The Affordability Crisis That Isn't

By

Mark Fleming on January 29, 2018

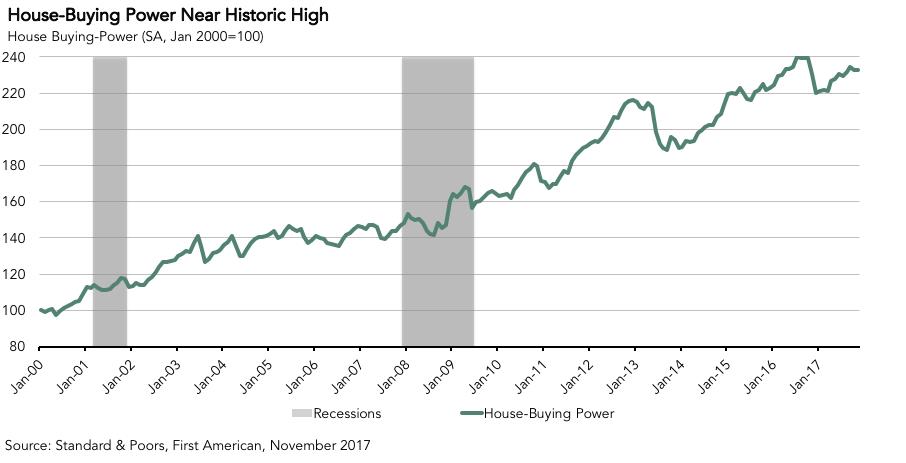

That nominal house prices are growing faster than household incomes is often used as the basis for arguing that we are facing an affordability crisis. It is true that unadjusted house prices grew faster than income between November 2016 and November 2017. Our Real House Price Index (RHPI) showed that unadjusted house prices increased by 6.0 ...

