For the second month in a row, the Loan Application Defect Index for purchase transactions increased in October compared with the previous month. Year over year, the Defect Index for purchase transactions decreased 8.9 percent compared with October 2017. The Defect Index for refinance transactions increased 1.4 percent compared with the previous month and is 2.9 percent higher than a year ago. The overall Defect Index, which includes both purchase and refinance transactions, increased 1.3 percent compared with October, but declined 4.8 percent year over year.

Rising Mortgage Fraud Risk Linked to Wildfires

While the overall risk of loan application defects, fraud and misrepresentation declined from a year-over-year perspective, there are regions with the potential for higher defect risk due to the impact from natural disasters – specifically, the communities impacted by recent wildfires in California. The Camp Fire wildfire in Butte county, which has been named the deadliest U.S. wildfire in a century, and the Woolsey Fire in Los Angeles and Ventura counties, are some of the worst wildfires in the state’s history.

In addition to the devastating impact on human life, the likely damage to housing is staggering. According to the California Department of Forestry and Fire Protection, the Camp Fire destroyed 13,972 residences and Woolsey Fire destroyed 1,500 structures. While it’s too early to estimate the cost of the damage from these fires, the Associated Press recently reported that wildfires in Northern California last year “gutted 6,800 homes and resulted in $12.6 billion in insured losses.” Since the damage from the recent wildfires greatly exceeded the 2017 wildfire damages, we can expect a higher estimate in losses.

Unfortunately, on top of the damage to thousands of homes, historical data indicates that natural disasters and loan application defect risk go hand-in-hand. As we’ve seen too often, natural disasters create the potential and opportunity for significant misrepresentation of collateral condition.

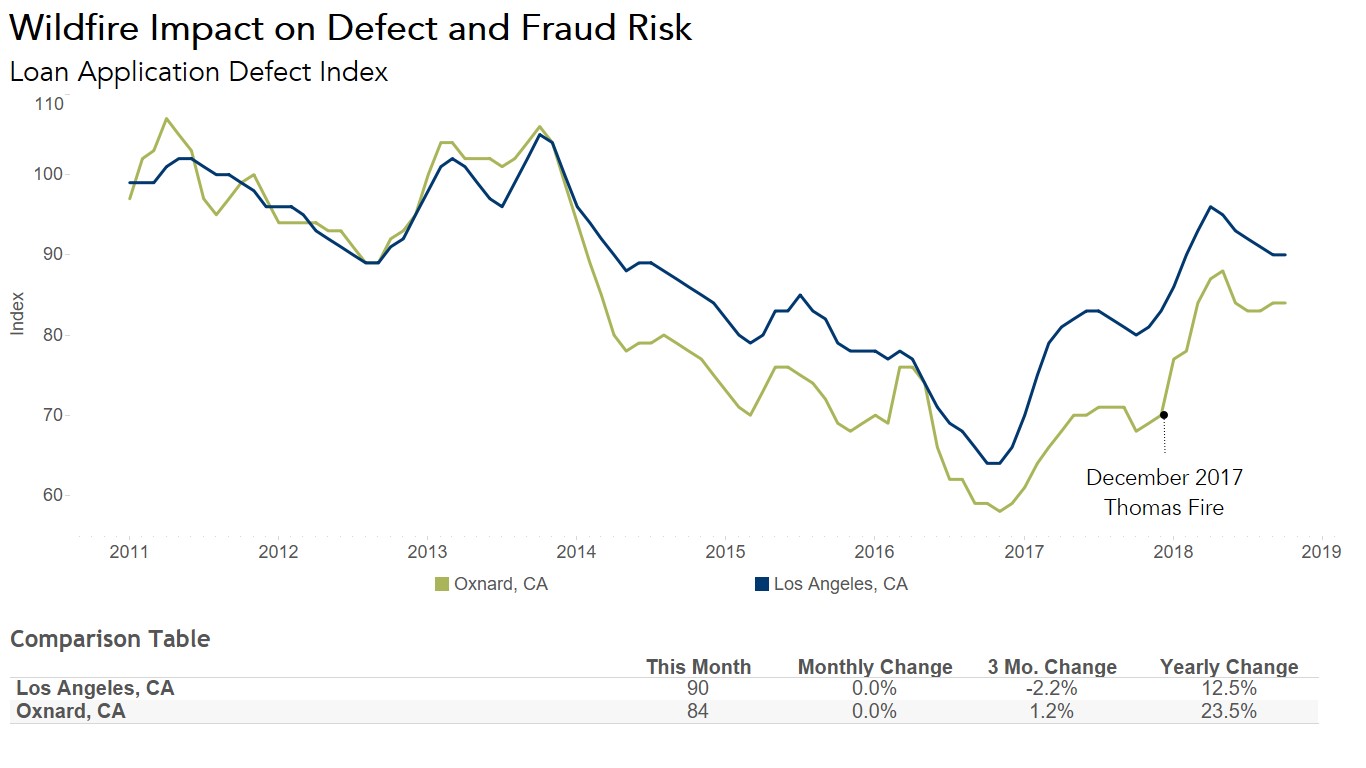

In the aftermath of the December 2017 Thomas Fire in Ventura and Santa Barbara counties, mortgage defect, fraud and misrepresentation risk, as measured by the Defect Index, increased 10 percent in one month in the Oxnard-Thousand Oaks-Ventura metropolitan area. Fraud and misrepresentation risk remained elevated for five months after the wildfire, before trending down again. Defect, fraud and misrepresentation risk in the Oxnard metropolitan area, which had been declining prior to the Thomas Fire, has yet to return to pre-wildfire levels.

Fraud Risk in California Likely to Increase in the Months Ahead

While the devastating impacts from the wildfires in California continue to be assessed, the risk of mortgage loan application fraud in the communities impacted is likely to increase in the coming months. The Defect Index in Los Angeles has trended down in recent months, while Oxnard has experienced a relatively flat trend in fraud risk following the post-Thomas Fire surge. Given historical trends, it’s fair to expect increases in defect and fraud risk in these affected markets in the near future.

For Mark’s full analysis on loan defect risk, the top five states and markets with the greatest increases and decreases in defect risk, and more, please visit the Loan Application Defect Index.

The Defect Index is updated monthly with new data. Look for the next edition of the Defect Index the week of December 24, 2018.