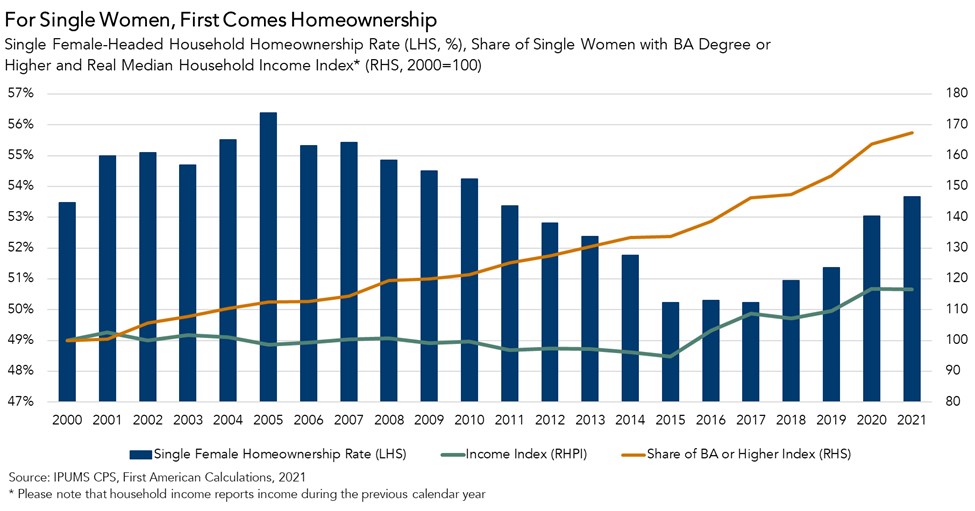

As we celebrate International Women’s Day and Women’s History Month, growing numbers of women, specifically single women, have become homeowners, achieving one of the main tenets of the American Dream. In the aftermath of the Great Recession, the overall homeownership rate reached a low point of 63 percent in 2016, but has since rebounded to 65.5 percent in 2021. Interestingly, single female-headed households are a major driver of the homeownership rebound since 2016. According to an analysis of anonymized household-level survey data, the homeownership rate among single female-headed households (including widowed, separated, or divorced) exceeded 53 percent in 2021, jumping from a low point of 50 percent in 2016. So, what’s driving the significant increase in homeownership among single female-headed households?

“As women’s earning power continues to rise, it seems first comes homeownership then, maybe, comes marriage?”

Single Women Know Homeownership Drives Wealth Creation

The first reason is simple: wealth creation. Analysis of the 2019 Survey of Consumer Finances data reveals that housing is in fact one of the biggest positive drivers of wealth creation in the US. In 2019, the median homeowner had 40 times the household wealth of a renter – nearly $255,000 for the homeowner compared with a little more than $6,000 for the renter. Between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups. While annual house price appreciation won’t always be a record-breaking 17 percent as it was in 2021, homeownership has remained a key driver of wealth creation even when annual house price growth was an average of 5 percent between 2016 to 2019.

Women are taking note. Our analysis found that more single women owned homes than single men in 2021, despite single women having a lower median household income, a clear sign of the importance of homeownership for this demographic. An analysis by the National Association of Realtors further supports the claim that single women are prioritizing homeownership. According to this 2021 analysis, 42 percent of single women make financial sacrifices compared with 32 percent of single men who purchase homes. Common financial sacrifices include cutting spending on non-essential goods, entertainment, clothes, and cancelling vacation plans. Growing numbers of single women see the wealth creation that comes with homeownership and have prioritized purchasing a home.

Women Get it - Get the Degree, Get the Earning Power, Get the Home

The second long-term driver of homeownership among single women is higher educational attainment. We know from previous research that higher educational attainment results in higher household income, and higher income improves the likelihood of homeownership. The impact of educational attainment on the likelihood of homeownership has more than doubled in 20 years. In 2000, the difference in the homeownership rate between those with a high school degree and those with a bachelor’s degree was 3.7 percentage points. By 2021, this gap had more than doubled to 7.6 percentage points. More than ever, educational attainment “unlocks” homeownership. The share of single female-headed households with a bachelor’s degree or higher has increased 13.6 percentage points since the year 2000. As a result, real median household income for single-female headed households has increased approximately 16.5% in 2020 since the year 2000, resulting in higher house-buying power.

As educational attainment and household income for women continue to rise, we can expect increased homeownership to follow suit. Getting married and having children have been shown to be key lifestyle decisions that increase the likelihood of homeownership, yet it seems single women are dispelling the traditional notion that buying a home follows love and marriage. As women’s earning power continues to rise, it seems first comes homeownership then, maybe, comes marriage?