Read More ›

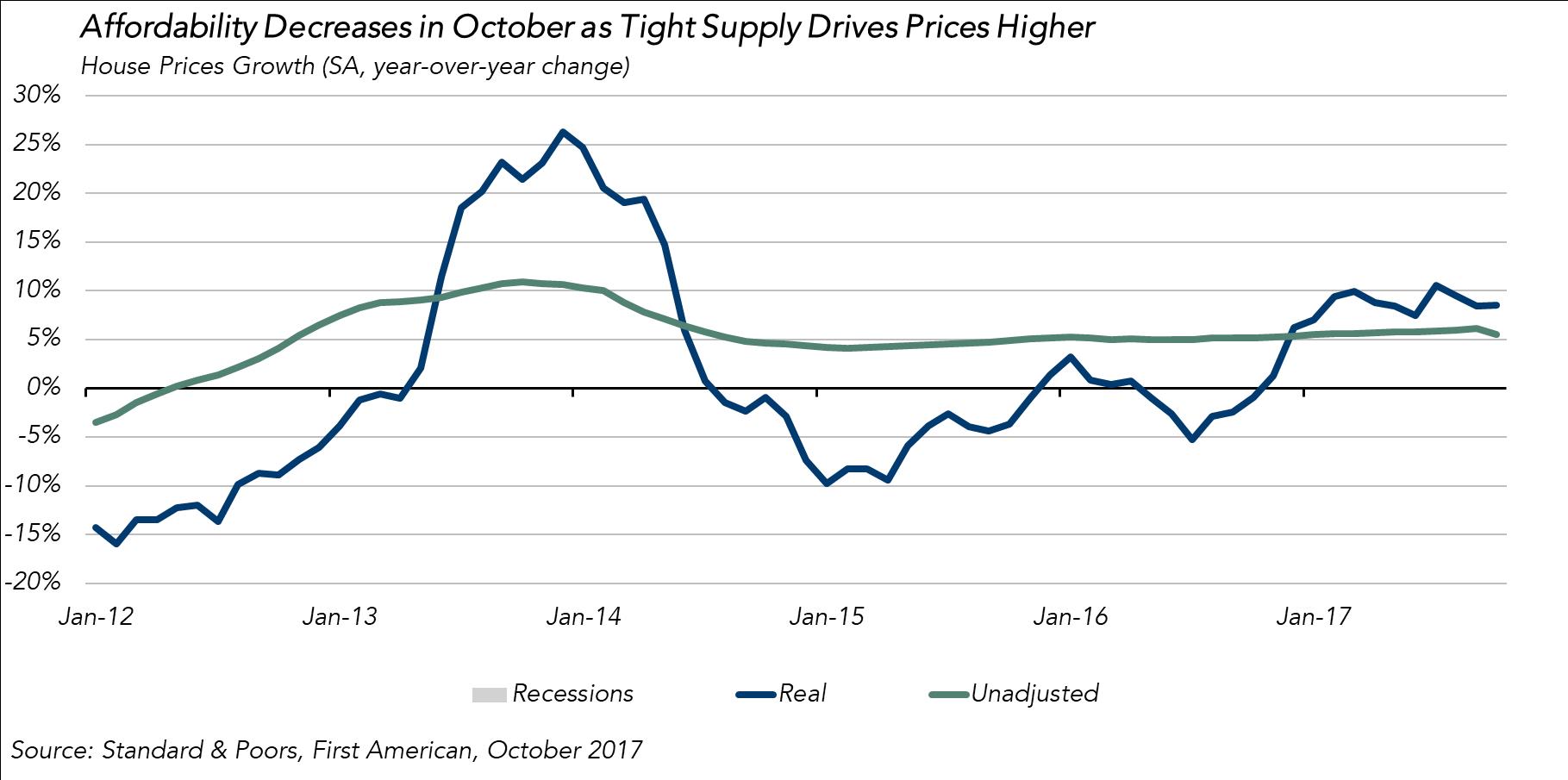

The Drag on Affordability Explained

By

FirstAm Editor on December 21, 2017

First American’s proprietary Real House Price Index (RHPI) looks at October 2017 data and includes analysis from First American Chief Economist Mark Fleming on the market forces that are keeping a lid on affordability.

