Loan Application Defect and Fraud Risk Reaches Historically Measured Low Point

By

FirstAm Editor on June 30, 2016

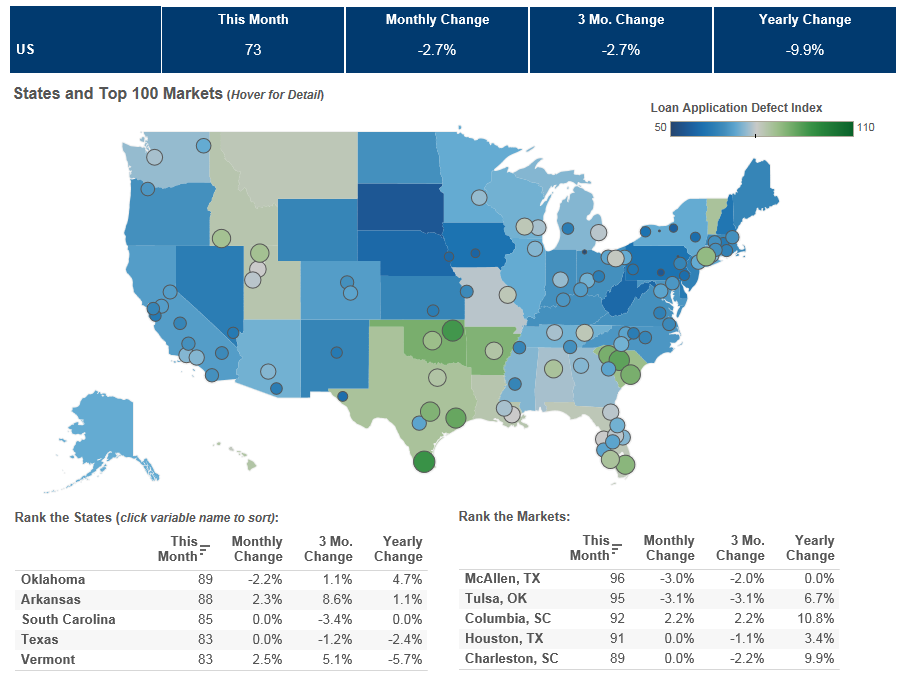

We’ve posted the May First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 2.7 percent in May as compared with April and decreased by 9.9 percent as compared with May 2015. The Defect Index is ...

Read More ›

“Brexit” Decision Uncertainty Contributed to Consumer House-Buying Power

By

FirstAm Editor on June 23, 2016

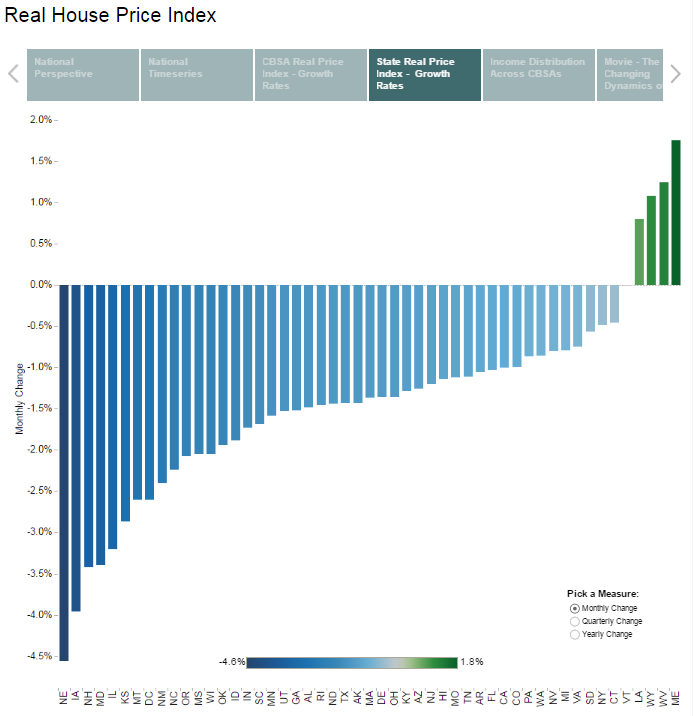

The second edition of First American’s proprietary Real House Price Index (RHPI) looks at April 2016 data and includes analysis from First American Chief Economist Mark Fleming explaining the connection between “Brexit” and recent trends in rates for fixed-rate mortgages.

