A Tale of Two Incomes - Income Inequality and Homeownership

By

Mark Fleming on February 9, 2016

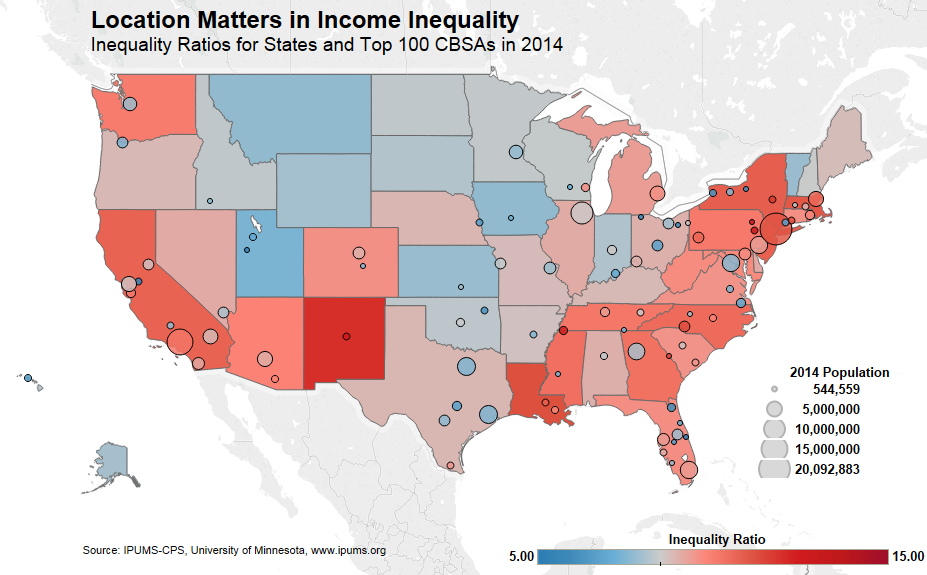

Aristotle said, “The worst form of inequality is to try to make unequal things equal.” While people are naturally drawn to the idea of an equal society, the truth of the matter is that it is quite rare, sometimes seemingly impossible. The question is determining when inequality has gone too far, and by what standards of measurement.

Read More ›

Fear the Boom and the Bust: A Hayek vs. Keynes Rap Anthem

By

Mark Fleming on February 4, 2016

In case you hadn’t heard last week, a Twitter debate exploded between the well-known rapper B.o.B and the also, although possibly not equally, well-known astrophysicist Neil deGrasse Tyson. The debate centered on B.o.B’s belief that the world is actually flat and Tyson’s scientifically reasoned explanation of how we know the world is actually ...

Read More ›

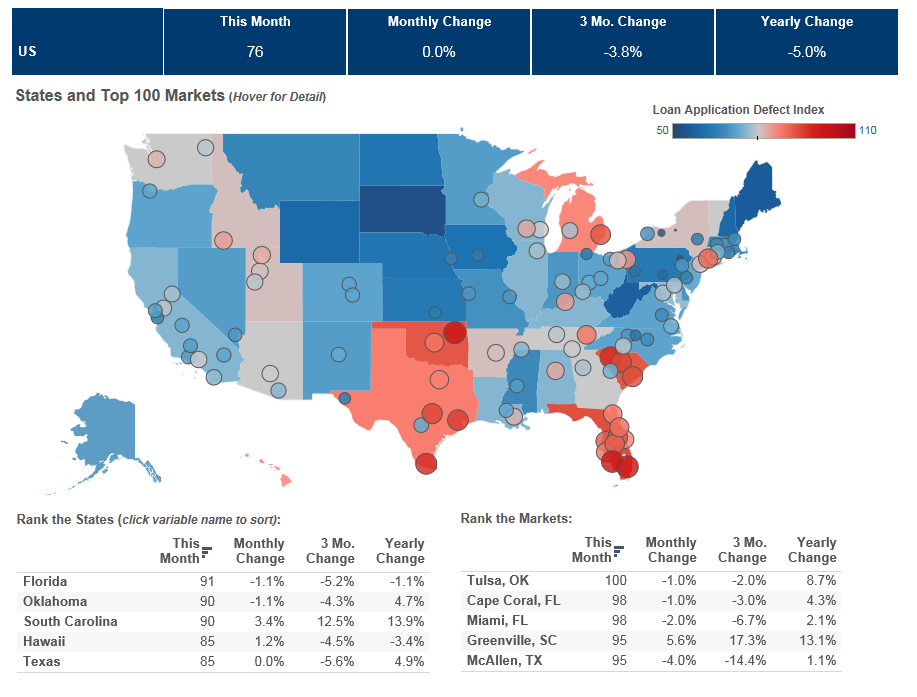

Mortgage Defect and Fraud Risk Declining in Super Tuesday States

By

FirstAm Editor on February 3, 2016

We’ve posted the January First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The index remained unchanged in January as compared with December and decreased by 5.0 percent as compared with January 2015. The Defect Index ...

Read More ›

Is China Keeping U.S. Mortgage Rates at Historic Lows?

By

Mark Fleming on February 2, 2016

In December 2015, the Federal Reserve raised the target range for the federal funds rate for the first time in almost a decade. At the time, there was much discussion regarding the impact this move would have on the still burgeoning housing recovery, specifically through higher mortgage rates and an increased cost of borrowing. Initially, it ...

Read More ›

Mortgage fraud and misrepresentation risk very low in Iowa

By

FirstAm Editor on January 28, 2016

We’ve posted the December First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. Overall, the index fell 2.6 percent in December as compared with November and decreased by 8.4 percent as compared with December 2014.

Read More ›

The Persistent REO

By

Mark Fleming on January 21, 2016

In November 2015, real-estate-owned (REO) sales as a share of all residential home sales remained steady on a month-to-month basis, moving up slightly to 8.2 percent from 8.0 percent in October on a non-seasonally adjusted basis. On a year-over-year basis, this was a decrease of 1.2 percentage points when compared to November 2014, which had an ...

Read More ›