Price appreciation fueled by low interest rates is driving market capacity for existing-home sales above actual existing-home sales

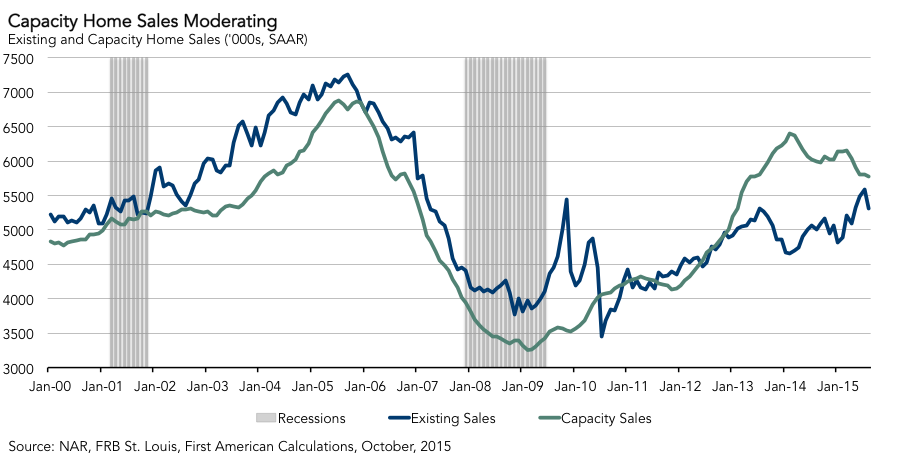

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-home sales are under capacity or over capacity based on current market fundamentals. For the month of September, the EHS-C rate decreased by 0.1 percent compared to August and decreased by 3.6 percent compared to a year ago. The seasonally adjusted, annualized rate (SAAR) of existing-home sales capacity is up 77.1 percent from the low point of sales reached in February 2009*.The EHS-C decreased by a modest 3,800 sales (SAAR) in September. Continued modest income gains and moderation in house price appreciation were factors that drove the market capacity for existing-home sales slightly lower, when compared to August. The user cost for housing, which is a measure of the cost of ownership that includes the interest cost of a mortgage, home maintenance, taxes, tax benefits, and appreciation, remains negative, meaning that owning a home "pays" the homeowner. This negative user cost, combined with income growth and slowly growing incomes, should counter the expected eventual rise in interest rates and deceleration in house prices. Our expectation is that existing-home sales capacity will rise slowly in 2016.

EHS-C is down 640,000 sales (SAAR) from the most recent peak in February 2014. Actual existing-home sales spiked in July, but in August dropped back to a pace below 5.4 million (SAAR) and rebounded in September to a rate of 5.55 million (SAAR). The current underperformance gap is an estimated 215,000 (SAAR), which is significantly less than the sales capacity gap of 1.7 million existing-home sales in February 2014.

Forecasts for September actual existing-home sales predict an increase to 5.56 million (SAAR), remarkably close to actual existing-home sales for September. This would be an increase of 4.7 percent over August’s disappointing preliminary estimate for actual existing-home sales. Recent volatility in the actual level of existing-home sales is being attributed to a breakdown in the adjustments made to account for seasonality in home sales data. Considering the likely recent outlier on the high side in July and the potential outlier on the low side in August, actual existing-home sales should reasonably be in the 5.4 to 5.5 million (SAAR) range.

HELOCS "Poised to Surge"

A recent survey of prospective homebuyers conducted on behalf of Trulia indicated that mortgage rates would have to rise above 6 percent before significantly discouraging homebuyers from buying a home. Last month, we published an analysis of the impact of a possible rate increase on existing-home sales and house prices entitled "Does a Fed Rate Increase Doom Housing?" Our research corroborates the Trulia survey findings that housing demand in a low-rate environment is relatively insensitive to mortgage rates but, as rates rise further, the impact will be stronger. In fact, there is reason to believe that as rates increase, home equity loans are "Poised to Surge."

Leverage-Assisted Housing Asset Inflation

Last month, the Federal Reserve decided not to raise the benchmark federal funds rate and recent economic data has decreased the likelihood that a rate increase will happen this year. Continued low mortgage rates, which remain below 4 percent, are certainly a contributing factor to the pace of price appreciation that we see in the housing market, which is significantly exceeding inflation and income growth. Leverage-assisted housing asset inflation, or home-price appreciation fueled by low mortgage rates, is a significant contributing factor to the reason why the market capacity for existing-home sales is exceeding actual existing-home sales.

The housing market’s capacity for existing-home sales is moderating as home-price appreciation slows, but remains in excess of actual sales due to leverage-assisted housing asset inflation. Looking forward, we expect greater equity reinvestment demand caused by rising rates. Yet, the financial benefits of owning a home and favorable demographic trends bode well for trends in market capacity for existing-home sales in the long run, and point to modest capacity growth expectations for the coming year.

Next EHS-C release: November 19, 2015 for October EHS-C

*Previous EHS-C releases referred to November 2011 as the low point of sales. The model used to generate existing-home sales capacity has been enhanced to more accurately reflect the dynamic relationships between sales, prices, interest rates and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About Existing-Home Sales Capacity

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-homes sales are under capacity or over capacity based on current market circumstances. The EHS-C rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and coops, are outperforming or underperforming based on current market fundamentals. The seasonally adjusted annualized EHS-C estimates the historical relationship between existing-home sales and the U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of existing-home sales above the level of the EHS-C indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of existing-home sales below the level of the EHS-C indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the capacity rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent EHS-C estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The EHS-C will be published prior to National Association of Realtors Existing-Home Sales report each month.