Read More ›

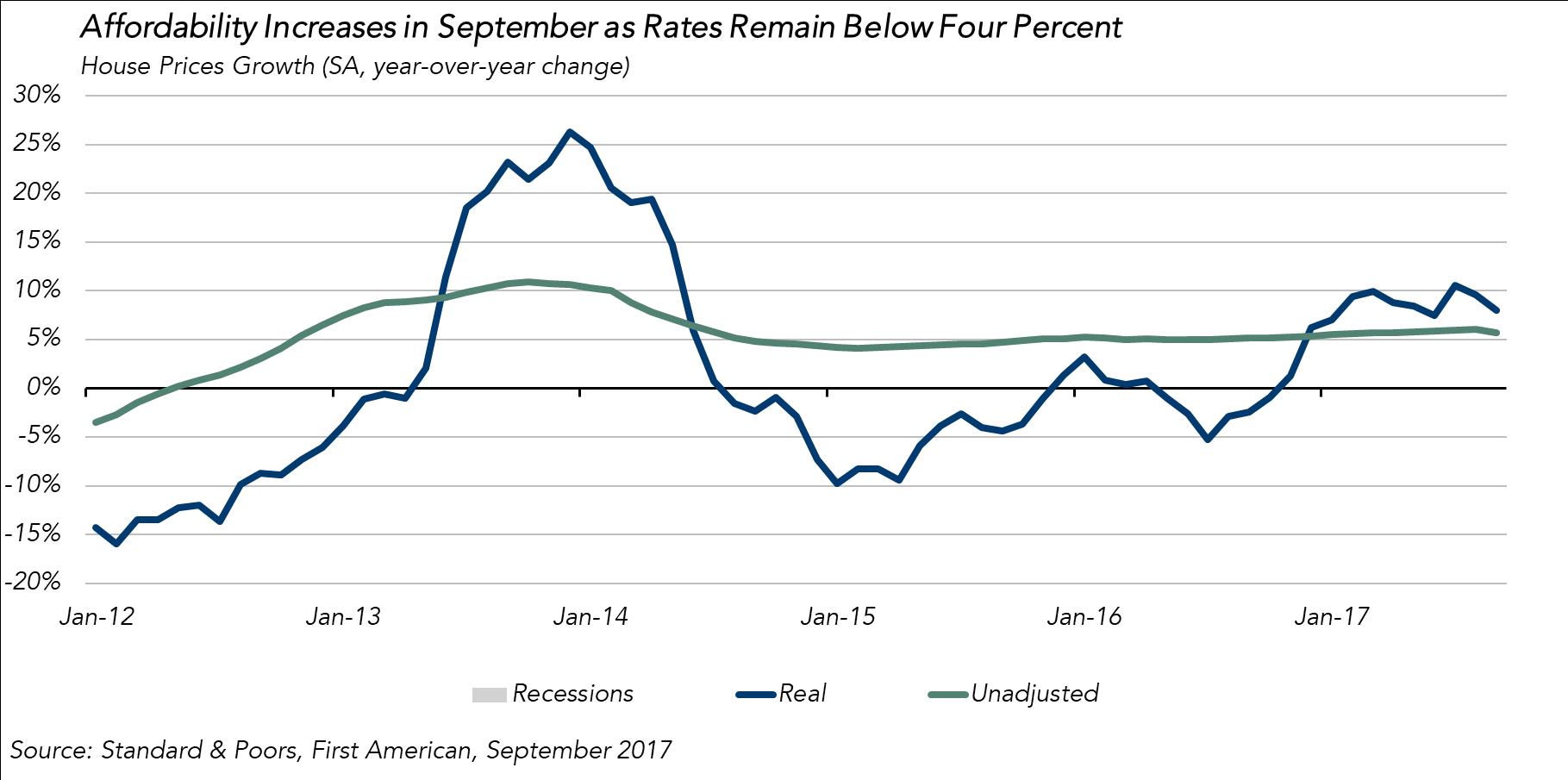

What’s Behind September’s Surprise Increase in Affordability?

By

FirstAm Editor on November 27, 2017

First American’s proprietary Real House Price Index (RHPI) looks at September 2017 data and includes analysis from First American Chief Economist Mark Fleming on the market forces that sparked a surprising increase in affordability in September.

Read More ›

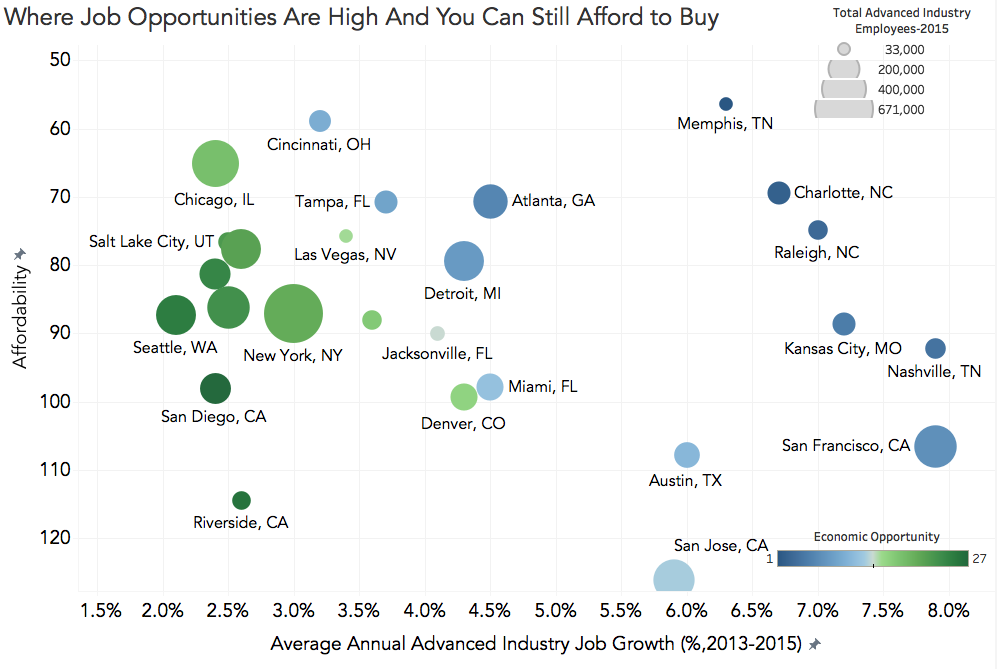

Five Best Cities for Economic Opportunity

By

Mark Fleming on November 16, 2017

Amazon’s very public search to identify the best location for its second headquarters made me wonder - what criteria would be helpful for young professionals when making their personal decision on where to live and work? Affordable housing would be important. For example, you can buy so much more home in Texas or Ohio than you can in California. ...

