”

Homeownership is the question on everyone’s lips. Why is it that Millennials have yet to achieve comparable levels to generations past? Is it a question of financial barriers, educational choices or lifestyle decisions?

For income and employment, Millennials are not doing as well as Generation X, but have kept pace with Baby Boomers, even with the trying economic conditions of recent years. Income is measured as median income, adjusted for inflation, and the employment is measured as the employment-to-population ratio indicating the level of participation in the labor force. The underperformance of Millennials relative to Generation X may be in large part due to the timing of their entry into the workforce, but also can, in part, be attributed to the time it takes to get educated.

Here is where we find Millennials’ greatest strength: they are the most highly educated generation in history with a higher percentage of college graduates than either of the previous generations. What does this mean? Millennials are prepared to invest in their future. College degrees pay off in the long run and are prerequisites for most high-paying occupations. Why do Millennials have lower incomes and employment-to-population ratios? Many of them are still in school! The explosion of higher education is reflective of a generation that recognizes the importance of education in order to meet the challenges of our modern American economy.

The lifestyle choices of today’s Millennials are strikingly different compared to previous generations. Millennials are waiting longer to get married and have children than previous generations and, as a result, marriage rates and families with children are at lower levels than ever before. This is again an indicator of the cautious and future-oriented nature of this cohort; Millennials want to be secure in their lives before starting families. However, what this also translates into is a reduced need to seek homeownership as young adults. Young singles without familial obligations have less reason to want to buy a home than someone of the same age who is getting married or having children. Renting an apartment or group-house makes much more sense for Millennials than it would for previous generations who were starting families at a younger age.

The standard explanation for lower homeownership rates among Millennials usually has to do with student loan debt, a bad economy, or wanting to live in mom’s basement forever. While these may be part of the story, they certainly aren’t the complete picture. The education and lifestyle decisions of Millennials, specifically staying in school longer and waiting longer to get married and have kids, contribute an important piece of the puzzle. Would one expect a young unmarried person to rush into buying a home? Of course not. As more and more Millennials fall into this category, the generation that prioritizes access over ownership has less incentive to buy a home. But this isn’t the end of the story either. This does not mean that Millennials will never get married, have children, or own a home -- most plan on it. It simply means this is a generation that is willing to wait.

By Connor Currie