Read More ›

Optimism for growth in real estate transactions improves substantially over last quarter

By

FirstAm Editor on June 21, 2016

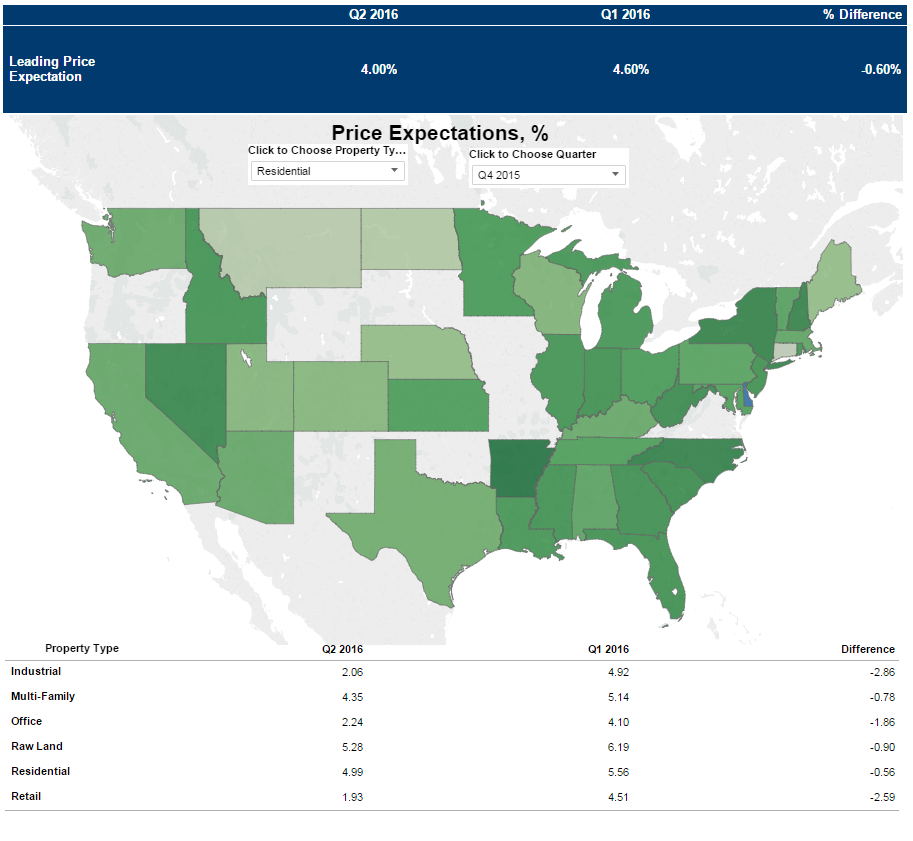

We invite you to browse the second quarter 2016 First American Real Estate Sentiment Index, which measures title agent sentiment on a variety of key market metrics and industry issues. In 2016, the survey has also tracked title agent sentiment regarding the implementation of the Know-Before-You-Owe rule, also referred to as the TILA-RESPA ...