Read More ›

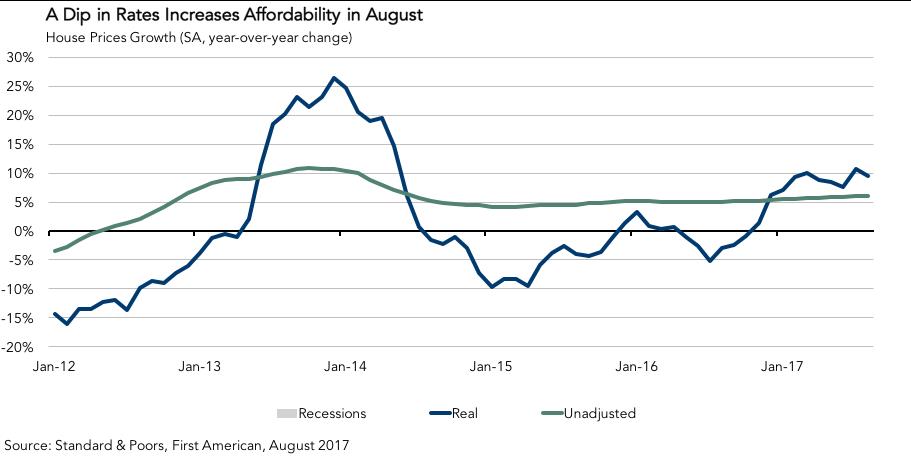

Will August Uptick in Affordability Continue?

By

FirstAm Editor on October 30, 2017

First American’s proprietary Real House Price Index (RHPI) looks at August 2017 data and includes analysis from First American Chief Economist Mark Fleming on what’s behind the surprising increase in affordability in August and whether or not that trend will continue.

Read More ›

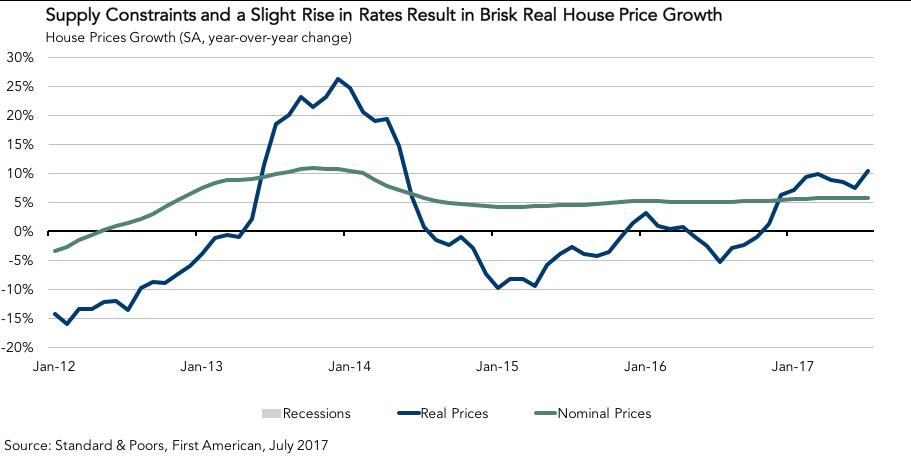

Supply Squeeze Tightens Grip on Affordability in July

By

FirstAm Editor on September 26, 2017

First American’s proprietary Real House Price Index (RHPI) looks at July 2017 data and includes analysis from First American Chief Economist Mark Fleming on the supply constraints impacting the housing market.

Read More ›