First American recently released the First American/Interthinx fourth quarter 2014 Mortgage Fraud Risk Report. You can view the full, interactive report here. First, let’s consider the main headline, “Fraud risk is up three percent from the third quarter, but unchanged from a year ago.” So, fraud, for now, isn’t trending for the worse or the better. But, the change rate for the fraud index cited in the headline is about as informative as the national change in house prices. Just as real estate is local, so is mortgage fraud!

The five riskiest states for mortgage fraud are Florida, Michigan, New Jersey, California, and New York. Certainly little geographically ties these states together, but, more importantly, it should be noted that these are all big states with a disproportionately large share of the U.S. population. Mortgage fraud follows opportunity, which explains why these states have high fraud risk levels. Large movements in price levels and stocks of distressed assets provide the assets of which mortgage fraud perpetrators can take advantage.

If you have a good credit score and a good job, watch out! You’re the perfect target for a mortgage fraud identity thief.

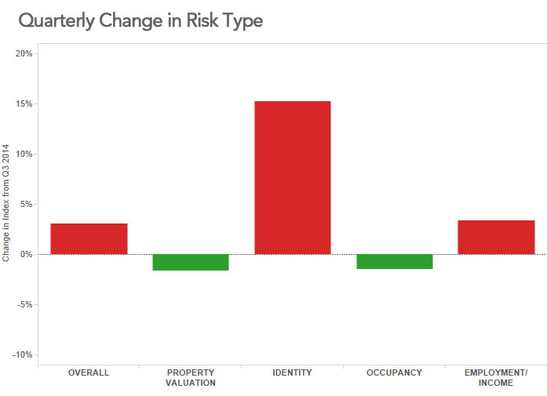

Yet, the more interesting question is how the mortgage fraud is attempted. For insight here, one can look at the fraud risk index by risk type – property valuation, occupancy, identity, and employment/income. Relative to the third quarter of 2014, the two most increased fraud risk types were identity and employment/income. Our data doesn’t allow us to formally test for the causal reasons why loan applications are increasingly being identified with misrepresentation with regard to the identity of the borrower and their employment and income. However, there is one reasonable possibility. It is the result of the CFPB Qualified Mortgage (QM) regulation and its Ability to Repay (ATR) rule.

Mortgage underwriters are keenly aware of the scrutiny and oversight being placed on documentation of accurate income in order to qualify for a loan. Gone are the days when a mortgage fraudster could “state” their income to qualify for a loan. As a result of increased scrutiny and the need to “prove” income, mortgage fraud perpetrators may be using stolen identities with good credit scores and easily documented income. From the criminal’s perspective, the best loan applicant is one who doesn’t draw too much attention and easily qualifies for a loan. If you have a good credit score and a good job, watch out! You’re the perfect target for a mortgage fraud identity thief.

The good news is that the industry is aware of the cost of mortgage fraud, not just to the lender, but also to the unwitting consumer who’s identity is stolen. Automated loan application screening, where we draw the data to make fraud risk indices such as this one, is fast becoming as ubiquitous as the requirement for a credit score. While the CFPB regulations may be helping to modify mortgage fraud behavior, the consumer’s best interest is well served by proactive monitoring for fraud. In other words, the industry is vigilantly looking for the fraudulent needle in the loan application haystack.