Read More ›

Market Activity Moves Closer To Potential

By

Mark Fleming on June 16, 2016

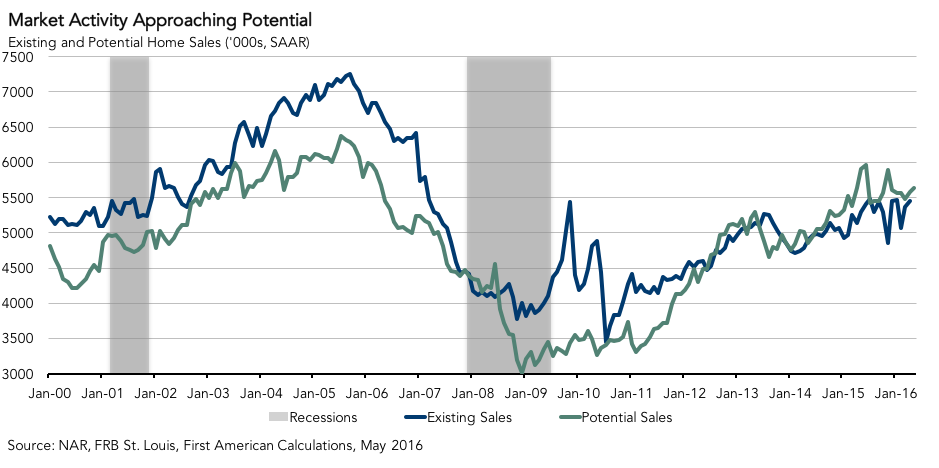

For the month of May, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by 2.8 percent or by an estimated 156,000 seasonally adjusted, annualized rate (SAAR) of sales. While still underperforming, this is an improvement over last month’s underperformance gap of ...

Read More ›

TheStreet.com - The Fed Holds Off on Rate Hike: Here’s what it means for your wallet

By

FirstAm Editor on June 15, 2016

First American Chief Economist Mark Fleming is quoted in an article from TheStreet.com explaining the forces behind low mortgage rates.

Read More ›

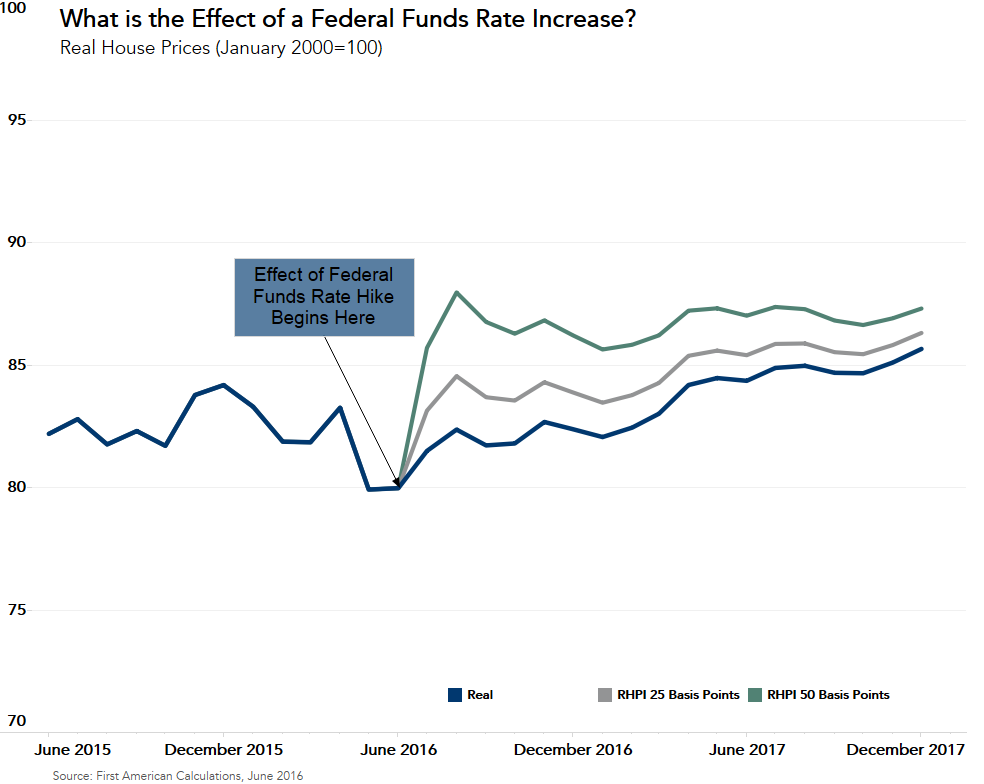

Really, How Important is That Rate Hike?

By

Mark Fleming on June 13, 2016

With the upcoming Federal Open Market Committee (FOMC) meeting this week, many are wondering if an interest rate hike is in the works. According to the CME FedWatch Tool, the current market expectation of a 0.50 percent rate increase in June is extremely low – 4 percent. However, the likelihood jumps to 27 percent in July. But, whether the Fed ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Income